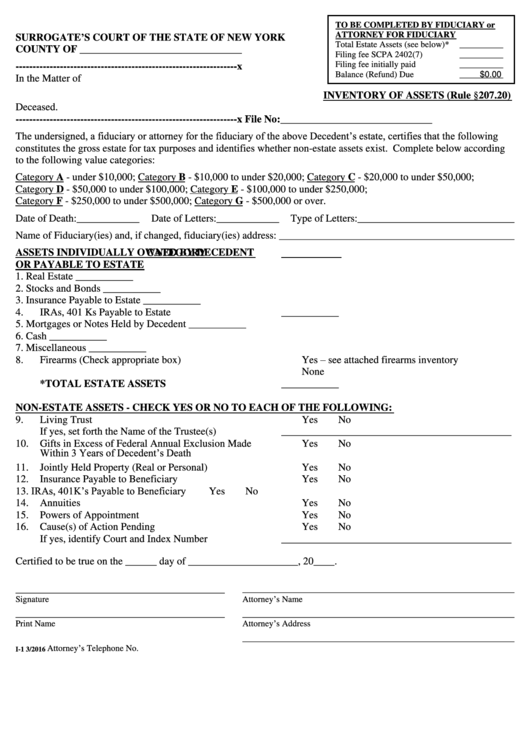

TO BE COMPLETED BY FIDUCIARY or

ATTORNEY FOR FIDUCIARY

SURROGATE’S COURT OF THE STATE OF NEW YORK

Total Estate Assets (see below)*

__________

COUNTY OF _______________________________

Filing fee SCPA 2402(7)

$__________

Filing fee initially paid

$__________

-----------------------------------------------------------------x

$0.00

Balance (Refund) Due

$__________

In the Matter of

INVENTORY OF ASSETS (Rule §207.20)

Deceased.

-----------------------------------------------------------------x

File No:_____________________________

The undersigned, a fiduciary or attorney for the fiduciary of the above Decedent’s estate, certifies that the following

constitutes the gross estate for tax purposes and identifies whether non-estate assets exist. Complete below according

to the following value categories:

Category A - under $10,000; Category B - $10,000 to under $20,000; Category C - $20,000 to under $50,000;

Category D - $50,000 to under $100,000; Category E - $100,000 to under $250,000;

Category F - $250,000 to under $500,000; Category G - $500,000 or over.

Date of Death:____________

Date of Letters:____________

Type of Letters:______________________________

Name of Fiduciary(ies) and, if changed, fiduciary(ies) address: _____________________________________________

ASSETS INDIVIDUALLY OWNED BY DECEDENT

CATEGORY

OR PAYABLE TO ESTATE

1.

Real Estate

___________

2.

Stocks and Bonds

___________

3.

Insurance Payable to Estate

___________

4.

IRAs, 401 Ks Payable to Estate

___________

5.

Mortgages or Notes Held by Decedent

___________

6.

Cash

___________

7.

Miscellaneous

___________

Yes – see attached firearms inventory

8.

Firearms (Check appropriate box)

None

___________

*TOTAL ESTATE ASSETS

NON-ESTATE ASSETS - CHECK YES OR NO TO EACH OF THE FOLLOWING:

9.

Living Trust

Yes

No

If yes, set forth the Name of the Trustee(s)

____________________________________________

10.

Gifts in Excess of Federal Annual Exclusion Made

Yes

No

Within 3 Years of Decedent’s Death

11.

Jointly Held Property (Real or Personal)

Yes

No

12.

Insurance Payable to Beneficiary

Yes

No

IRAs, 401K’s Payable to Beneficiary

13.

Yes

No

14.

Annuities

Yes

No

15.

Powers of Appointment

Yes

No

16.

Cause(s) of Action Pending

Yes

No

If yes, identify Court and Index Number

____________________________________________

Certified to be true on the ______ day of _____________________, 20____.

____________________________________________________

________________________________________

Signature

Attorney’s Name

________________________________________

____________________________________________________

Print Name

Attorney’s Address

____________________________________________________

Attorney’s Telephone No.

I-1 3/2016

1

1