Tiffin Income Tax Return Form - 2016

ADVERTISEMENT

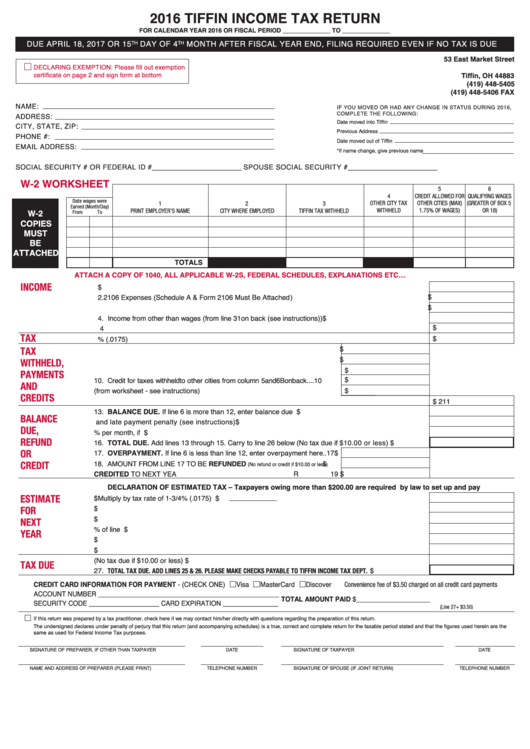

2016 TIFFIN INCOME TAX RETURN

FOR CALENDAR YEAR 2016 OR FISCAL PERIOD ______________ TO ______________

DUE APRIL 18, 2017 OR 15

DAY OF 4

MONTH AFTER FISCAL YEAR END, FILING REQUIRED EVEN IF NO TAX IS DUE

TH

TH

53 East Market Street

DECLARING EXEMPTION: Please fill out exemption

P.O. Box 518

certificate on page 2 and sign form at bottom

Tiffin, OH 44883

(419) 448-5405

(419) 448-5406 FAX

NAME:

IF YOU MOVED OR HAD ANY CHANGE IN STATUS DURING 2016,

COMPLETE THE FOLLOWING:

ADDRESS:

Date moved into Tiffin

CITY, STATE, ZIP:

Previous Address

PHONE #:

Date moved out of Tiffin

EMAIL ADDRESS:

*If name change, give previous name

SOCIAL SECURITY # OR FEDERAL ID #_______________________ SPOUSE SOCIAL SECURITY #_______________________

W-2 WORKSHEET

5

6

4

CREDIT ALLOWED FOR

QUALIFYING WAGES

Date wages were

OTHER CITY TAX

OTHER CITIES (MAX)

(GREATER OF BOX 5

1

2

3

Earned (Month/Day)

WITHHELD

1.75% OF WAGES)

OR 18)

PRINT EMPLOYER’S NAME

CITY WHERE EMPLOYED

TIFFIN TAX WITHHELD

W-2

From

To

COPIES

MUST

BE

ATTACHED

TOTALS

ATTACH A COPY OF 1040, ALL APPLICABLE W-2S, FEDERAL SCHEDULES, EXPLANATIONS ETC…

INCOME

1. Total W-2 wages from column 6 ...............................................................................................................1

$

$

2. 2106 Expenses (Schedule A & Form 2106 Must Be Attached ) ................................................................2

$

3. TAXABLE WAGES. SUBTRACT LINE 2 FROM LINE 1 ........................................................................ 3

4. Income from other than wages (from line 31 on back (see instructions))...................................................4 $

$

5. TOTAL TIFFIN INCOME. ADD LINES 3 AND 4 ........................................................................................5

TAX

$

6. TIFFIN INCOME TAX. MULTIPLY LINE 5 BY 1-3/4% (.0175) .................................................................6

$

7. Tiffin income tax withheld from column 3 ...................................................7

TAX

$

8. Prior year credits ......................................................................................... 8

WITHHELD,

9. Estimated payments ................................................................................... 9

$

PAYMENTS

$

10. Credit for taxes withheld to other cities from column 5 and 6B on back ....10

AND

$

11. Credit for nondeductible expenses (from worksheet - see instructions).....11

CREDITS

1

. 2

T

O

T

A

L

P

A

Y

M

E

N

T

S

A

N

D

C

R

E

D

T I

. S

A

D

D

L

N I

E

S

7

T

H

R

O

U

G

H

1

1 .......................................................

1

2

$

13. BALANCE DUE.

If line 6 is more than 12, enter balance due here ......................................................13 $

BALANCE

14. Late filing and late payment penalty (see instructions) ....................................................................... 14 $

DUE,

15. Interest. 0.42% per month, if applicable .................................................................................................15 $

REFUND

16. TOTAL DUE. Add lines 13 through 15. Carry to line 26 below (No tax due if $10.00 or less) ............ 16 $

OR

17. OVERPAYMENT. If line 6 is less than line 12, enter overpayment here ..17 $

18. AMOUNT FROM LINE 17 TO BE REFUNDED

....18 $

CREDIT

(No refund or credit if $10.00 or less)

19. AMOUNT FROM LINE 17 TO BE CREDITED TO NEXT YEAR ............... 19 $

DECLARATION OF ESTIMATED TAX – Taxpayers owing more than $200.00 are required by law to set up and pay

ESTIMATE

20. Total estimated income subject to tax $

Multiply by tax rate of 1-3/4% (.0175) ............20 $

21. Subtract any estimated income tax to be withheld or paid to other cities .............................................. 21 $

FOR

22. Balance of city income tax declared. Subtract line 21 from line 20 ........................................................22 $

NEXT

23. Tax due before credits. Enter at least 25% of line 22 ............................................................................23 $

YEAR

24. Less credits. Enter line 19 from above ....................................................................................................24 $

25. Net estimated tax due. Subtract line 24 from line 23 ..............................................................................25 $

26. Enter balance due from line 16 above (No tax due if $10.00 or less) ...................................................26 $

TAX DUE

27. TOTAL TAX DUE. ADD LINES 25 & 26. PLEASE MAKE CHECKS PAYABLE TO TIFFIN INCOME TAX DEPT.

.........................27 $

CREDIT CARD INFORMATION FOR PAYMENT - (CHECK ONE)

Visa

MasterCard

Discover

Convenience fee of $3.50 charged on all credit card payments

ACCOUNT NUMBER _________________________________________________

TOTAL AMOUNT PAID $____________________

SECURITY CODE ___________________ CARD EXPIRATION _______________

(Line 27+ $3.50)

If this return was prepared by a tax practitioner, check here if we may contact him/her directly with questions regarding the preparation of this return.

The undersigned declares under penalty of perjury that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated and that the figures used herein are the

same as used for Federal Income Tax purposes.

SIGNATURE OF PREPARER, IF OTHER THAN TAXPAYER

DATE

SIGNATURE OF TAXPAYER

DATE

NAME AND ADDRESS OF PREPARER (PLEASE PRINT)

TELEPHONE NUMBER

SIGNATURE OF SPOUSE (IF JOINT RETURN)

TELEPHONE NUMBER

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2