Exemption Certificate Form - Division Of Taxation - 2016

ADVERTISEMENT

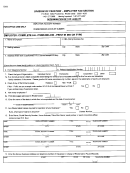

EXEMPTION CERTIFICATE

I LIVE IN A MANDATORY FILING CITY AND I AM NOT REQUIRED TO PAY CITY INCOME TAX BECAUSE:

@

@

RETIRED, received only pension, Social Security, interest or

NO EARNED INCOME FOR THE ENTIRE YEAR

1.

4.

dividend income

2016. (Public Assistance, Unemployment, SSI, etc.)

@

@

AN ACTIVE MEMBER OF THE ARMED FORCES OF THE

BUSINESS CLOSED OR RENTAL PROPERTY

2.

5.

UNITED STATES FOR THE ENTIRE YEAR 2016. (This does not

SOLD _____ / _____ / _____ (date)

include civilians employed by the military or National Guard.)

@

UNDER 18 FOR THE ENTIRE YEAR 2016.

3.

*see reverse for exceptions

IF EXEMPT, COMPLETE, DETACH AND RETURN THE EXEMPTION CERTIFICATE IN THE ENCLOSED ENVELOPE.

KEEP TOP PORTION FOR YOUR RECORDS.

IF YOU ARE NOT FILING THIS EXEMPTION CERTIFICATE, PLEASE DISCARD.

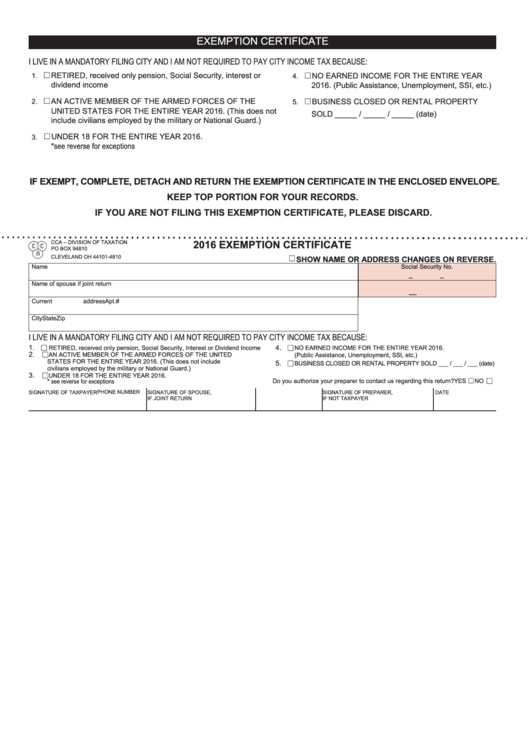

2016 EXEMPTION CERTIFICATE

CCA – DIVISION OF TAXATION

@

PO BOX 94810

CLEVELAND OH 44101-4810

SHOW NAME OR ADDRESS CHANGES ON REVERSE.

Name

Social Security No.

–

–

Name of spouse if joint return

– –

Current address

Apt. #

City

State

Zip

@ @

@

I LIVE IN A MANDATORY FILING CITY AND I AM NOT REQUIRED TO PAY CITY INCOME TAX BECAUSE:

1.

4.

RETIRED, received only pension, Social Security, Interest or Dividend Income

NO EARNED INCOME FOR THE ENTIRE YEAR 2016.

@

2.

AN ACTIVE MEMBER OF THE ARMED FORCES OF THE UNITED

(Public Assistance, Unemployment, SSI, etc.)

STATES FOR THE ENTIRE YEAR 2016. (This does not include

@

5.

BUSINESS CLOSED OR RENTAL PROPERTY SOLD ___ / ___ / ___ (date)

@

civilians employed by the military or National Guard.)

@

3.

UNDER 18 FOR THE ENTIRE YEAR 2016.

Do you authorize your preparer to contact us regarding this return? YES

NO

*see reverse for exceptions

PHONE NUMBER

SIGNATURE OF TAXPAYER

SIGNATURE OF SPOUSE,

SIGNATURE OF PREPARER,

DATE

IF JOINT RETURN

IF NOT TAXPAYER

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1