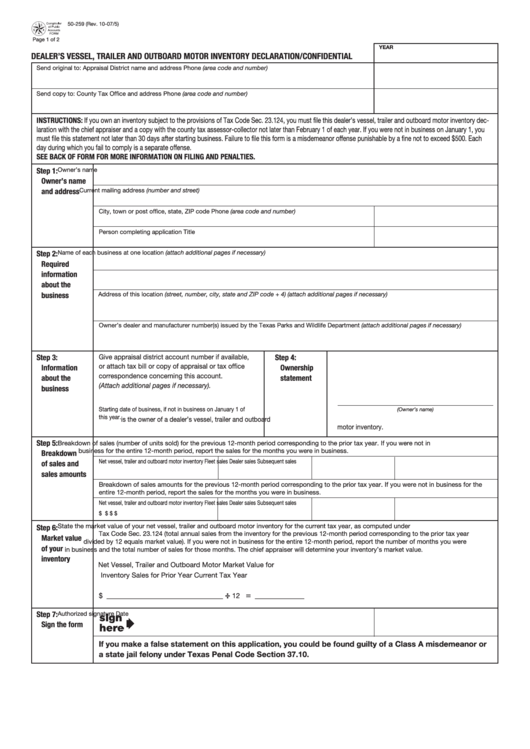

50-259 (Rev. 10-07/5)

Page 1 of 2

YEAR

DEALER’S VESSEL, TRAILER AND OUTBOARD MOTOR INVENTORY DECLARATION/CONFIDENTIAL

Send original to: Appraisal District name and address

Phone (area code and number)

Send copy to: County Tax Office and address

Phone (area code and number)

INSTRUCTIONS: If you own an inventory subject to the provisions of Tax Code Sec. 23.124, you must file this dealer’s vessel, trailer and outboard motor inventory dec-

laration with the chief appraiser and a copy with the county tax assessor-collector not later than February 1 of each year. If you were not in business on January 1, you

must file this statement not later than 30 days after starting business. Failure to file this form is a misdemeanor offense punishable by a fine not to exceed $500. Each

day during which you fail to comply is a separate offense.

SEE BACK OF FORM FOR MORE INFORMATION ON FILING AND PENALTIES.

Step 1:

Owner’s name

Owner’s name

and address

Current mailing address (number and street)

City, town or post office, state, ZIP code

Phone (area code and number)

Person completing application

Title

Step 2:

Name of each business at one location (attach additional pages if necessary)

Required

information

about the

business

Address of this location (street, number, city, state and ZIP code + 4) (attach additional pages if necessary)

Owner’s dealer and manufacturer number(s) issued by the Texas Parks and Wildlife Department (attach additional pages if necessary)

Step 3:

Give appraisal district account number if available,

Step 4:

or attach tax bill or copy of appraisal or tax office

Information

Ownership

correspondence concerning this account.

about the

statement

(Attach additional pages if necessary).

business

Starting date of business, if not in business on January 1 of

(Owner’s name)

this year.

is the owner of a dealer’s vessel, trailer and outboard

motor inventory.

Step 5:

Breakdown of sales (number of units sold) for the previous 12-month period corresponding to the prior tax year. If you were not in

business for the entire 12-month period, report the sales for the months you were in business.

Breakdown

Net vessel, trailer and outboard motor inventory

Fleet sales

Dealer sales

Subsequent sales

of sales and

sales amounts

Breakdown of sales amounts for the previous 12-month period corresponding to the prior tax year. If you were not in business for the

entire 12-month period, report the sales for the months you were in business.

Net vessel, trailer and outboard motor inventory

Fleet sales

Dealer sales

Subsequent sales

$

$

$

$

State the market value of your net vessel, trailer and outboard motor inventory for the current tax year, as computed under

Step 6:

Tax Code Sec. 23.124 (total annual sales from the inventory for the previous 12-month period corresponding to the prior tax year

Market value

divided by 12 equals market value). If you were not in business for the entire 12-month period, report the number of months you were

of your

in business and the total number of sales for those months. The chief appraiser will determine your inventory’s market value.

inventory

Net Vessel, Trailer and Outboard Motor

Market Value for

Inventory Sales for Prior Year

Current Tax Year

÷

=

$ _________________________________

12

______________

Step 7:

Authorized signature

Date

Sign the form

If you make a false statement on this application, you could be found guilty of a Class A misdemeanor or

a state jail felony under Texas Penal Code Section 37.10.

1

1 2

2