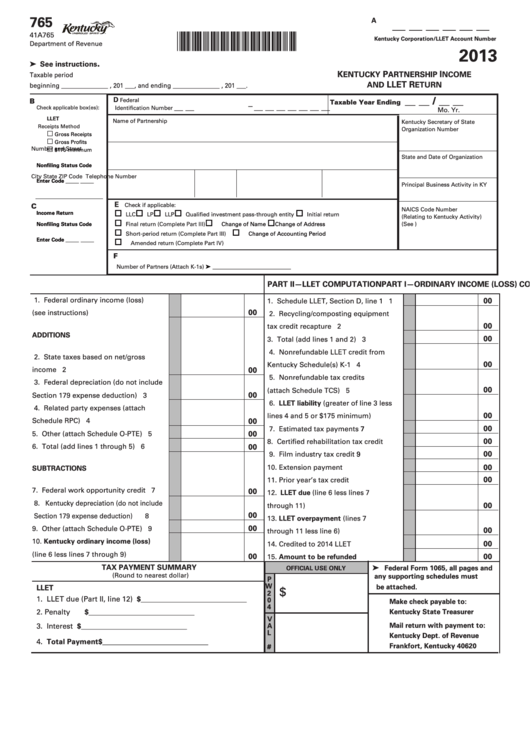

Form 765 - Kentucky Partnership Income And Llet Return - 2013

ADVERTISEMENT

765

A

__ __ __ __ __ __

41A765

*1300010263*

Kentucky Corporation/LLET Account Number

Department of Revenue

2013

.

➤ See instructions

K

P

I

ENTUCKY

ARTNERSHIP

NCOME

Taxable period

LLET R

AND

ETURN

beginning _______________ , 201 ___, and ending _______________ , 201 ___.

__ __ / __ __

D

B

Federal

Taxable Year Ending

__ __ – __ __ __ __ __ __ __

Check applicable box(es):

Identification Number

Mo.

Yr.

LLET

Name of Partnership

Kentucky Secretary of State

Receipts Method

Organization Number

Gross Receipts

Gross Profits

Number and Street

$175 minimum

State and Date of Organization

Nonfiling Status Code

City

State

ZIP Code

Telephone Number

_____ _____

Enter Code

Principal Business Activity in KY

E

C

Check if applicable:

NAICS Code Number

Income Return

LLC

LP

LLP

Qualified investment pass-through entity

Initial return

(Relating to Kentucky Activity)

Final return (Complete Part III)

Change of Name

Change of Address

(See )

Nonfiling Status Code

Short-period return (Complete Part III)

Change of Accounting Period

_____ _____

Enter Code

Amended return (Complete Part IV)

F

➤ ____________________________

Number of Partners (Attach K-1s)

PART I—ORDINARY INCOME (LOSS) COMPUTATION

PART II—LLET COMPUTATION

1. Federal ordinary income (loss)

00

1. Schedule LLET, Section D, line 1 .....

1

00

(see instructions) ................................

1

2. Recycling/composting equipment

00

tax credit recapture ...........................

2

ADDITIONS

00

3. Total (add lines 1 and 2) ...................

3

4. Nonrefundable LLET credit from

2. State taxes based on net/gross

00

Kentucky Schedule(s) K-1 .................

4

income ................................................

2

00

5. Nonrefundable tax credits

3. Federal depreciation (do not include

00

(attach Schedule TCS) .....................

5

00

Section 179 expense deduction) .......

3

6. LLET liability (greater of line 3 less

4. Related party expenses (attach

00

lines 4 and 5 or $175 minimum) .....

6

Schedule RPC) ....................................

4

00

00

7. Estimated tax payments

..................

7

00

5. Other (attach Schedule O-PTE) .........

5

00

8. Certified rehabilitation tax credit ....

8

6. Total (add lines 1 through 5) .............

6

00

00

9. Film industry tax credit

....................

9

00

10. Extension payment ..........................

10

SUBTRACTIONS

00

11. Prior year’s tax credit .......................

11

7. Federal work opportunity credit .......

7

00

12. LLET due (line 6 less lines 7

8. Kentucky depreciation (do not include

00

through 11) .......................................

12

00

Section 179 expense deduction) ..........

8

13. LLET overpayment (lines 7

00

9. Other (attach Schedule O-PTE) .........

9

00

through 11 less line 6) ....................

13

10. Kentucky ordinary income (loss)

00

14. Credited to 2014 LLET ......................

14

(line 6 less lines 7 through 9) ............

10

00

00

15. Amount to be refunded ..................

15

TAX PAYMENT SUMMARY

Federal Form 1065, all pages and

OFFICIAL USE ONLY

➤

(Round to nearest dollar)

any supporting schedules must

P

W

be attached.

LLET

$

2

1. LLET due (Part II, line 12)

$_____________________________

0

Make check payable to:

4

2. Penalty

Kentucky State Treasurer

$_____________________________

V

Mail return with payment to:

3. Interest

$_____________________________

A

L

Kentucky Dept. of Revenue

4. Total Payment

$_____________________________

Frankfort, Kentucky 40620

#

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5