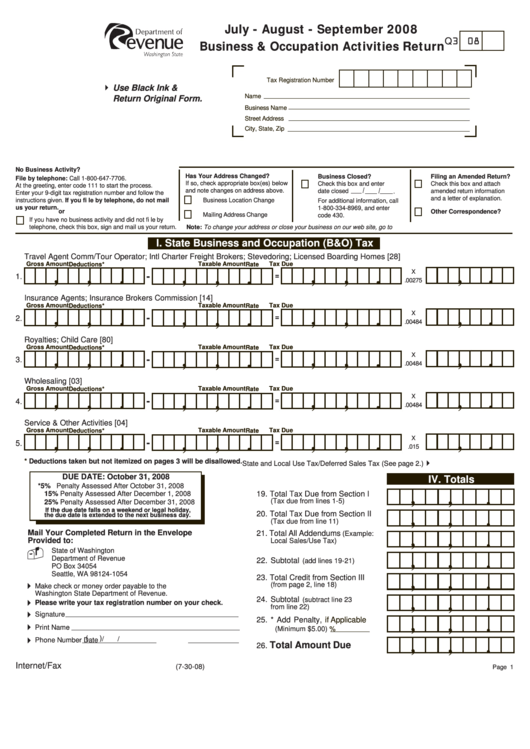

Form Q3-08 - Business And Occupation Activities Return - 2008

ADVERTISEMENT

July - August - September 2008

3 08

Q

Business & Occupation Activities Return

Tax Registration Number

Use Black Ink &

Name

Return Original Form.

Business Name

Street Address

City, State, Zip

No Business Activity?

Has Your Address Changed?

Business Closed?

Filing an Amended Return?

File by telephone: Call 1-800-647-7706.

If so, check appropriate box(es) below

Check this box and enter

Check this box and attach

At the greeting, enter code 111 to start the process.

and note changes on address above.

date closed

amended return information

.

Enter your 9-digit tax registration number and follow the

and a letter of explanation.

instructions given. If you fi le by telephone, do not mail

Business Location Change

For additional information, call

us your return.

1-800-334-8969, and enter

or

Other Correspondence?

Mailing Address Change

code 430.

If you have no business activity and did not fi le by

telephone, check this box, sign and mail us your return.

Note: To change your address or close your business on our web site, go to

I. State Business and Occupation (B&O) Tax

Travel Agent Comm/Tour Operator; Intl Charter Freight Brokers; Stevedoring; Licensed Boarding Homes [28]

Gross Amount

Taxable Amount

Tax Due

Deductions*

Rate

X

,

,

,

,

,

,

.

.

-

,

.

.

=

1.

.00275

Insurance Agents; Insurance Brokers Commission [14]

Gross Amount

Deductions*

Taxable Amount

Rate

Tax Due

X

,

,

,

,

.

,

,

,

.

.

-

.

=

2.

.00484

Royalties; Child Care [80]

Gross Amount

Taxable Amount

Tax Due

Deductions*

Rate

X

,

,

,

,

,

,

.

.

,

.

-

.

=

3.

.00484

Wholesaling [03]

Gross Amount

Taxable Amount

Tax Due

Deductions*

Rate

X

,

,

,

,

,

,

.

.

-

,

.

.

=

4.

.00484

Service & Other Activities [04]

Gross Amount

Taxable Amount

Tax Due

Deductions*

Rate

X

,

,

,

,

,

,

.

.

-

,

.

.

=

5.

.015

*

Deductions taken but not itemized on pages 3 will be disallowed.

State and Local Use Tax/Deferred Sales Tax (See page 2.)

DUE DATE: October 31, 2008

IV. Totals

* 5% Penalty Assessed After October 31, 2008

19. Total Tax Due from Section I

15% Penalty Assessed After December 1, 2008

,

,

.

(Tax due from lines 1-5)

25% Penalty Assessed After December 31, 2008

If the due date falls on a weekend or legal holiday,

20. Total Tax Due from Section II

,

the due date is extended to the next business day.

,

.

(Tax due from line 11)

Mail Your Completed Return in the Envelope

21. Total All Addendums

(Example:

,

,

.

Provided to:

Local Sales/Use Tax)

State of Washington

Department of Revenue

,

,

.

22. Subtotal

(add lines 19-21)

PO Box 34054

Seattle, WA 98124-1054

23. Total Credit from Section III

,

,

.

(from page 2, line 18)

Make check or money order payable to the

Washington State Department of Revenue.

24. Subtotal

(subtract line 23

,

,

.

Please write your tax registration number on your check.

from line 22)

Signature

25. * Add Penalty,

if Applicable

,

,

.

Print Name

(Minimum $5.00)

%

(

)

/

/

Phone Number

Date

,

,

Total Amount Due

.

26.

Internet/Fax

(7-30-08)

Page

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4