Short Term Rental Tax Quarterly Report Form - City Of Martinsville

ADVERTISEMENT

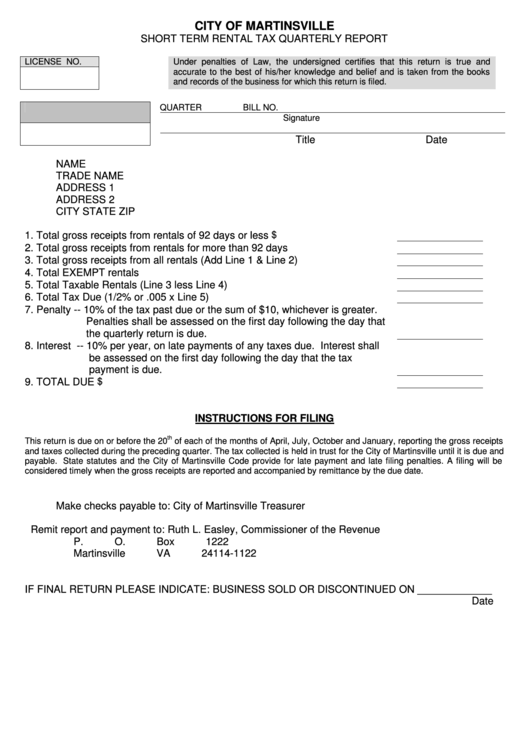

CITY OF MARTINSVILLE

SHORT TERM RENTAL TAX QUARTERLY REPORT

LICENSE NO.

Under penalties of Law, the undersigned certifies that this return is true and

accurate to the best of his/her knowledge and belief and is taken from the books

and records of the business for which this return is filed.

QUARTER

BILL NO.

Signature

Title

Date

NAME

TRADE NAME

ADDRESS 1

ADDRESS 2

CITY STATE ZIP

$

1. Total gross receipts from rentals of 92 days or less

2. Total gross receipts from rentals for more than 92 days

3. Total gross receipts from all rentals (Add Line 1 & Line 2)

4. Total EXEMPT rentals

5. Total Taxable Rentals (Line 3 less Line 4)

6. Total Tax Due (1/2% or .005 x Line 5)

7. Penalty -- 10% of the tax past due or the sum of $10, whichever is greater.

Penalties shall be assessed on the first day following the day that

the quarterly return is due.

8. Interest -- 10% per year, on late payments of any taxes due. Interest shall

be assessed on the first day following the day that the tax

payment is due.

$

9. TOTAL DUE

INSTRUCTIONS FOR FILING

th

This return is due on or before the 20

of each of the months of April, July, October and January, reporting the gross receipts

and taxes collected during the preceding quarter. The tax collected is held in trust for the City of Martinsville until it is due and

payable. State statutes and the City of Martinsville Code provide for late payment and late filing penalties. A filing will be

considered timely when the gross receipts are reported and accompanied by remittance by the due date.

Make checks payable to: City of Martinsville Treasurer

Remit report and payment to: Ruth L. Easley, Commissioner of the Revenue

P. O. Box 1222

Martinsville VA 24114-1122

IF FINAL RETURN PLEASE INDICATE: BUSINESS SOLD OR DISCONTINUED ON _____________

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1