CLEAR FORM

PRINT FORM

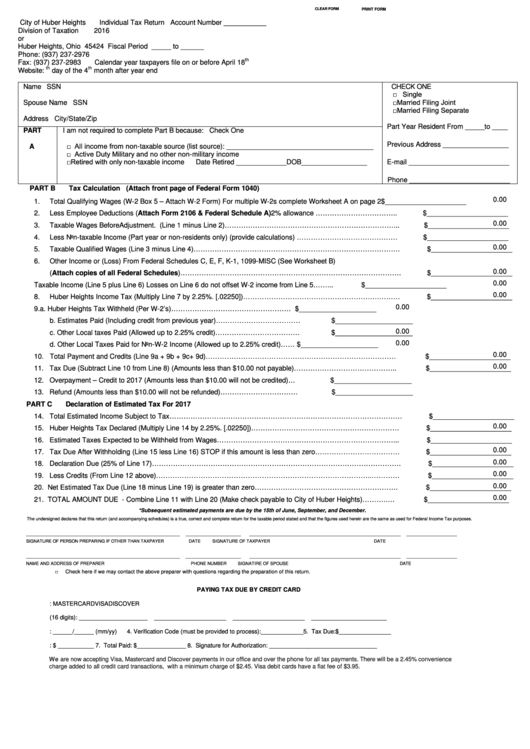

City of Huber Heights

Individual Tax Return

Account Number ___________

Division of Taxation

2016

P.O. Box 24309

or

Huber Heights, Ohio 45424

Fiscal Period _____ to ______

Phone: (937) 237-2976

th

Fax: (937) 237-2983

Calendar year taxpayers file on or before April 18

th

th

Website:

Fiscal year due on 15

day of the 4

month after year end

Name

SSN

CHECK ONE

□ Single

□ Married Filing Joint

Spouse Name

SSN

□ Married Filing Separate

Address

City/State/Zip

Part Year Resident From _____to ____

PART

I am not required to complete Part B because: Check One

□ All income from non-taxable source (list source): ______________________________________

Previous Address _________________

A

□ Active Duty Military and no other non-military income

□ Retired with only non-taxable income

Date Retired _____________DOB_________________

E-mail __________________________

Phone __________________________

PART B

Tax Calculation

(Attach front page of Federal Form 1040)

0.00

1.

Total Qualifying Wages (W-2 Box 5 – Attach W-2 Form) For multiple W-2s complete Worksheet A on page 2........

$_____________________

2.

Less Employee Deductions (Attach Form 2106 & Federal Schedule A) 2% allowance ……………………………..

$_____________________

0.00

3.

Taxable Wages Before Adjustment. (Line 1 minus Line 2)………………………………………………………………...

$_____________________

4.

Less Non-taxable Income (Part year or non-residents only) (provide calculations) …………………………………….

$_____________________

0.00

5.

Taxable Qualified Wages (Line 3 minus Line 4)…………………………………………………………………………….

$_____________________

6.

Other Income or (Loss) From Federal Schedules C, E, F, K-1, 1099-MISC (See Worksheet B)

0.00

(Attach copies of all Federal Schedules)………………………………………………………………………………….

$_____________________

0.00

7.

Huber Heights Taxable Income (Line 5 plus Line 6) Losses on Line 6 do not offset W-2 income from Line 5……...

$_____________________

0.00

8.

Huber Heights Income Tax (Multiply Line 7 by 2.25%. [.02250])………………………………………………….………

$_____________________

0.00

9.

a. Huber Heights Tax Withheld (Per W-2’s)……………………………………………

$____________________

b. Estimates Paid (Including credit from previous year)………………………………

$____________________

0.00

c. Other Local taxes Paid (Allowed up to 2.25% credit)………………………………

$____________________

0.00

d. Other Local Taxes Paid for Non-W-2 Income (Allowed up to 2.25% credit)……

$____________________

0.00

10. Total Payment and Credits (Line 9a + 9b + 9c + 9d)………………………………………………………………………

$_____________________

0.00

11. Tax Due (Subtract Line 10 from Line 8) (Amounts less than $10.00 not payable)……………………………………..

$_____________________

12. Overpayment – Credit to 2017 (Amounts less than $10.00 will not be credited)…

$____________________

13. Refund (Amounts less than $10.00 will not be refunded)……………………………

$____________________

PART C

Declaration of Estimated Tax For 2017

14. Total Estimated Income Subject to Tax………………………………………………………………………………………

$_____________________

0.00

15. Huber Heights Tax Declared (Multiply Line 14 by 2.25%. [.02250])………………………………………………………

$_____________________

16. Estimated Taxes Expected to be Withheld from Wages…………………………………………………………………...

$_____________________

0.00

17. Tax Due After Withholding (Line 15 less Line 16) STOP if this amount is less than zero………………………………

$_____________________

0.00

18. Declaration Due (25% of Line 17)…………………………………………………………………………………………….

$_____________________

0.00

19. Less Credits (From Line 12 above)………………………………………………………………………………..…………

$_____________________

0.00

20. Net Estimated Tax Due (Line 18 minus Line 19) is greater than zero…………………………………………………….

$_____________________

0.00

21. TOTAL AMOUNT DUE - Combine Line 11 with Line 20 (Make check payable to City of Huber Heights)……….….

$_____________________

*Subsequent estimated payments are due by the 15th of June, September, and December.

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated and that the figures used herein are the same as used for Federal Income Tax purposes.

________________________________________________________________

_______________________

_______________________________________________________________

_____________________

SIGNATURE OF PERSON PREPARING IF OTHER THAN TAXPAYER

DATE

SIGNATURE OF TAXPAYER

DATE

________________________________________________________________

_______________________

_______________________________________________________________

_____________________

NAME AND ADDRESS OF PREPARER

PHONE NUMBER

SIGNATIRE OF SPOUSE

DATE

□

Check here if we may contact the above preparer with questions regarding the preparation of this return.

PAYING TAX DUE BY CREDIT CARD

1. Circle One:

MASTERCARD

VISA

DISCOVER

2. Account Number (16 digits): _____________________

______________________

______________________

_______________________

3. Expiration Date: ______/______ (mm/yy)

4. Verification Code (must be provided to process):_____________5. Tax Due: $________________

6. Convenience Charge: $ ___________ 7. Total Paid: $_______________ 8. Signature for Authorization: _________________________________

We

are now accepting Visa, Mastercard and Discover payments in our office and over the phone for all tax payments. There will be a 2.45% convenience

charge added to all credit card transactions, with a minimum charge of $2.45. Visa debit cards have a flat fee of $3.95.

1

1 2

2