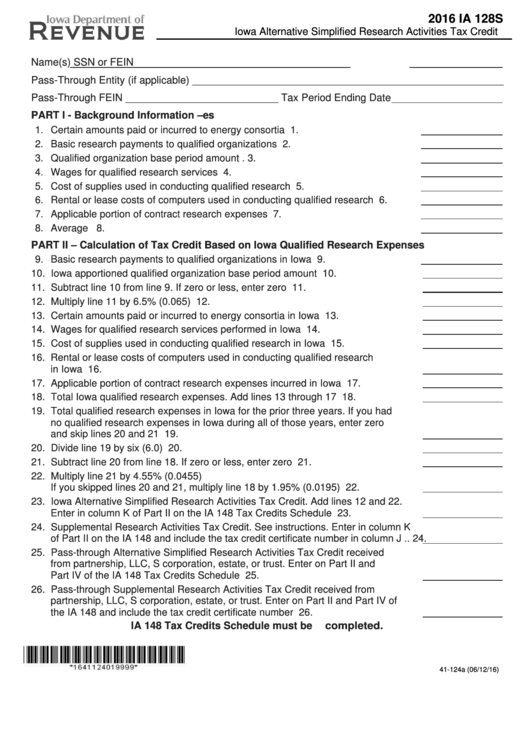

2016 IA 128S

Iowa Alternative Simplified Research Activities Tax Credit

https://tax.iowa.gov

Name(s)

SSN or FEIN

Pass-Through Entity (if applicable) _______________________________________________________

Pass-Through FEIN ___________________________ Tax Period Ending Date

PART I - Background Information – U.S. Qualified Research Expenses

1. Certain amounts paid or incurred to energy consortia ................................................. 1.

2. Basic research payments to qualified organizations .................................................... 2.

3. Qualified organization base period amount ................................................................. 3.

4. Wages for qualified research services ......................................................................... 4.

5. Cost of supplies used in conducting qualified research ............................................... 5.

6. Rental or lease costs of computers used in conducting qualified research .................. 6.

7. Applicable portion of contract research expenses ....................................................... 7.

8. Average U.S. annual gross receipts for tax years 2012 through 2015 ......................... 8.

PART II – Calculation of Tax Credit Based on Iowa Qualified Research Expenses

9. Basic research payments to qualified organizations in Iowa .................................... 9.

10. Iowa apportioned qualified organization base period amount ................................ 10.

11. Subtract line 10 from line 9. If zero or less, enter zero ........................................... 11.

12. Multiply line 11 by 6.5% (0.065) ............................................................................. 12.

13. Certain amounts paid or incurred to energy consortia in Iowa ............................... 13.

14. Wages for qualified research services performed in Iowa ...................................... 14.

15. Cost of supplies used in conducting qualified research in Iowa ............................. 15.

16. Rental or lease costs of computers used in conducting qualified research

in Iowa ................................................................................................................... 16.

17. Applicable portion of contract research expenses incurred in Iowa ........................ 17.

18. Total Iowa qualified research expenses. Add lines 13 through 17 ......................... 18.

19. Total qualified research expenses in Iowa for the prior three years. If you had

no qualified research expenses in Iowa during all of those years, enter zero

and skip lines 20 and 21 ........................................................................................ 19.

20. Divide line 19 by six (6.0) ....................................................................................... 20.

21. Subtract line 20 from line 18. If zero or less, enter zero ......................................... 21.

22. Multiply line 21 by 4.55% (0.0455)

If you skipped lines 20 and 21, multiply line 18 by 1.95% (0.0195) ........................ 22.

23. Iowa Alternative Simplified Research Activities Tax Credit. Add lines 12 and 22.

Enter in column K of Part II on the IA 148 Tax Credits Schedule ........................... 23.

24. Supplemental Research Activities Tax Credit. See instructions. Enter in column K

of Part II on the IA 148 and include the tax credit certificate number in column J .. 24.

25. Pass-through Alternative Simplified Research Activities Tax Credit received

from partnership, LLC, S corporation, estate, or trust. Enter on Part II and

Part IV of the IA 148 Tax Credits Schedule ............................................................ 25.

26. Pass-through Supplemental Research Activities Tax Credit received from

partnership, LLC, S corporation, estate, or trust. Enter on Part II and Part IV of

the IA 148 and include the tax credit certificate number ......................................... 26.

IA 148 Tax Credits Schedule must be completed.

41-124a (06/12/16)

1

1 2

2 3

3