Form Mfut-12 - Application For Motor Fuel Use Tax Ifta License And Decals January 2005

ADVERTISEMENT

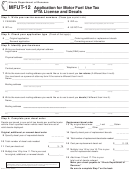

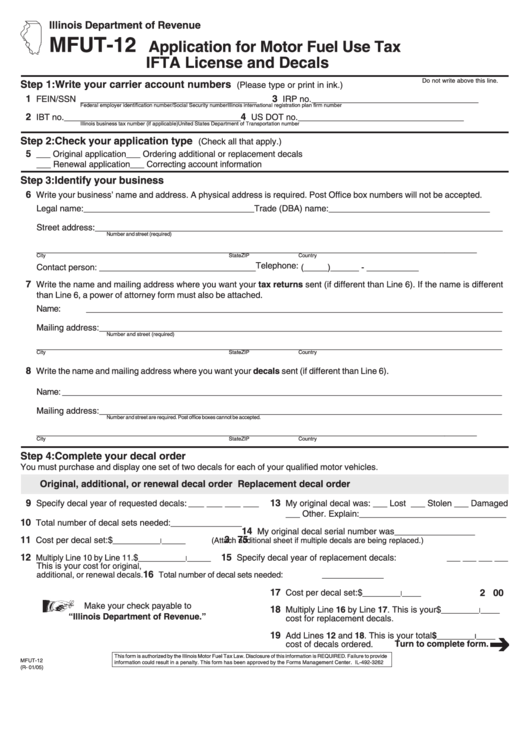

Illinois Department of Revenue

MFUT-12

Application for Motor Fuel Use Tax

IFTA License and Decals

Do not write above this line.

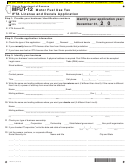

Step 1: Write your carrier account numbers

(Please type or print in ink.)

1

3

FEIN/SSN _____________________________________

IRP no.

___________________________________

Federal employer identification number/Social Security number

Illinois international registration plan firm number

2

4

IBT no.

_____________________________________

US DOT no. ___________________________________

Illinois business tax number (if applicable)

United States Department of Transportation number

Step 2: Check your application type

(Check all that apply.)

5

___ Original application

___ Ordering additional or replacement decals

___ Renewal application

___ Correcting account information

Step 3: Identify your business

6

Write your business’ name and address. A physical address is required. Post Office box numbers will not be accepted.

Legal name: ____________________________________

Trade (DBA) name: __________________________________

Street address:______________________________________________________________________________________

Number and street (required)

_________________________________________________________________________________________________

City

State

ZIP

Country

Telephone: (_____)______ - ___________

Contact person: _________________________________

7

Write the name and mailing address where you want your tax returns sent (if different than Line 6). If the name is different

than Line 6, a power of attorney form must also be attached.

Name:

_____________________________________________________________________________________________

Mailing address:_____________________________________________________________________________________

Number and street (required)

_________________________________________________________________________________________________

City

State

ZIP

Country

8

Write the name and mailing address where you want your decals sent (if different than Line 6).

Name: __________________________________________________________________________________________________

Mailing address:_____________________________________________________________________________________

Number and street are required. Post office boxes cannot be accepted.

_________________________________________________________________________________________________

City

State

ZIP

Country

Step 4: Complete your decal order

You must purchase and display one set of two decals for each of your qualified motor vehicles.

Original, additional, or renewal decal order

Replacement decal order

9

13

Specify decal year of requested decals: ___ ___ ___ ___

My original decal was: ___ Lost ___ Stolen ___ Damaged

___ Other. Explain: _______________________________

10

Total number of decal sets needed:

_______________

14

My original decal serial number was _________________

3 75

11

Cost per decal set:

$__________

_____

(Attach additional sheet if multiple decals are being replaced.)

|

12

15

$__________

_____

Specify decal year of replacement decals: ___ ___ ___ ___

Multiply Line 10 by Line 11.

|

This is your

cost for original,

16

:

_____________

additional, or renewal decals.

Total number of decal sets needed

17

Cost per decal set:

$________

2 00

____

|

Make your check payable to

18

Multiply Line 16 by Line 17. This is your

$________

____

|

“Illinois Department of Revenue.”

cost for replacement decals.

19

Add Lines 12 and 18. This is your total

$________

____

|

Turn to complete form.

cost of decals ordered.

This form is authorized by the Illinois Motor Fuel Tax Law. Disclosure of this information is REQUIRED. Failure to provide

MFUT-12

information could result in a penalty. This form has been approved by the Forms Management Center. IL-492-3262

(R- 01/05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2