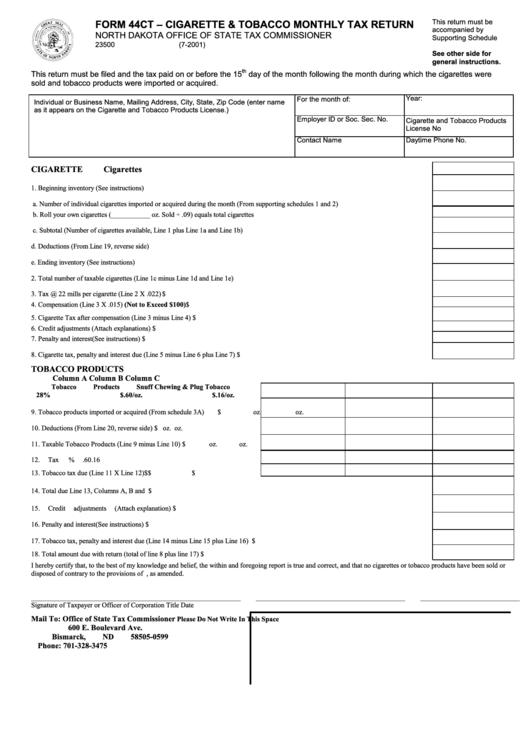

This return must be

FORM 44CT – CIGARETTE & TOBACCO MONTHLY TAX RETURN

accompanied by

NORTH DAKOTA OFFICE OF STATE TAX COMMISSIONER

Supporting Schedule

23500 (7-2001)

See other side for

general instructions.

th

This return must be filed and the tax paid on or before the 15

day of the month following the month during which the cigarettes were

sold and tobacco products were imported or acquired.

Year:

For the month of:

Individual or Business Name, Mailing Address, City, State, Zip Code (enter name

as it appears on the Cigarette and Tobacco Products License.)

Employer ID or Soc. Sec. No.

Cigarette and Tobacco Products

License No

Contact Name

Daytime Phone No.

CIGARETTE

Cigarettes

1.

Beginning inventory (See instructions).............................................................................................................................................................

a.

Number of individual cigarettes imported or acquired during the month (From supporting schedules 1 and 2) ....................................

b.

Roll your own cigarettes (___________ oz. Sold ÷ .09) equals total cigarettes ......................................................................................

c.

Subtotal (Number of cigarettes available, Line 1 plus Line 1a and Line 1b) ...........................................................................................

d.

Deductions (From Line 19, reverse side) ..................................................................................................................................................

e.

Ending inventory (See instructions) ..........................................................................................................................................................

2.

Total number of taxable cigarettes (Line 1c minus Line 1d and Line 1e)........................................................................................................

3.

Tax @ 22 mills per cigarette (Line 2 X .022) ...................................................................................................................................................

$

4.

Compensation (Line 3 X .015) (Not to Exceed $100) .....................................................................................................................................

$

5.

Cigarette Tax after compensation (Line 3 minus Line 4) .................................................................................................................................

$

6.

Credit adjustments (Attach explanations) .........................................................................................................................................................

$

7.

Penalty and interest (See instructions) ..............................................................................................................................................................

$

8.

Cigarette tax, penalty and interest due (Line 5 minus Line 6 plus Line 7).......................................................................................................

$

TOBACCO PRODUCTS

Column A

Column B

Column C

Tobacco Products

Snuff

Chewing & Plug Tobacco

28%

$.60/oz.

$.16/oz.

9.

Tobacco products imported or acquired (From schedule 3A) ......................

$

oz.

oz.

10.

Deductions (From Line 20, reverse side) ......................................................

$

oz.

oz.

11.

Taxable Tobacco Products (Line 9 minus Line 10) ......................................

$

oz.

oz.

12.

Tax Rates .......................................................................................................

28%

.60

.16

13.

Tobacco tax due (Line 11 X Line 12) ...........................................................

$

$

$

14.

Total due Line 13, Columns A, B and C...........................................................................................................................................................

$

15.

Credit adjustments (Attach explanation)...........................................................................................................................................................

$

16.

Penalty and interest (See instructions) ..............................................................................................................................................................

$

17.

Tobacco tax, penalty and interest due (Line 14 minus Line 15 plus Line 16) .................................................................................................

$

18.

Total amount due with return (total of line 8 plus line 17) ...............................................................................................................................

$

I hereby certify that, to the best of my knowledge and belief, the within and foregoing report is true and correct, and that no cigarettes or tobacco products have been sold or

disposed of contrary to the provisions of N.D.C.C. ch. 57-36, as amended.

___________________________________________________________

__________________________________________

____________________________

Signature of Taxpayer or Officer of Corporation

Title

Date

Mail To: Office of State Tax Commissioner

Please Do Not Write In This Space

600 E. Boulevard Ave.

Bismarck, ND 58505-0599

Phone: 701-328-3475

1

1 2

2 3

3 4

4