Income Tax Return Form - City Of Vandalia - City Of Brookville - 2016

ADVERTISEMENT

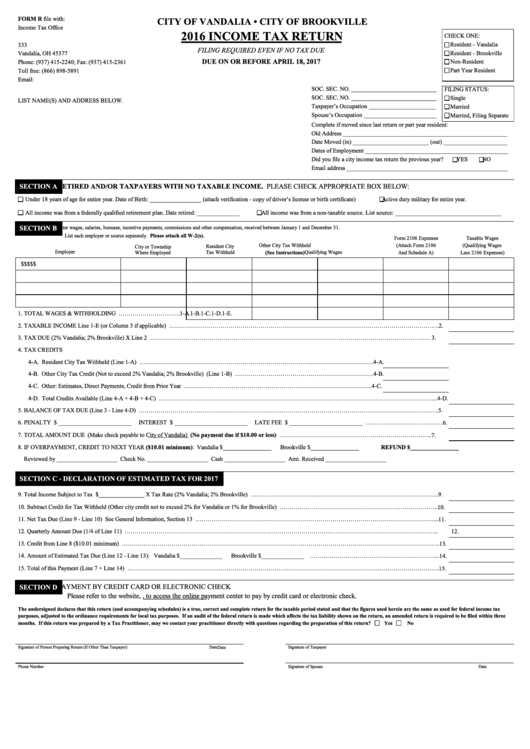

FORM R file with:

CITY OF VANDALIA • CITY OF BROOKVILLE

Income Tax Office

2016 INCOME TAX RETURN

CHECK ONE:

P.O. Box 727

333 J.E. Bohanan Memorial Dr.

Resident - Vandalia

FILING REQUIRED EVEN IF NO TAX DUE

Vandalia, OH 45377

Resident - Brookville

DUE ON OR BEFORE APRIL 18, 2017

Non-Resident

Phone: (937) 415-2240; Fax: (937) 415-2361

Part Year Resident

Toll free: (866) 898-5891

Email:

SOC. SEC. NO. ____________________________

FILING STATUS:

SOC. SEC. NO. ____________________________

Single

LIST NAME(S) AND ADDRESS BELOW.

Taxpayer’s Occupation ______________________

Married

Spouse’s Occupation ________________________

Married, Filing Separate

Complete if moved since last return or part year resident:

Old Address ______________________________________________________

Date Moved (in) _________________________ (out) _____________________

Dates of Employment _______________________________________________

Did you file a city income tax return the previous year?

YES

NO

Email address _____________________________________________________

SECTION A

RETIRED AND/OR TAXPAYERS WITH NO TAXABLE INCOME. PLEASE CHECK APPROPRIATE BOX BELOW:

Under 18 years of age for entire year. Date of Birth: _________________ (attach verification - copy of driver’s license or birth certificate)

Active duty military for entire year.

All income was from a federally qualified retirement plan. Date retired: ______________

All income was from a non-taxable source. List source: ___________________________________

SECTION B

Enter wages, salaries, bonuses, incentive payments, commissions and other compensation, received between January 1 and December 31.

List each employer or source separately. Please attach all W-2(s).

Form 2106 Expenses

Taxable Wages

Other City Tax Withheld

(Attach Form 2106

(Qualifying Wages

Resident City

City or Township

Employer

Qualifying Wages

Tax Withheld

(See Instructions)

And Schedule A)

Less 2106 Expenses)

Where Employed

$

$

$

$

$

1. TOTAL WAGES & WITHHOLDING …………………………. 1-A.

1-B.

1-C.

1-D.

1-E.

2. TAXABLE INCOME Line 1-E (or Column 3 if applicable) ………………………………………………………………………………………………………………………. 2.

3. TAX DUE (2% Vandalia; 2% Brookville) X Line 2 …………………………………………………………………………………………………………………………….....

3.

4. TAX CREDITS

4-A. Resident City Tax Withheld (Line 1-A) ……………………………………………………………………………………………………….

4-A.

4-B. Other City Tax Credit (Not to exceed 2% Vandalia; 2% Brookville) (Line 1-B) …………………………………………………………….

4-B.

4-C. Other: Estimates, Direct Payments, Credit from Prior Year …………………………………………………………………………………..

4-C.

4-D.

4-D. Total Credits Available (Line 4-A + 4-B + 4-C) …………………………………………………………………………………………………………………………...

5. BALANCE OF TAX DUE (Line 3 - Line 4-D) ……………………………………………………………………………………………………………………………………. 5.

6. PENALTY $ ________________________

INTEREST $ ________________________

LATE FEE $ ________________________ ………………………………… 6.

7. TOTAL AMOUNT DUE (Make check payable to City of Vandalia) (No payment due if $10.00 or less) …………………………………………………………………..

7.

8. IF OVERPAYMENT, CREDIT TO NEXT YEAR ($10.01 minimum): Vandalia $________________

Brookville $________________

REFUND $________________

Reviewed by ____________________ Check No. ____________________ Cash ____________________ Amt. Received ____________________

SECTION C - DECLARATION OF ESTIMATED TAX FOR 2017

9. Total Income Subject to Tax $_______________ X Tax Rate (2% Vandalia; 2% Brookville) …………………………………………………………………………………..

9.

10. Subtract Credit for Tax Withheld (Other city credit not to exceed 2% for Vandalia or 1% for Brookville) ……………………………………………………………………..

10.

11. Net Tax Due (Line 9 - Line 10) See General Information, Section 13 …………………………………………………………………………………………………………... 11.

12. Quarterly Amount Due (1/4 of Line 11) …………………………………………………………………………………………………………………………………………..

12.

13. Credit from Line 8 ($10.01 minimum) ……………………………………………………………………………………………………………………………………………. 13.

14. Amount of Estimated Tax Due (Line 12 - Line 13): Vandalia $______________

Brookville $______________ ………………………………………………………...

14.

15. Total of this Payment (Line 7 + Line 14) …………………………………………………………………………………………………………………………………………. 15.

SECTION D

PAYMENT BY CREDIT CARD OR ELECTRONIC CHECK

Please refer to the website, , to access the online payment center to pay by credit card or electronic check.

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated and that the figures used herein are the same as used for federal income tax

purposes, adjusted to the ordinance requirements for local tax purposes. If an audit of the federal return is made which affects the tax liability shown on the return, an amended return is required to be filed within three

months. If this return was prepared by a Tax Practitioner, may we contact your practitioner directly with questions regarding the preparation of this return?

Yes

No

Signature of Taxpayer

Signature of Person Preparing Return (If Other Than Taxpayer)

Date

Date

Phone Number

Signature of Spouse

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2