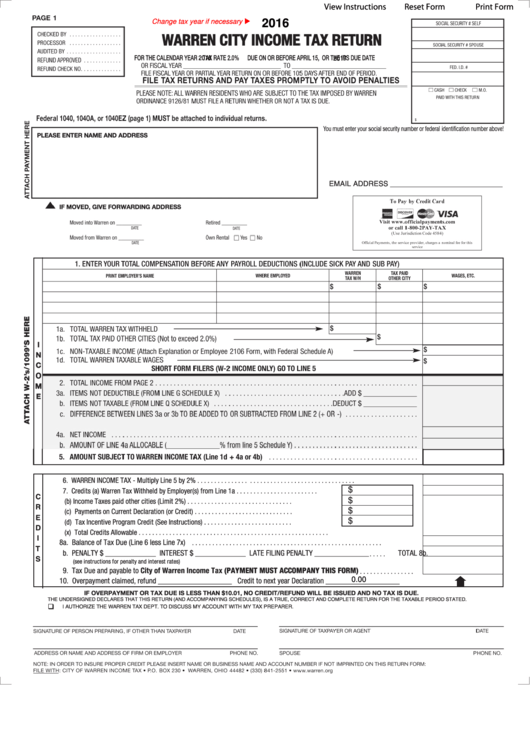

View Instructions

Reset Form

Print Form

Change tax year if necessary u

2016

FOR THE CALENDAR YEAR

2016

TAX RATE 2.0% DUE ON OR BEFORE APRIL 15,

2017

OR THE IRS DUE DATE

PLEASE ENTER NAME AND ADDRESS

EMAIL ADDRESS ____________________________

IF MOVED, GIVE FORWARDING ADDRESS

6. WARREN INCOME TAX - Multiply Line 5 by 2% . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

7. Credits (a) Warren Tax Withheld by Employer(s) from Line 1a

. . . . . . . . . . . . . . . . . . . . . . . .

C

$

(b) Income Taxes paid other cities (Limit 2%)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

R

$

(c) Payments on Current Declaration (or Credit)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

E

$

(d) Tax Incentive Program Credit (See Instructions)

. . . . . . . . . . . . . . . . . . . . . . . . . .

D

(x) Total Credits Allowable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

I

8a. Balance of Tax Due (Line 6 less Line 7x)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

T

b. PENALTY $ _____________ INTEREST $ _____________ LATE FILING PENALTY ______________

TOTAL 8b.

. . . . .

S

(see instructions for penalty and interest rates)

9. Tax Due and payable to City of Warren Income Tax (PAYMENT MUST ACCOMPANY THIS FORM)

. . . . . . . . . . . . . . . .

10. Overpayment claimed, refund ___________________ Credit to next year Declaration ___________________

0.00

IF OVERPAYMENT OR TAX DUE IS LESS THAN $10.01, NO CREDIT/REFUND WILL BE ISSUED AND NO TAX IS DUE.

THE UNDERSIGNED DECLARES THAT THIS RETURN (AND ACCOMPANYING SCHEDULES), IS A TRUE, CORRECT AND COMPLETE RETURN FOR THE TAXABLE PERIOD STATED.

q

I AUTHORIZE THE WARREN TAX DEPT. TO DISCUSS MY ACCOUNT WITH MY TAX PREPARER.

1

1 2

2 3

3