Employer'S Withholding Tax Forms And Instructions - City Of Grand Rapids - 2002

ADVERTISEMENT

RETURN TO:

GRAND RAPIDS CITY INCOME TAX

P.O. BOX 347

GRAND RAPIDS, MI 49501-0347

ADDRESS SERVICE REQUESTED

MAIL TO:

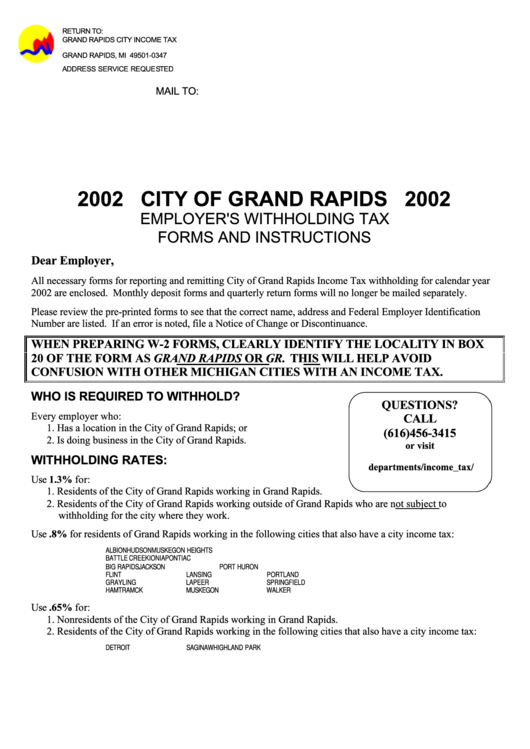

2002 CITY OF GRAND RAPIDS 2002

EMPLOYER'S WITHHOLDING TAX

FORMS AND INSTRUCTIONS

Dear Employer,

All necessary forms for reporting and remitting City of Grand Rapids Income Tax withholding for calendar year

2002 are enclosed. Monthly deposit forms and quarterly return forms will no longer be mailed separately.

Please review the pre-printed forms to see that the correct name, address and Federal Employer Identification

Number are listed. If an error is noted, file a Notice of Change or Discontinuance.

WHEN PREPARING W-2 FORMS, CLEARLY IDENTIFY THE LOCALITY IN BOX

20 OF THE FORM AS GRAND RAPIDS OR GR.

THIS WILL HELP AVOID

CONFUSION WITH OTHER MICHIGAN CITIES WITH AN INCOME TAX.

WHO IS REQUIRED TO WITHHOLD?

QUESTIONS?

Every employer who:

CALL

1. Has a location in the City of Grand Rapids; or

(616)456-3415

2. Is doing business in the City of Grand Rapids.

or visit

WITHHOLDING RATES:

departments/income_tax/

Use 1.3% for:

taxforms.asp

1. Residents of the City of Grand Rapids working in Grand Rapids.

2. Residents of the City of Grand Rapids working outside of Grand Rapids who are not subject to

withholding for the city where they work.

Use .8% for residents of Grand Rapids working in the following cities that also have a city income tax:

ALBION

HUDSON

MUSKEGON HEIGHTS

BATTLE CREEK

IONIA

PONTIAC

BIG RAPIDS

JACKSON

PORT HURON

FLINT

LANSING

PORTLAND

GRAYLING

LAPEER

SPRINGFIELD

HAMTRAMCK

MUSKEGON

WALKER

Use .65% for:

1. Nonresidents of the City of Grand Rapids working in Grand Rapids.

2. Residents of the City of Grand Rapids working in the following cities that also have a city income tax:

DETROIT

SAGINAW

HIGHLAND PARK

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4