Form Ar-1030-Cec - Equipment Donation Or Sale Below Cost

ADVERTISEMENT

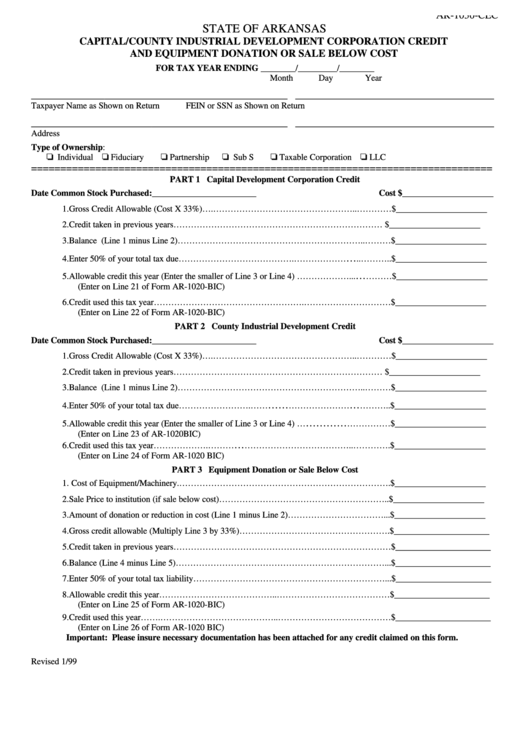

AR-1030-CEC

STATE OF ARKANSAS

CAPITAL/COUNTY INDUSTRIAL DEVELOPMENT CORPORATION CREDIT

AND EQUIPMENT DONATION OR SALE BELOW COST

FOR TAX YEAR ENDING ________/_________/________

Month

Day

Year

_________________________________________________ ______________________________________

Taxpayer Name as Shown on Return

FEIN or SSN as Shown on Return

_________________________________________________ ______________________________________

Address

Type of Ownership:

o Individual

o Fiduciary

o Partnership

o Sub S

o Taxable Corporation

o LLC

===============================================================================

PART 1 Capital Development Corporation Credit

Date Common Stock Purchased:________________________

Cost $_____________________

1. Gross Credit Allowable (Cost X 33%)….…………………………………………..…………$_____________________

2. Credit taken in previous years………………………………………………………………....$_____________________

3. Balance (Line 1 minus Line 2)………………………………………………………..………$_____________________

…

4. Enter 50% of your total tax due………………………………….………………

..………..$_____________________

…

5. Allowable credit this year (Enter the smaller of Line 3 or Line 4) ………………...

………$_____________________

(Enter on Line 21 of Form AR-1020-BIC)

6. Credit used this tax year…………………………………………….…………………………$_____________________

(Enter on Line 22 of Form AR-1020-BIC)

PART 2 County Industrial Development Credit

Date Common Stock Purchased:________________________

Cost $_____________________

1. Gross Credit Allowable (Cost X 33%)….…………………………………………..…………$_____________________

2. Credit taken in previous years………………………………………………………………....$_____________________

3. Balance (Line 1 minus Line 2)………………………………………………………..………$_____________________

……

…

4. Enter 50% of your total tax due…………………….……

…………………

………..$_____________________

…………

5. Allowable credit this year (Enter the smaller of Line 3 or Line 4) …

……………$_____________________

(Enter on Line 23 of AR-1020BIC)

…

6. Credit used this tax year……………….………

………………………………..………….$_____________________

(Enter on Line 24 of Form AR-1020 BIC)

PART 3 Equipment Donation or Sale Below Cost

1.

Cost of Equipment/Machinery.……………………………………………………………….$_____________________

2. Sale Price to institution (if sale below cost)…………………………………………………..$_____________________

3. Amount of donation or reduction in cost (Line 1 minus Line 2)……………………………...$_____________________

4. Gross credit allowable (Multiply Line 3 by 33%)…………………………………………….$______________________

5. Credit taken in previous years…………………………………………………………………$______________________

6. Balance (Line 4 minus Line 5)………………………………………………………………...$______________________

7. Enter 50% of your total tax liability…………………………………………………………...$______________________

8. Allowable credit this year…………………………………..…………………………………$______________________

(Enter on Line 25 of Form AR-1020-BIC)

9. Credit used this year…….…………………………………..…………………………………$______________________

(Enter on Line 26 of Form AR-1020 BIC)

Important: Please insure necessary documentation has been attached for any credit claimed on this form.

Revised 1/99

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1