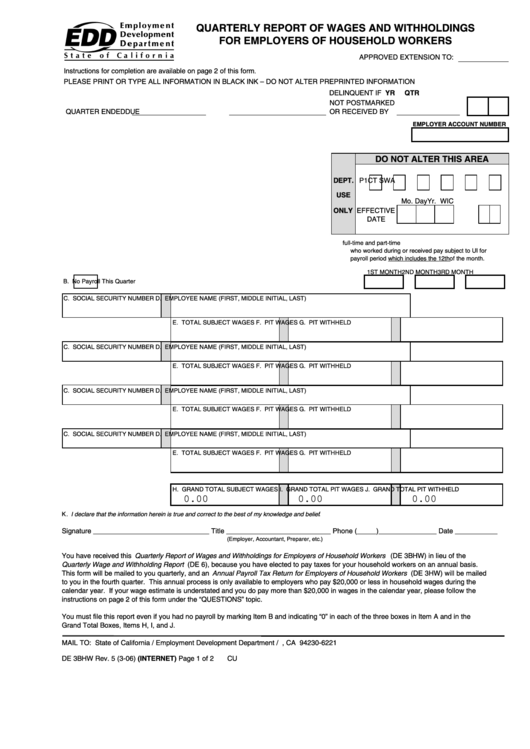

QUARTERLY REPORT OF WAGES AND WITHHOLDINGS

FOR EMPLOYERS OF HOUSEHOLD WORKERS

APPROVED EXTENSION TO:

Instructions for completion are available on page 2 of this form

.

PLEASE PRINT OR TYPE ALL INFORMATION IN BLACK INK – DO NOT ALTER PREPRINTED INFORMATION

DELINQUENT IF

YR

QTR

NOT POSTMARKED

QUARTER ENDED

DUE

OR RECEIVED BY

EMPLOYER ACCOUNT NUMBER

DO NOT ALTER THIS AREA

DEPT. P1

C

T

S

W

A

USE

Mo. Day

Yr.

WIC

ONLY EFFECTIVE

DATE

A. NUMBER OF EMPLOYEES full-time and part-time

who worked during or received pay subject to UI for

payroll period which includes the 12th of the month.

1ST MONTH

2ND MONTH

3RD MONTH

B.

No Payroll This Quarter

C. SOCIAL SECURITY NUMBER

D. EMPLOYEE NAME

(FIRST, MIDDLE INITIAL, LAST)

E. TOTAL SUBJECT WAGES

F. PIT WAGES

G. PIT WITHHELD

C. SOCIAL SECURITY NUMBER

D. EMPLOYEE NAME

(FIRST, MIDDLE INITIAL, LAST)

E. TOTAL SUBJECT WAGES

F. PIT WAGES

G. PIT WITHHELD

C. SOCIAL SECURITY NUMBER

D. EMPLOYEE NAME

(FIRST, MIDDLE INITIAL, LAST)

E. TOTAL SUBJECT WAGES

F. PIT WAGES

G. PIT WITHHELD

C. SOCIAL SECURITY NUMBER

D. EMPLOYEE NAME

(FIRST, MIDDLE INITIAL, LAST)

E. TOTAL SUBJECT WAGES

F. PIT WAGES

G. PIT WITHHELD

H. GRAND TOTAL SUBJECT WAGES

I. GRAND TOTAL PIT WAGES

J. GRAND TOTAL PIT WITHHELD

0.00

0.00

0.00

K . I declare that the information herein is true and correct to the best of my knowledge and belief .

Signature ______________________________ Title ___________________________ Phone (_____)_______________ Date ___________

(Employer, Accountant, Preparer, etc.)

You have received this Quarterly Report of Wages and Withholdings for Employers of Household Workers (DE 3BHW) in lieu of the

Quarterly Wage and Withholding Report (DE 6), because you have elected to pay taxes for your household workers on an annual basis.

This form will be mailed to you quarterly, and an Annual Payroll Tax Return for Employers of Household Workers (DE 3HW) will be mailed

to you in the fourth quarter. This annual process is only available to employers who pay $20,000 or less in household wages during the

calendar year. If your wage estimate is understated and you do pay more than $20,000 in wages in the calendar year, please follow the

instructions on page 2 of this form under the “QUESTIONS” topic.

You must file this report even if you had no payroll by marking Item B and indicating “0” in each of the three boxes in Item A and in the

Grand Total Boxes, Items H, I, and J.

MAIL TO: State of California / Employment Development Department / P.O. Box 826221 / MIC 28B / Sacramento, CA 94230-6221

DE 3BHW Rev. 5 (3-06) (INTERNET)

Page 1 of 2

CU

1

1