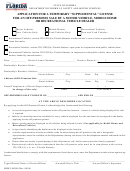

STATUTORY PROVISIONS

Section 320.08 (3)(d), Florida Statutes, defines a "goat" as a truck or any other

vehicle when used in the field by a farmer or in the woods for the purpose of harvesting

a crop, including naval stores, during such harvesting operations and which is not

principally operated upon the roads of the state, for registration tax of $7.50 flat. A

"goat" is a motor vehicle designed, constructed, and used principally for the

transportation of citrus fruit within citrus groves, or for the transportation of crops on

farms, and which can also be used for the hauling of associated equipment or supplies,

including required sanitary equipment, and the towing of farm trailers.

Section 320.08(4)(n), Florida Statutes, provides for a truck tractor or heavy truck,

not operated as a for-hire vehicle, which is engaged exclusively in transporting raw,

unprocessed, and non-manufactured agricultural or horticultural products, within a 150

mile radius of the vehicles home address, shall be eligible for a restricted license plate

for a fee of $65 flat, if such vehicle's declared gross vehicle weight is less than 44,000

pounds; or $240 flat, if such vehicle's declared gross vehicle weight is 44,000 pounds or

more and such vehicle only transports:

A.

From point of production to the point of primary manufacture;

B.

From point of production to the point of assembling the same; or

C.

From the point of production to a shipping point by rail, water or motor

transportation company.

This section also provides for not-for-hire truck tractors and heavy trucks used

exclusively in transporting raw, unprocessed and non-manufactured agricultural or

horticultural products to be incidentally used to haul farm implements and fertilizers

when delivered direct to the growers. For the purpose of this paragraph, "not-for-hire"

means the owner of the motor vehicle must also be the owner of the raw unprocessed,

and non-manufactured agricultural or horticultural product, or the user of farm

implements and fertilizer being delivered.

GENERAL INFORMATION

In an opinion filed March 7, 1958, the Supreme Court of Florida stated that the

farmer could get the benefit of a "goat" series license plate for use on a truck which was

used to transport his harvested crop within the farm and such benefit extended to using

the truck to reach the farm or to return to his headquarters over the public highways; but

without load.

This was interpreted by the Division of Motorist Services to mean that a motor

vehicle displaying a "goat" license plate is restricted to operation within the farm, grove

or woods in connection with harvesting operations. This vehicle cannot be operated

over the public roads carrying a load.

HSMV 83110 (Rev. 10/11) S

1

1 2

2