Form Rf 1-2000 - Application For Municipal Income Tax Refund Page 2

ADVERTISEMENT

TAX OFFICE USE ONLY

__________________________________

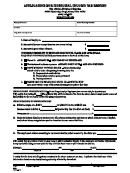

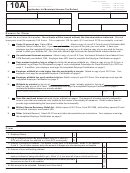

APPLICATION FOR MUNICIPAL INCOME TAX REFUND

VOUCHER #

__________________________________

CITY OF PARMA HEIGHTS

20__

____ EXCESS TAX WITHHELD

6281 Pearl Road, Parma Heights Ohio 44130-3084

____ EXCESS TAX PAID BY TAXPAYER

____ TAX PAID TO WRONG CITY

TAX OFFICE PHONE (440) 888-6440

____ OTHER _____________________

TAXPAYER NAME:

SOCIAL SECURITY NUMBER:

ADDRESS:

PHONE:

CITY, STATE AND ZIP CODE:

1.

IMPORTANT: Follow the Instructions On the Reverse Side of This Form to Expedite the Processing of Your Refund.

2. Enter total compensation below (i.e., gross wages, salaries, bonuses, commissions, and other compensation received before any deductions):

3.

Employer Name

Employer Federal I.D. No.

City Tax Withheld

Wages, Etc.

4. TOTAL WAGES AND CITY TAX WITHHELD .......................................................................... $

$

(

)

$

5. WAGES NOT SUBJECT TO TAX (Explain in Line 10 Below)..........................................................................................................

$

6. ADJUSTED WAGES SUBJECT TO TAX (Line 4 minus Line 5) ......................................................................................................

$

7. ADJUSTED MUNICIPAL INCOME TAX ...........................................................................................................................................

$

8. INCOME TAX WITHHELD BY EMPLOYER (Line 4)........................................................................................................................

$

9. OVERPAYMENT CLAIMED AND REFUND REQUESTED (Line 8 minus Line 7) ..........................................................................

10. INDICATE IN BLOCK BELOW THE KIND OF CLAIM FILED (SEE INSTRUCTIONS ON REVERSE SIDE)

REFUND OF MUNICIPAL INCOME TAX WITHHELD FOR ALL OR PART OF 20___. APPLICANT WAS UNDER 18 YEARS OF AGE.

EMPLOYEE BUSINESS EXPENSES - SEE REVERSE SIDE OF FORM FOR INSTRUCTIONS.

OTHER (STATE REASON AND ATTACH DOCUMENTATION) ________________________________________________________________________

______________________________________________________________________________________________________________________________

I DECLARE UNDER THE PENALTIES OF PERJURY THAT THIS CLAIM (INCLUDING ANY ACCOMPANYING STATEMENTS) HAS BEEN EXAMINED BY ME AND, TO

THE BEST OF MY KNOWLEDGE AND BELIEFE, IS TRUE AND CORRECT. I AUTHORIZE THE DISCLOSURE OF THE INFORMATION HEREIN TO M ANY TAXING

AUTHORITY AFFECTED BY THIS REFUND.

Date: _____________ 20_____

SIGNED______________________________________________________

EMPLOYER'S CERTIFICATION -

to be completed by Employer (see reverse side for instructions)

I/We verify that during 20___ I/we withheld City of Parma Heights Income Tax from the above named employee in excess of his/her liability for the tax based on the

following computation:

A. Salaries, wages, etc. paid were $ _____________ on which Parma Heights Tax withheld was:................................................................ $ _______________________

1. Income Earned in Parma Heights $_____________ subject to City Tax @ 2% prior to 1/1/05 @ 3% after 1/1/05:........................ $ (______________________)

2. Income Earned in 20___ prior to 18 years of age $_____________ on which Parma Heights Tax withheld was:.......................... $ (______________________)

OVERPAYMENT: ............................................................................................................................................................................................... $ _______________________

B. Basis for Refund (Employer must provide all pertinent information and facts on which claim is based). Explain the method and show computations used to determine

income earned in Parma Heights: _________________________________________________________________________________________________________

____________________________________________________________________________________________________________________________________

C. The employee’s address according to our records for the period covered by the claim was __________________________________________________________

_____________________________________________________________________________________________________________________________________

I/We verify that no portion of said tax has been or will be refunded directly to the employee and that no adjustments to my/our withholding account with the City of Parma

Heights have been or will be made for said Tax.

SIGNED _________________________________________(Employer) BY _________________________________________________________

(Title)

FEDERAL I.D. ______________________________________ DATE _____________________________________________________________

RF 1-2000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2