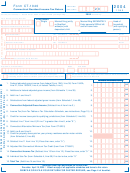

Form Ct-1040 - Connecticut Resident Income Tax Return - 2006 Page 4

ADVERTISEMENT

Form CT-1040 - Page 4

Your Social

-

-

Security Number

Schedule 3 - Property Tax Credit Worksheet

(See instructions, Page 25.)

Auto 2

Qualifying Property

Primary Residence

Auto 1

(Joint returns or Qualifying Widow(er) Only)

Name of Connecticut

Tax Town or District

Description of Property

If primary residence, enter

street address.

If motor vehicle, enter year,

make, and model.

Date(s) Paid

_ _ /_ _ / 2006

_ _ /_ _ / 2006

_ _ /_ _ / 2006

_ _ /_ _ / 2006

_ _ /_ _ / 2006

_ _ /_ _ / 2006

00

00

00

.

.

.

,

,

,

Amount Paid

60.

61.

62.

00

63. Total Property Tax Paid (Add Lines 60, 61, and 62.)

63.

.

,

500

64. Maximum Property Tax Credit Allowed

64.

00

.

00

65. Enter the lesser of Line 63 or Line 64.

65.

.

66. Enter the decimal amount for your filing status and Connecticut AGI from the Property Tax Credit Table

.

exactly as it appears on Page 27. (If zero, enter the amount from Line 65 on Line 68.)

66.

00

67. Multiply Line 65 by Line 66.

67.

.

00

68. Subtract Line 67 from Line 65. Enter here and on Line 11.

68.

.

Schedule 4 - Individual Use Tax Worksheet

Complete this worksheet to calculate your Connecticut individual use tax liability.

Column A

Column B

Column C

Column D

Column E

Column F

Column G

Tax, if any,

Balance due

Date of

Description of

Retailer or

Purchase

paid to

CT tax due

(Column E minus

purchase

goods or services

service provider

price

another

(.06 X Column D)

Column F but not

jurisdiction

less than zero)

Total of individual purchases under $300 not listed above

00

.

,

69. Individual Use Tax (Add all amounts for Column G.) Enter here and on Line 15.

69.

Schedule 5 - Contribution Worksheet

00

70a. AIDS Research

70a.

.

,

,

00

70b. Organ Transplant

70b.

.

,

,

00

70c. Endangered Species/Wildlife

70c.

.

,

,

00

70d. Breast Cancer Research

70d.

.

,

,

00

70e. Safety Net Services

70e.

.

,

,

00

70f. Military Family Relief Fund

70f.

.

,

,

00

.

70. Total Contributions (Add Lines 70a through 70f; enter amount here and on Line 24.)

70.

,

,

Use envelope provided, with correct mailing label, or mail to:

For refunds and all other tax forms without payment:

For all tax forms with payment:

Department of Revenue Services

Department of Revenue Services

PO Box 2976

PO Box 2977

Hartford CT 06104-2976

Hartford CT 06104-2977

Make your check or money order payable to: Commissioner of Revenue Services

To ensure proper posting, write your SSN(s) (optional) and “2006 Form CT-1040” on your check or money order.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4