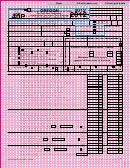

Page 2 — 2010 Form 40P

40 Amount from front of form, line 38F (federal amount) ....................................................................................... 40

.00

•

41 Itemized deductions from federal Schedule A, line 29 .........................................

41

.00

DEDUCTIONS

•

AND

42 State income tax claimed as itemized deduction .................................................

42

.00

MODIFICATIONS

EIThER,

•

.00

43 Net Oregon itemized deductions. Line 41 minus line 42 ......................................

43

NOT BOTh

•

44 Standard deduction from page 25 ........................................................................

44

.00

•

45 2010 federal tax liability ($0–$5,850; see instructions for the correct amount) ....

45

.00

•

•

•

46y $

.00

46 Other deductions and modifications. Identify:

46x

46z

46

Schedule

•

47 Add lines 43, 45, and 46 if itemizing. Otherwise, add lines 44, 45, and 46 ...................................................

47

.00

•

48 Taxable income. Line 40 minus line 47 ..........................................................................................................

48

.00

•

.00

49 Tax from tax charts. 49a

See instructions, page 27 .....

49

OREGON

•

TAX

50 Oregon income tax. Line 49 X Oregon percentage from line 39, or .................

.00

50

•

•

Check if tax is from:

50a

Form FIA-40P or

50b

Worksheet FCG

•

51 Interest on certain installment sales ......................................................................

51

.00

•

➛

52 Total tax before credits. Add lines 50 and 51 ................................................................... OREGON TAX

52

.00

•

53 Exemption credit. See instructions, page 28 ......................................................

53

.00

NONREFUNDABlE

•

CREDITS

54 Child and dependent care credit. See instructions, page 29................................

54

.00

ADD TOGEThER

}

•

•

.00

55 Credit for income taxes paid to another state. State:

55y

55z

55

Schedule

INClUDE PROOF

•

•

•

56y $

56 Other credits. Identify:

56x

56z

56

.00

Schedule included

•

57 Total non-refundable credits. Add lines 53 through 56 ..................................................................................

57

.00

•

58 Net income tax. Line 52 minus line 57. If line 57 is more than line 52, enter -0- ..........................................

58

.00

•

59 Oregon income tax withheld from income. Include Forms W-2 and 1099 ........

.00

59

PAYMENTS AND

REFUNDABlE

•

60 Estimated tax payments for 2010 and payments made with your extension ......

60

.00

CREDITS

•

61 Tax withheld from pass-through entity and real estate transactions ....................

61

.00

•

.00

ADD TOGEThER

62 Earned income credit. See instructions, page 34 .................................................

62

Include Schedule

•

63 Working family child care credit from WFC-N/P, line 21 ..................................

63

.00

WFC-N/P if you

claim this credit

•

64 Mobile home park closure credit. Include Schedule MPC ....................................

64

.00

•

65 Total payments and refundable credits. Add lines 59 through 64 ..................................................................

65

.00

•

➛

66 Overpayment. Is line 58 less than line 65? If so, line 65 minus line 58 ....................... OVERPAYMENT

66

.00

➛

•

67 Tax to pay. Is line 58 more than line 65? If so, line 58 minus line 65 ................................ TAX TO PAY

67

.00

68 Penalty and interest for filing or paying late. See instructions, page 34 .................. 68

.00

ADD TOGEThER

•

69 Interest on underpayment of estimated tax. Include Form 10 and check box

69

.00

•

•

Exception # from Form 10, line 1

69a

Check box if you annualized

69b

70 Total penalty and interest due. Add lines 68 and 69 ......................................................................................... 70

.00

➛

•

71 Amount you owe. Line 67 plus line 70 ................................................................ AMOUNT YOU OWE

.00

71

➛

•

72 Refund. Is line 66 more than line 70? If so, line 66 minus line 70 ............................................ REFUND

72

.00

•

.00

73 Estimated tax. Fill in the part of line 72 you want applied to 2011 estimated tax

73

.00

.00

.00

•

•

ChARITABlE

74

75

Oregon Nongame Wildlife

St. Vincent de Paul Society

.00

ChECkOFF

.00

.00

•

•

76

77

The Nature Conservancy

Doernbecher Children’s Hospital

DONATIONS,

These will

.00

•

.00

•

.00

78

79

Oregon Humane Society

The Salvation Army

reduce

PAGE 35

.00

•

.00

•

.00

80

81

your refund

Oregon Veterans’ Home

Planned Parenthood of Oregon

I want to donate

.00

.00

.00

•

•

82

83

Oregon Lions Sight & Hearing

Shriners Hospitals for Children

part of my tax

.00

.00

.00

•

•

refund to the

84

85

Special Olympics Oregon

Susan G. Komen for the Cure

.00

following fund(s)

•

•

.00

•

•

.00

86a

86b

87a

87b

Charity code

Charity code

•

.00

88 Total. Add lines 73 through 87. Total can’t be more than your refund on line 72 ..........................................

88

➛

•

.00

89 NET REFUND. Line 72 minus line 88. This is your net refund .........................................NET REFUND

89

•

90 For direct deposit of your refund, see instructions, page 35.

Type of Account:

Checking or

Savings

DIRECT

•

•

Routing No.

Account No.

DEPOSIT

•

Will this refund go to an account outside the United States?

Yes

Important: Include a copy of your federal Form 1040, 1040A, 1040EZ, or 1040NR. Do not Include other federal schedules.

Under penalty for false swearing, I declare that the information in this return is true, correct, and complete.

•

Your signature

Date

Signature of preparer other than taxpayer

License No.

X

X

Address

Telephone No.

Spouse’s/RDP's signature

Date

(if filing jointly, BOTH must sign)

X

150-101-055 (Rev. 12-10)

1

1 2

2