Form Mfut-12 - Application For Motor Fuel Use Tax Ifta License And Decals January 2005 Page 2

ADVERTISEMENT

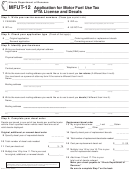

Step 5: Identify your type of operation

20

Check your type of business ownership.

____ Individual

____ Corporation

____ Partnership

____ State/federal government

____ Non-profit organization

21

If you checked “Corporation,” write the date and state of incorporation.

__ __/__ __/__ __ __ __

______________

Month

Day

Year

State

22

List the owners or corporate officers.

Social Security no.

Name and title

City and state

_ _ _ - _ _ - _ _ _ _

__________________________________________________

_______________________________

_ _ _ - _ _ - _ _ _ _

__________________________________________________

_______________________________

_ _ _ - _ _ - _ _ _ _

__________________________________________________

_______________________________

_ _ _ - _ _ - _ _ _ _

__________________________________________________

_______________________________

23

Do you currently have or have you ever had an IFTA license from a state other than Illinois?

____ yes

____ no

If you checked “yes,” tell us in what jurisdictions you were previously licensed.

____________________________________

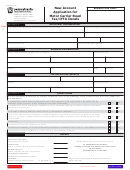

Step 6: Tell us your fuel types, operations, and bulk fuel storage

24

List the number of qualified motor vehicles you own or operate interstate________________________________________

25

List the number of qualified motor vehicles you own or operate intrastate________________________________________

26

Check the type of fuels used in the qualified motor vehicles you own or operate:

❒

❒

❒

❒

Diesel

Gasoline

Gasohol

Compressed natural gas

❒

❒

❒

LP gas

Ethanol

Methanol

❒

❒

❒

E-85

M-85

A-55

27

List each jurisdiction in which you maintain bulk fuel storage. Attach additional sheets if necessary.

______________________

________________________

________________________

_______________________

______________________

________________________

________________________

_______________________

______________________

________________________

________________________

_______________________

______________________

________________________

________________________

_______________________

______________________

________________________

________________________

_______________________

______________________

________________________

________________________

_______________________

______________________

________________________

________________________

_______________________

______________________

________________________

________________________

_______________________

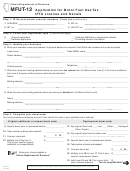

Step 7: Sign below

Your FEIN or SSN is used for account identification, payment processing, and record keeping. Your number and pertinent account information

may be provided to IFTA jurisdictions, governmental and state agencies, and any persons necessary for administering the Motor Fuel Tax Law.

Under penalties of perjury, I state that I have examined this application and, to the best of my knowledge, it is true, correct, and complete. The applicant

agrees to comply with all license display, record keeping, reporting, and payment requirements as specified in the Illinois Motor Fuel Tax Law and the

International Fuel Tax Agreement. Applicant further agrees that the Illinois Department of Revenue may withhold any overpayments due if it is delinquent

on payments of motor fuel use taxes due the state of Illinois or any IFTA member jurisdiction. Applicant understands that failure to comply with these

provisions is grounds for revocation of its license in all applicable jurisdictions.

Note:

Without proper signature from an owner, partner, authorized corporate officer, authorized agent, or employee who has the control,

supervision, or responsibility of filing returns and making payment of the tax, your application will be denied.

_________________________________________________

Mail to:

MOTOR FUEL USE TAX SECTION

Signature

ILLINOIS DEPARTMENT OF REVENUE

_______________________

PO BOX 19467

Title

SPRINGFIELD IL 62794-9467

(_____) _____ - _________

__ __/__ __/__ __ __ __

Telephone

Month

Day

Year

Telephone: 217 785-1397

MFUT-12 Back (R- 01/05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2