State Tax Form 96-1 - Senior Application For Statutory Exemption - 2007 Page 3

ADVERTISEMENT

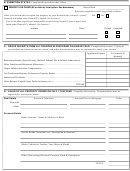

E. SIGNATURE. Sign here to complete the application.

This application has been prepared or examined by me. Under the pains and penalties of perjury, I declare that to the

best of my knowledge and belief, this return and all accompanying documents and statements are true, correct and

complete.

Signature

Date

If signed by agent, attach copy of written authorization to sign on behalf of taxpayer.

TAXPAYER INFORMATION ABOUT PERSONAL EXEMPTIONS

PERSONAL EXEMPTIONS. You may be eligible to reduce all or a portion of the taxes assessed on your

domicile if you meet the qualifications for one of the personal exemptions allowed under Massachusetts law.

Qualifications vary, but generally relate to age, ownership, residency, disability, income or assets.

You may be eligible for an exemption if you fall into any of these categories:

•

•

Blind

Minor child of deceased parent

•

•

Veteran with a service-connected disability

Senior citizen age 70 and older (65 and

•

older by local option)

Surviving spouse

More detailed information about the qualifications for each exemption may be obtained from your board of

assessors.

WHO MAY FILE AN APPLICATION. You may file an application if you meet all qualifications for a personal

exemption as of July 1. You may also apply if you are the administrator or executor of a person who qualified

for a personal exemption on July 1.

WHEN AND WHERE APPLICATION MUST BE FILED. Your application for any personal exemption, except

local option Clause 41C½ for seniors, must be filed with the assessors by December 15 or 3 months after the

actual bills were mailed for the fiscal year, whichever is later. An application for Clause 41C½ must be filed by

the earlier abatement application deadline for the fiscal year, which is the same day that the first actual tax

payment for the year is due. An application is filed when (1) received by the assessors on or before the filing

deadline, or (2) mailed by United States mail, first class postage prepaid, to the proper address of the assessors,

on or before the filing deadline, as shown by a postmark made by the United States Postal Service. THIS

DEADLINE CANNOT BE EXTENDED OR WAIVED BY THE ASSESSORS FOR ANY REASON. IF YOUR

APPLICATION IS NOT TIMELY FILED, YOU LOSE ALL RIGHTS TO AN EXEMPTION AND THE

ASSESSORS CANNOT BY LAW GRANT YOU ONE.

PAYMENT OF TAX. Filing an application does not stay the collection of your taxes. In some cases, you must

pay the tax when due to appeal the assessors’ disposition of your application. Failure to pay the tax when due

may also subject you to interest charges and collection action. To avoid any loss of rights or additional

charges, you should pay the tax as assessed. If an exemption is granted and you have already paid the entire

year’s tax as exempted, you will receive a refund of any overpayment.

ASSESSORS DISPOSITION. Upon applying for an exemption, you may be required to provide the assessors

with further information and supporting documentation to establish your eligibility. The assessors have 3

months from the date your application is filed to act on it unless you agree in writing before that period

expires to extend it for a specific time. If the assessors do not act on your application within the original or

extended period, it is deemed denied. You will be notified in writing whether an exemption has been granted

or denied.

APPEAL. You may appeal the disposition of your application. The disposition notice will provide you with

further information about the appeal procedure and deadline.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3