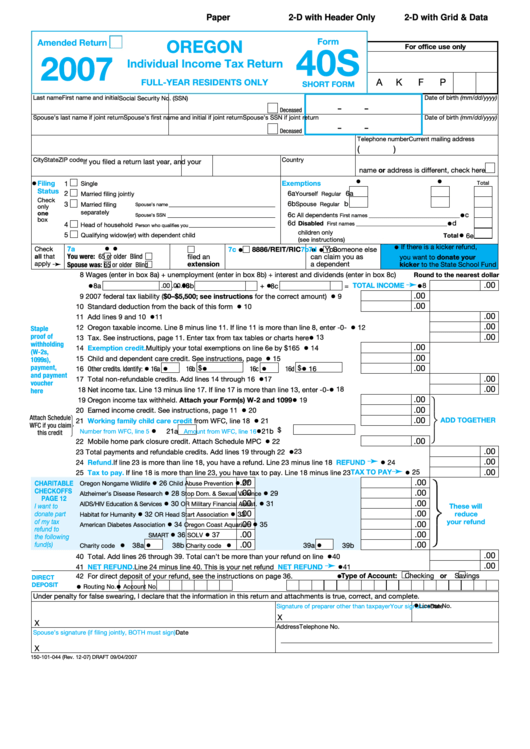

Form 40s - Oregon Individual Income Tax Return - 2007 (Blue)

ADVERTISEMENT

1

1

2

1

1

1

1

1

1

1

1

1

1

2

2

2

2

2

2

2

2

2

2

3

3

3

3

3

3

3

3

3

3

4

4

4

4

4

4

4

4

4

4

5

5

5

5

5

5

5

5

5

5

6

6

6

6

6

6

6

6

6

6

7

7

7

7

7

7

7

7

7

7

8

8

2

8

8

8

Paper

2-D with Header Only

2-D with Grid & Data

1

2

3

5

6 7 8 9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

3

4

5

4

82

3

3

OREGON

Amended Return

Form

For office use only

4

40S

4

OREGON

Form

Amended Return

2007

40S

For office use only

Individual Income Tax Return

5

5

2007

6

6

Individual Income Tax Return

FULL-YEAR RESIDENTS ONLY

FULL-YEAR RESIDENTS ONLY

ShORT FORM

ShORT FORM

A

K

F

P

7

7

P s s n x x - x x x x

s s s n x x - x x x x

8

A

K

F

P

8

FULL-YEAR RESIDENTS ONLY

ShORT FORM

P L A s T n A M E x x x x x x x x x x x P F I R s T n A M E x x I

D o b

x x / x x / x x x x

D E C E A s E D

9

9

s L A s T n A M E x x x x x x x x x x x s F I R s T n A M E x x I

D o b

x x / x x / x x x x

D E C E A s E D

Last name

First name and initial

Date of birth (mm/dd/yyyy)

Social Security No. (SSN)

10

10

A D D R E s s 1 x x x x x x x x x x x x x x x x x x x x x x x x x x x

P h o n E

x x x - x x x - x x x x

–

–

E x T E n s I o n F I L E D

Deceased

11

11

A D D R E s s 2 x x x x x x x x x x x x x x x x x x x x x x x x x x x

Spouse’s last name if joint return

Spouse’s first name and initial if joint return

Spouse’s SSN if joint return

8 8 8 6 / R E I T / R I C

Date of birth (mm/dd/yyyy)

12

12

–

–

C L A I M E D / D E P E n D E n T

C I T Y x x x x x x x x x x x x x x x x x s T Z I P x x x x x x x

n E W n A M E / A D D R E s s

Deceased

13

13

C o u n T R Y x x x x x x x x x x x x x x x

F o R C o M P u T E R u s E o n L Y

Current mailing address

Telephone number

14

14

(

)

F I L I n g s T A T u s :

x x x x x x x x x x x x x x x x x x x x

15

15

s P o u s E :

x x x x x x x x x x x x x x x s s n - x x - x x x x

City

State

ZIP code

Country

If you filed a return last year, and your

16

16

q u A L I F Y I n g n A M E :

x x x x x x x x x x x x x x x x x x

name or address is different, check here

17

17

PRINT 2-D bARCODE hERE

•

•

E x E M P T I o n s :

•

Filing

Exemptions

1

Total

Single

18

18

6 A s E L F

Status

:

R E g u L A R

D I s A b L E D

x

2

6a

6a

Married filing jointly

Yourself ....

Regular

.........Severely disabled

.........

19

19

6 b s P o u s E :

Check

R E g u L A R

D I s A b L E D

x

6b

b

3

Spouse .....

Married filing

Regular

.........Severely disabled

...........

