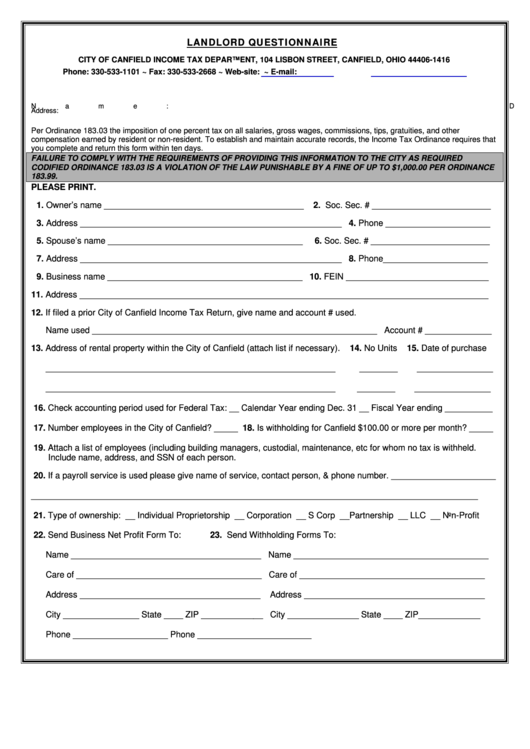

LANDLORD QUESTIONNAIRE

CITY OF CANFIELD INCOME TAX DEPARTMENT, 104 LISBON STREET, CANFIELD, OHIO 44406-1416

Phone: 330-533-1101 ~ Fax: 330-533-2668 ~ Web-site:

~ E-mail:

vshook@ci.canfield.oh.us

Name:

DATE:

Address:

Per Ordinance 183.03 the imposition of one percent tax on all salaries, gross wages, commissions, tips, gratuities, and other

compensation earned by resident or non-resident. To establish and maintain accurate records, the Income Tax Ordinance requires that

you complete and return this form within ten days.

FAILURE TO COMPLY WITH THE REQUIREMENTS OF PROVIDING THIS INFORMATION TO THE CITY AS REQUIRED

CODIFIED ORDINANCE 183.03 IS A VIOLATION OF THE LAW PUNISHABLE BY A FINE OF UP TO $1,000.00 PER ORDINANCE

183.99.

PLEASE PRINT.

1. Owner’s name __________________________________________

2. Soc. Sec. # _________________________

3. Address _______________________________________________________ 4. Phone ______________________

5. Spouse’s name _________________________________________

6. Soc. Sec. # _________________________

7. Address _______________________________________________________ 8. Phone______________________

9. Business name _________________________________________ 10. FEIN ______________________________

11. Address ______________________________________________________________________________________

12. If filed a prior City of Canfield Income Tax Return, give name and account # used.

Name used ____________________________________________________________ Account # ______________

13. Address of rental property within the City of Canfield (attach list if necessary).

14. No Units

15. Date of purchase

_____________________________________________________________

________

________________

_____________________________________________________________

________

________________

16. Check accounting period used for Federal Tax: __ Calendar Year ending Dec. 31 __ Fiscal Year ending __________

17. Number employees in the City of Canfield? _____ 18. Is withholding for Canfield $100.00 or more per month? _____

19. Attach a list of employees (including building managers, custodial, maintenance, etc for whom no tax is withheld.

Include name, address, and SSN of each person.

20. If a payroll service is used please give name of service, contact person, & phone number. ______________________

______________________________________________________________________________________________

21. Type of ownership: __ Individual Proprietorship __ Corporation __ S Corp __Partnership __ LLC __ Non-Profit

22. Send Business Net Profit Form To:

23. Send Withholding Forms To:

Name ________________________________________ Name _________________________________________

Care of _______________________________________ Care of _______________________________________

Address ______________________________________

Address ______________________________________

City ________________ State ____ ZIP _____________ City _______________ State ____ ZIP_____________

Phone ____________________

Phone ________________________

1

1 2

2