Declaration Of Estimated Tax Form- The City Of Xenia

ADVERTISEMENT

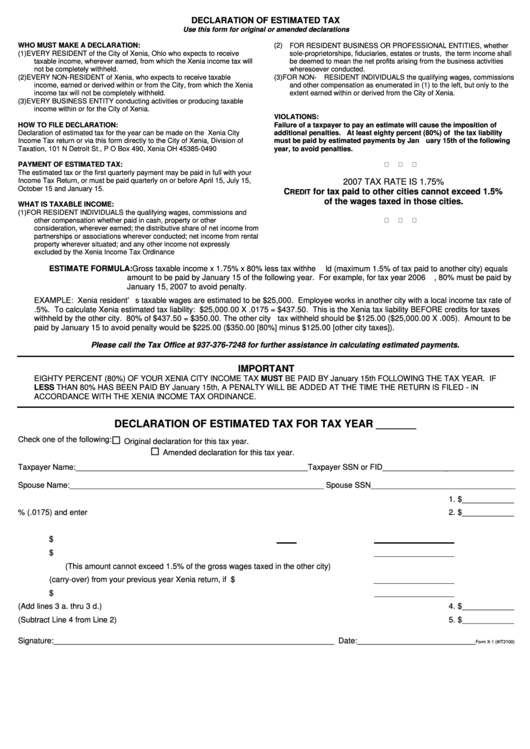

DECLARATION OF ESTIMATED TAX

Use this form for original or amended declarations

WHO MUST MAKE A DECLARATION:

(2)

FOR RESIDENT BUSINESS OR PROFESSIONAL ENTITIES, whether

(1)

EVERY RESIDENT of the City of Xenia, Ohio who expects to receive

sole-proprietorships, fiduciaries, estates or trusts, the term income shall

taxable income, wherever earned, from which the Xenia income tax will

be deemed to mean the net profits arising from the business activities

not be completely withheld.

wheresoever conducted.

(2)

EVERY NON-RESIDENT of Xenia, who expects to receive taxable

(3)

FOR NON-RESIDENT INDIVIDUALS the qualifying wages, commissions

income, earned or derived within or from the City, from which the Xenia

and other compensation as enumerated in (1) to the left, but only to the

income tax will not be completely withheld.

extent earned within or derived from the City of Xenia.

(3)

EVERY BUSINESS ENTITY conducting activities or producing taxable

income within or for the City of Xenia.

VIOLATIONS:

HOW TO FILE DECLARATION:

Failure of a taxpayer to pay an estimate will cause the imposition of

Declaration of estimated tax for the year can be made on the Xenia City

additional penalties. At least eighty percent (80%) of the tax liability

Income Tax return or via this form directly to the City of Xenia, Division of

must be paid by estimated payments by January 15th of the following

Taxation, 101 N Detroit St., P O Box 490, Xenia OH 45385-0490

year, to avoid penalties.

PAYMENT OF ESTIMATED TAX:

The estimated tax or the first quarterly payment may be paid in full with your

Income Tax Return, or must be paid quarterly on or before April 15, July 15,

2007 TAX RATE IS 1.75%

October 15 and January 15.

C

for tax paid to other cities cannot exceed 1.5%

REDIT

of the wages taxed in those cities.

WHAT IS TAXABLE INCOME:

(1)

FOR RESIDENT INDIVIDUALS the qualifying wages, commissions and

other compensation whether

paid in cash,

property or other

consideration, wherever earned; the distributive share of net income from

partnerships or associations wherever conducted; net income from rental

property wherever situated; and any other income not expressly

excluded by the Xenia Income Tax Ordinance

ESTIMATE FORMULA: Gross taxable income x 1.75% x 80% less tax withheld (maximum 1.5% of tax paid to another city) equals

amount to be paid by January 15 of the following year. For example, for tax year 2006, 80% must be paid by

January 15, 2007 to avoid penalty.

EXAMPLE: Xenia resident’ s taxable wages are estimated to be $25,000. Employee works in another city with a local income tax rate of

.5%. To calculate Xenia estimated tax liability: $25,000.00 X .0175 = $437.50. This is the Xenia tax liability BEFORE credits for taxes

withheld by the other city. 80% of $437.50 = $350.00. The other city tax withheld should be $125.00 ($25,000.00 X .005). Amount to be

paid by January 15 to avoid penalty would be $225.00 ($350.00 [80%] minus $125.00 [other city taxes]).

Please call the Tax Office at 937-376-7248 for further assistance in calculating estimated payments.

IMPORTANT

EIGHTY PERCENT (80%) OF YOUR XENIA CITY INCOME TAX MUST BE PAID BY January 15th FOLLOWING THE TAX YEAR. IF

LESS THAN 80% HAS BEEN PAID BY January 15th, A PENALTY WILL BE ADDED AT THE TIME THE RETURN IS FILED - IN

ACCORDANCE WITH THE XENIA INCOME TAX ORDINANCE.

DECLARATION OF ESTIMATED TAX FOR TAX YEAR _______

Check one of the following:

Original declaration for this tax year.

Amended declaration for this tax year.

Taxpayer Name:_____________________________________________________Taxpayer SSN or FID_______________________________

Spouse Name:__________________________________________________________ Spouse SSN_________________________________

1.

Enter your total estimated Xenia taxable income ................................................................................................................. 1. $____________

2.

Multiply Line 1 by 1.75% (.0175) and enter here.................................................................................................................. 2. $____________

3.

TAX CREDITS

a.

Enter the tax your employer will withhold and send directly to Xenia.............................a. $

b.

Enter the tax to be withheld by your employer for another city.......................................b. $

(This amount cannot exceed 1.5% of the gross wages taxed in the other city)

c.

Enter the overpayment (carry-over) from your previous year Xenia return, if any..........c. $

d.

Enter other credits..........................................................................................................d. $

4.

Enter your total credits. (Add lines 3 a. thru 3 d.) ................................................................................................................. 4. $____________

5.

Net Estimated Tax Due (Subtract Line 4 from Line 2).......................................................................................................... 5. $____________

Signature:________________________________________________________________ Date:___________________________

Form X-1 (#IT2100)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1