20

20

Spouse’s name

only

6 C A L L D E P E n D E n T s :

x x x x x x x x x x x x x x x x

separately

•

one

6c

c

All dependents

21

Spouse’s SSN

21

First names __________________________________

⁄

1

Minimum

" white space

box

8

6 D D I s A b L E D C h I L D R E n o n L Y :

x x

•

4

Head of household

6d

d

22

Disabled

22

Person who qualifies you

First names __________________________________

around all four sides of barcode

x x x x x x x x x x x x x x x x x x x x x x x x x x x x x

children only

•

5

6e

Qualifying widow(er) with dependent child

Total

23

23

(see instructions)

6 E T o T A L E x E M P T I o n s :

x x

24

•

•

24

•

•

•

•

Check

7a

7b

You

7c

8886/REIT/RIC

7d

Someone else

7e

If there is a kicker refund,

7 A s E L F

:

6 5 o R o L D E R

b L I n D

all that

You were:

65 or older

Blind

filed an

can claim you as

25

you want to donate your

25

s P o u s E :

6 5 o R o L D E R

b L I n D

apply

➛

extension

Spouse was:

a dependent

kicker to the State School Fund

65 or older

Blind

26

26

8 Wages (enter in box 8a) + unemployment (enter in box 8b) + interest and dividends (enter in box 8c)

Round to the nearest dollar

27

27

➛

•

•

•

•

.00

TOTAL INCOME

8

8a

.00

+

8b

.00

+

8c

.00

=

28

28

•

.00

9 2007 federal tax liability ($0–$5,500; see instructions for the correct amount) .......

9

29

29

•

.00

10 Standard deduction from the back of this form .........................................................

10

30

30

•

.00

11 Add lines 9 and 10 .........................................................................................................................................

11

31

31

•

.00

12 Oregon taxable income. Line 8 minus line 11. If line 11 is more than line 8, enter -0- ..................................

12

Staple

32

32

•

proof of

.00

13 Tax. See instructions, page 11. Enter tax from tax tables or charts here ......................................................

13

33

33

withholding

•

.00

14

Exemption credit.

Multiply your total exemptions on line 6e by $165 .....................

14

34

34

(W-2s,

•

.00

15 Child and dependent care credit. See instructions, page 11.....................................

15

1099s),

35

35

•

•

•

•

•

payment,

.00

16b $

16d $

16 Other credits. Identify:

16a

16c

16

36

36

and payment

•

.00

17 Total non-refundable credits. Add lines 14 through 16 .................................................................................

17

37

37

voucher

•

.00

18 Net income tax. Line 13 minus line 17. If line 17 is more than line 13, enter -0- ...........................................

18

here

38

38

•

.00

19 Oregon income tax withheld. Attach your Form(s) W-2 and 1099 .........................

19

39

39

•

.00

20 Earned income credit. See instructions, page 11 ......................................................

20

40

40

Attach Schedule

•

.00

ADD TOGEThER

21

Working family child care credit

from WFC, line 18 ...............................................

21

41

41

WFC if you claim

•

•

21b $

21a

Number from WFC, line 5

Amount from WFC, line 16

this credit

42

42

•

.00

22 Mobile home park closure credit. Attach Schedule MPC ..........................................

22

43

43

•

.00

23

23 Total payments and refundable credits. Add lines 19 through 22 .................................................................

44

44

➛

•

.00

24

Refund.

If line 23 is more than line 18, you have a refund. Line 23 minus line 18 .................

REFUND

24

45

45

➛

•

.00

If line 18 is more than line 23, you have tax to pay. Line 18 minus line 23 ....

TAX TO PAY

25

25

Tax to pay.

46

46

•

•

.00

.00

ChARITAbLE

26

27

Oregon Nongame Wildlife

Child Abuse Prevention

47

47

ChECkOFFS

•

•

.00

.00

28

29

Alzheimer’s Disease Research

Stop Dom. & Sexual Violence

48

48

PAGE 12

•

•

.00

.00

30

31

AIDS/HIV Education & Services

OR Military Financial Assist.

49

I want to

These will

49

•

•

.00

.00

donate part

32

33

reduce

Habitat for Humanity

OR Head Start Association

50

50

of my tax

your refund

•

•

.00

.00

34

35

American Diabetes Association

Oregon Coast Aquarium

51

51

refund to

•

•

.00

.00

36

37

SMART

SOLV

the following

52

52

•

•

•

•

.00

.00

fund(s)

38a

38b

39a

39b

Charity code

Charity code

53

53

•

.00

40 Total. Add lines 26 through 39. Total can’t be more than your refund on line 24..........................................

40

54

54

➛

•

.00

41

NET REFUND.

Line 24 minus line 40. This is your net refund .......................................

NET REFUND

41

55

55

•

Type of Account:

Checking or

42 For direct deposit of your refund, see the instructions on page 36.

Savings

DIRECT

56

56

•

•

DEPOSIT

Routing No.

Account No.

57

57

Under penalty for false swearing, I declare that the information in this return and attachments is true, correct, and complete.

58

58

•

License No.

Your signature

Date

Signature of preparer other than taxpayer

59

59

X

60

60

X

Address

Telephone No.

61

61

Spouse’s signature (if filing jointly, BOTH must sign)

Date

62

62

X

63

63

150-101-044-2 (Rev. 12-07) DRAFT 09/04/2007

150-101-044 (Rev. 12-07) DRAFT 09/04/2007

64

64

65

4

4

4

4

4

4

4

4

5

5

5

5

5

5

5

5

5

5

6

6

6

6

6

6

6

6

6

6

7

7

7

7

7

7

7

7

7

8

65

8

8

8

1

1

1

1

1

1

1

1

1

1

2

2

2

2

2

2

2

2

2

2

3

3

3

3

3

3

3

3

3

3

4

4

7

8

1

2

3

5

6 7 8 9

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

3

4

5

0

4

82

66

66

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2