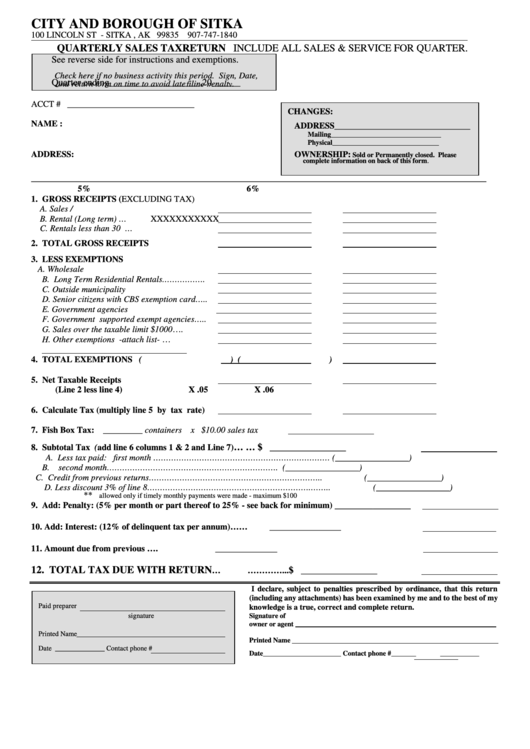

Quarterly Sales Tax Return Form - City And Borough Of Sitka

ADVERTISEMENT

CITY AND BOROUGH OF SITKA

100 LINCOLN ST - SITKA , AK 99835 907-747-1840

QUARTERLY SALES TAX RETURN INCLUDE ALL SALES & SERVICE FOR QUARTER.

See reverse side for instructions and exemptions.

9

Check here if no business activity this period. Sign, Date,

Quarter ending___________________,20______

and return form on time to avoid late filing penalty.

ACCT # _____________________________

CHANGES:

9

NAME :

ADDRESS_______________________________

9

Mailing_______________________________

9

Physical______________________________

9

OWNERSHIP:

Sold or Permanently closed. Please

ADDRESS:

complete information on back of this form.

_______________________________________________________________________________________

5%

6%

1. GROSS RECEIPTS (EXCLUDING TAX)

A. Sales / Service...............................................

B. Rental (Long term)................................…....

XXXXXXXXXXX

C. Rentals less than 30 days....................…......

2. TOTAL GROSS RECEIPTS

3. LESS EXEMPTIONS

A. Wholesale.....................................................

B. Long Term Residential Rentals.…………….

C. Outside municipality....................................

D. Senior citizens with CBS exemption card…..

E. Government agencies...................................

F. Government supported exempt agencies…..

G. Sales over the taxable limit $1000......…......

H. Other exemptions -attach list- .........…........

4. TOTAL EXEMPTIONS

(

)

(

)

5. Net Taxable Receipts

(Line 2 less line 4)

X .05

X .06

6. Calculate Tax (multiply line 5 by tax rate)

7. Fish Box Tax: _________ containers x $10.00 sales tax

.........................................….....….......

$ ________________

8. Subtotal Tax (add line 6 columns 1 & 2 and Line 7)

A. Less tax paid: first month ……………………………………………………………

(_________________)

B.

second month………………………………………………………….

(_________________)

C. Credit from previous returns…………………………………………………………..

(_________________)

D. Less discount 3% of line 8……………………………………………………….……..

(_________________)

**

allowed only if timely monthly payments were made - maximum $100

________________

9. Add: Penalty: (5% per month or part thereof to 25% - see back for minimum)......................

_______________

10. Add: Interest: (12% of delinquent tax per annum)................…….............................................

_____________

11. Amount due from previous return............................................................................…................

12. TOTAL TAX DUE WITH RETURN

$ ________________

............................................….........…………...

I declare, subject to penalties prescribed by ordinance, that this return

(including any attachments) has been examined by me and to the best of my

knowledge is a true, correct and complete return.

Paid preparer

signature

Signature of

owner or agent

Printed Name

Printed Name

Date ______________ Contact phone #

Date______________________ Contact phone #_______

___________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2