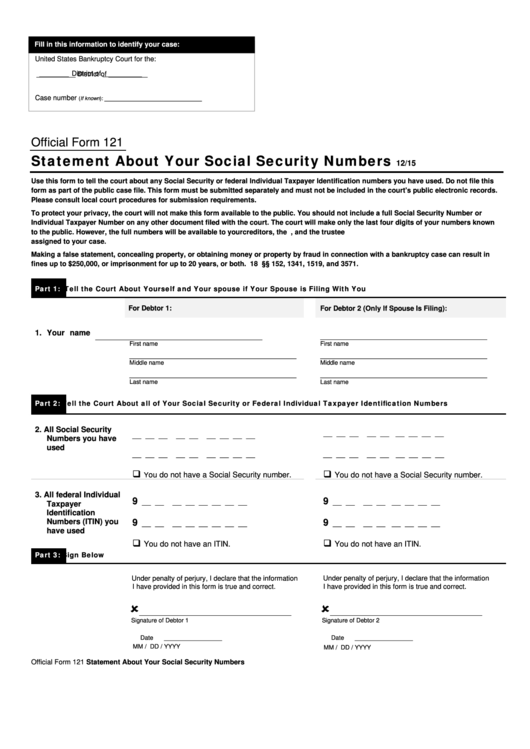

Fill in this information to identify your case:

United States Bankruptcy Court for the:

District of __________

__________ District of __________

__________

Case number

_________________________

(If known):

Official Form 121

Statement About Your Social Security Numbers

12/15

Use this form to tell the court about any Social Security or federal Individual Taxpayer Identification numbers you have used. Do not file this

form as part of the public case file. This form must be submitted separately and must not be included in the court’s public electronic records.

Please consult local court procedures for submission requirements.

To protect your privacy, the court will not make this form available to the public. You should not include a full Social Security Number or

Individual Taxpayer Number on any other document filed with the court. The court will make only the last four digits of your numbers known

to the public. However, the full numbers will be available to your creditors, the U.S. Trustee or bankruptcy administrator, and the trustee

assigned to your case.

Making a false statement, concealing property, or obtaining money or property by fraud in connection with a bankruptcy case can result in

fines up to $250,000, or imprisonment for up to 20 years, or both. 18 U.S.C. §§ 152, 1341, 1519, and 3571.

Part 1:

Tell the Court About Yourself and Your spouse if Your Spouse is Filing With You

For Debtor 1:

For Debtor 2 (Only If Spouse Is Filing):

1. Your name

_________________________________________________

_________________________________________________

First name

First name

_________________________________________________

_________________________________________________

Middle name

Middle name

_________________________________________________

_________________________________________________

Last name

Last name

Part 2:

Tell the Court About all of Your Social Security or Federal Individual Taxpayer Identification Numbers

2. All Social Security

__ __ __

__ __

__ __ __ __

__ __ __

__ __

__ __ __ __

Numbers you have

used

__ __ __

__ __

__ __ __ __

__ __ __

__ __ __ __ __ __

ou do not have a Social Security number.

You do not have a Social Security number.

Y

3. All federal Individual

9

9

__ __

__ __

__ __ __ __

__ __

__ __

__ __ __ __

Taxpayer

Identification

Numbers (ITIN) you

9

9

__ __

__ __

__ __ __ __

__ __

__ __

__ __ __ __

have used

You do not have an ITIN.

You do not have an ITIN.

Part 3:

Sign Below

Under penalty of perjury, I declare that the information

Under penalty of perjury, I declare that the information

I have provided in this form is true and correct.

I have provided in this form is true and correct.

_______________________________________

_______________________________________

Signature of Debtor 1

Signature of Debtor 2

Date _________________

Date _________________

MM / DD / YYYY

MM / DD / YYYY

Official Form 121

Statement About Your Social Security Numbers

Print

Save As...

Reset

1

1