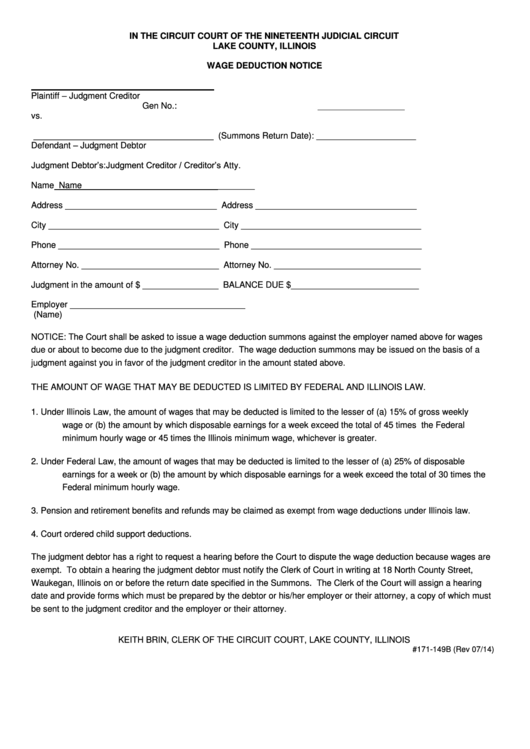

IN THE CIRCUIT COURT OF THE NINETEENTH JUDICIAL CIRCUIT

LAKE COUNTY, ILLINOIS

WAGE DEDUCTION NOTICE

Plaintiff – Judgment Creditor

Gen No.:

vs.

______________________________________

(Summons Return Date): _____________________

Defendant – Judgment Debtor

Judgment Debtor’s:

Judgment Creditor / Creditor’s Atty.

Name

Name ____________________________________

Address ________________________________

Address __________________________________

City ____________________________________

City ______________________________________

Phone __________________________________

Phone ____________________________________

Attorney No. _____________________________

Attorney No. _______________________________

Judgment in the amount of $ ________________

BALANCE DUE $___________________________

Employer _____________________________________

(Name)

NOTICE: The Court shall be asked to issue a wage deduction summons against the employer named above for wages

due or about to become due to the judgment creditor. The wage deduction summons may be issued on the basis of a

judgment against you in favor of the judgment creditor in the amount stated above.

THE AMOUNT OF WAGE THAT MAY BE DEDUCTED IS LIMITED BY FEDERAL AND ILLINOIS LAW.

1.

Under Illinois Law, the amount of wages that may be deducted is limited to the lesser of (a) 15% of gross weekly

wage or (b) the amount by which disposable earnings for a week exceed the total of 45 times the Federal

minimum hourly wage or 45 times the Illinois minimum wage, whichever is greater.

2.

Under Federal Law, the amount of wages that may be deducted is limited to the lesser of (a) 25% of disposable

earnings for a week or (b) the amount by which disposable earnings for a week exceed the total of 30 times the

Federal minimum hourly wage.

3.

Pension and retirement benefits and refunds may be claimed as exempt from wage deductions under Illinois law.

4.

Court ordered child support deductions.

The judgment debtor has a right to request a hearing before the Court to dispute the wage deduction because wages are

exempt. To obtain a hearing the judgment debtor must notify the Clerk of Court in writing at 18 North County Street,

Waukegan, Illinois on or before the return date specified in the Summons. The Clerk of the Court will assign a hearing

date and provide forms which must be prepared by the debtor or his/her employer or their attorney, a copy of which must

be sent to the judgment creditor and the employer or their attorney.

KEITH BRIN, CLERK OF THE CIRCUIT COURT, LAKE COUNTY, ILLINOIS

#171-149B (Rev 07/14)

1

1