Clear Form

__

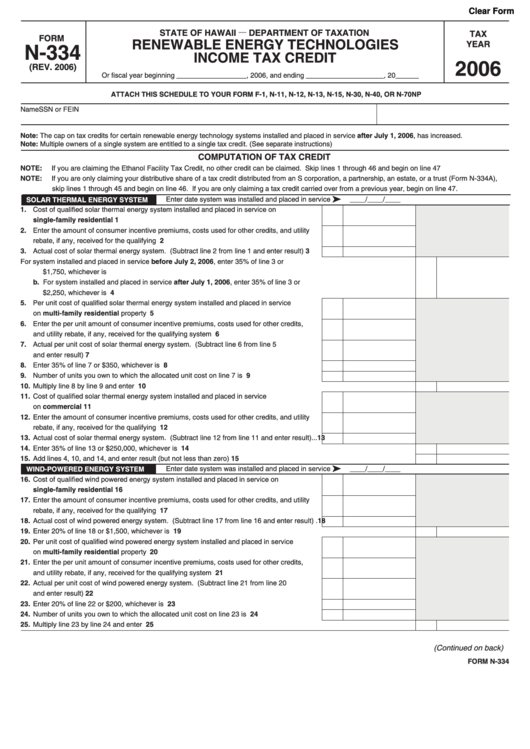

STATE OF HAWAII

DEPARTMENT OF TAXATION

TAX

FORM

RENEWABLE ENERGY TECHNOLOGIES

YEAR

N-334

INCOME TAX CREDIT

2006

(REV. 2006)

Or fiscal year beginning __________________, 2006, and ending ____________________, 20______

ATTACH THIS SCHEDULE TO YOUR FORM F-1, N-11, N-12, N-13, N-15, N-30, N-40, OR N-70NP

Name

SSN or FEIN

Note: The cap on tax credits for certain renewable energy technology systems installed and placed in service after July 1, 2006, has increased.

Note: Multiple owners of a single system are entitled to a single tax credit. (See separate instructions)

COMPUTATION OF TAX CREDIT

NOTE:

If you are claiming the Ethanol Facility Tax Credit, no other credit can be claimed. Skip lines 1 through 46 and begin on line 47

NOTE:

If you are only claiming your distributive share of a tax credit distributed from an S corporation, a partnership, an estate, or a trust (Form N-334A),

skip lines 1 through 45 and begin on line 46. If you are only claiming a tax credit carried over from a previous year, begin on line 47.

ä

Enter date system was installed and placed in service

____/____/____

SOLAR THERMAL ENERGY SYSTEM

1. Cost of qualified solar thermal energy system installed and placed in service on

single-family residential property............................................................................................

1

2. Enter the amount of consumer incentive premiums, costs used for other credits, and utility

rebate, if any, received for the qualifying system.......................................................................

2

3. Actual cost of solar thermal energy system. (Subtract line 2 from line 1 and enter result).......

3

4. a. For system installed and placed in service before July 2, 2006, enter 35% of line 3 or

$1,750, whichever is less .....................................................................................................................................................

b. For system installed and placed in service after July 1, 2006, enter 35% of line 3 or

$2,250, whichever is less ......................................................................................................................................................

4

5. Per unit cost of qualified solar thermal energy system installed and placed in service

on multi-family residential property ........................................................................................

5

6. Enter the per unit amount of consumer incentive premiums, costs used for other credits,

and utility rebate, if any, received for the qualifying system ......................................................

6

7. Actual per unit cost of solar thermal energy system. (Subtract line 6 from line 5

and enter result).........................................................................................................................

7

8. Enter 35% of line 7 or $350, whichever is less ..........................................................................

8

9. Number of units you own to which the allocated unit cost on line 7 is applicable......................

9

10. Multiply line 8 by line 9 and enter result .....................................................................................................................................

10

11. Cost of qualified solar thermal energy system installed and placed in service

on commercial property............................................................................................................

11

12. Enter the amount of consumer incentive premiums, costs used for other credits, and utility

rebate, if any, received for the qualifying system.......................................................................

12

13. Actual cost of solar thermal energy system. (Subtract line 12 from line 11 and enter result)...

13

14. Enter 35% of line 13 or $250,000, whichever is less..................................................................................................................

14

15. Add lines 4, 10, and 14, and enter result (but not less than zero)..............................................................................................

15

ä

WIND-POWERED ENERGY SYSTEM

Enter date system was installed and placed in service

____/____/____

16. Cost of qualified wind powered energy system installed and placed in service on

single-family residential property............................................................................................

16

17. Enter the amount of consumer incentive premiums, costs used for other credits, and utility

rebate, if any, received for the qualifying system.......................................................................

17

18. Actual cost of wind powered energy system. (Subtract line 17 from line 16 and enter result) .

18

19. Enter 20% of line 18 or $1,500, whichever is less......................................................................................................................

19

20. Per unit cost of qualified wind powered energy system installed and placed in service

on multi-family residential property ........................................................................................

20

21. Enter the per unit amount of consumer incentive premiums, costs used for other credits,

and utility rebate, if any, received for the qualifying system ......................................................

21

22. Actual per unit cost of wind powered energy system. (Subtract line 21 from line 20

and enter result).........................................................................................................................

22

23. Enter 20% of line 22 or $200, whichever is less ........................................................................

23

24. Number of units you own to which the allocated unit cost on line 23 is applicable....................

24

25. Multiply line 23 by line 24 and enter result .................................................................................................................................

25

(Continued on back)

FORM N-334

1

1 2

2