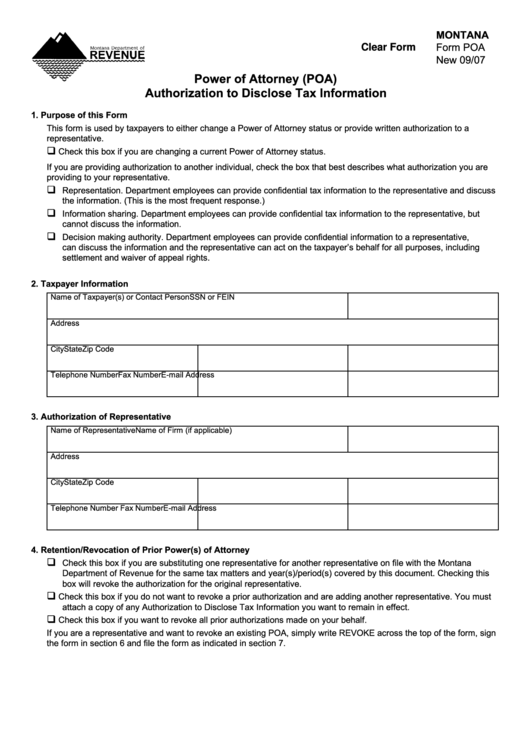

MONTANA

Form POA

Clear Form

New 09/07

Power of Attorney (POA)

Authorization to Disclose Tax Information

1. Purpose of this Form

This form is used by taxpayers to either change a Power of Attorney status or provide written authorization to a

representative.

q

Check this box if you are changing a current Power of Attorney status.

If you are providing authorization to another individual, check the box that best describes what authorization you are

providing to your representative.

q

Representation. Department employees can provide confidential tax information to the representative and discuss

the information. (This is the most frequent response.)

q

Information sharing. Department employees can provide confidential tax information to the representative, but

cannot discuss the information.

q

Decision making authority. Department employees can provide confidential information to a representative,

can discuss the information and the representative can act on the taxpayer’s behalf for all purposes, including

settlement and waiver of appeal rights.

2. Taxpayer Information

Name of Taxpayer(s) or Contact Person

SSN or FEIN

Address

City

State

Zip Code

Telephone Number

Fax Number

E-mail Address

3. Authorization of Representative

Name of Representative

Name of Firm (if applicable)

Address

City

State

Zip Code

Telephone Number

Fax Number

E-mail Address

4. Retention/Revocation of Prior Power(s) of Attorney

q

Check this box if you are substituting one representative for another representative on file with the Montana

Department of Revenue for the same tax matters and year(s)/period(s) covered by this document. Checking this

box will revoke the authorization for the original representative.

q

Check this box if you do not want to revoke a prior authorization and are adding another representative. You must

attach a copy of any Authorization to Disclose Tax Information you want to remain in effect.

q

Check this box if you want to revoke all prior authorizations made on your behalf.

If you are a representative and want to revoke an existing POA, simply write REVOKE across the top of the form, sign

the form in section 6 and file the form as indicated in section 7.

1

1 2

2