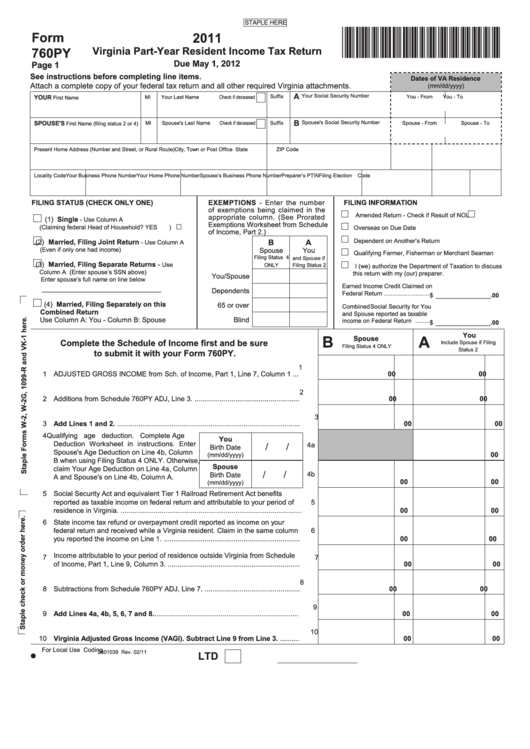

Form 760py - Virginia Part-Year Resident Income Tax Return - 2011

ADVERTISEMENT

STAPLE HERE

*VA760P111888*

Form

2011

Virginia Part-Year Resident Income Tax Return

760PY

Due May 1, 2012

Page 1

See instructions before completing line items.

Dates of VA Residence

Attach a complete copy of your federal tax return and all other required Virginia attachments.

(mm/dd/yyyy)

A

Your Social Security Number

YOuR

mI

Your Last Name

Check if deceased

Suffix

You - From

You - To

First Name

B

Spouse's Social Security Number

SPOuSE'S

mI

Spouse's Last Name

Check if deceased

Suffix

Spouse - From

Spouse - To

First Name (filing status 2 or 4)

Present Home Address (Number and Street, or Rural Route)

city, Town or Post Office

State

ZIP code

Locality code

Your Business Phone Number

Your Home Phone Number

Spouse’s Business Phone Number

Preparer’s PTIN

Filing Election

code

FILING STATuS (ChECK ONLY ONE)

EXEMPTIONS - Enter the number

FILING INFORMATION

of exemptions being claimed in the

Amended Return - check if Result of NOL

appropriate column. (See Prorated

(1) Single

- use column A

Exemptions Worksheet from Schedule

(claiming federal Head of Household? YES

)

Overseas on due date

of Income, Part 2.)

dependent on Another’s Return

(2) Married, Filing Joint Return

B

A

- use column A

(Even if only one had income)

Spouse

You

Qualifying Farmer, Fisherman or merchant Seaman

Filing Status 4

and Spouse if

(3) Married, Filing Separate Returns -

use

ONLY

Filing Status 2

I (we) authorize the department of Taxation to discuss

column A (Enter spouse’s SSN above)

this return with my (our) preparer.

You/Spouse

Enter spouse's full name on line below

Earned Income credit claimed on

___________________________________

dependents

Federal Return ............................ $ ________________.00

(4) Married, Filing Separately on this

65 or over

combined Social Security for You

Combined Return

and Spouse reported as taxable

use column A: You - column B: Spouse

Blind

income on Federal Return .......... $ ________________.00

You

B

A

Spouse

Complete the Schedule of Income first and be sure

Include Spouse if Filing

Filing Status 4 ONLY

Status 2

to submit it with your Form 760PY.

1

1 AdjuSTEd GROSS INcOmE from Sch. of Income, Part 1, Line 7, column 1 ...

00

00

2

2 Additions from Schedule 760PY Adj, Line 3. ......................................................

00

00

3

3 Add Lines 1 and 2. ..............................................................................................

00

00

4 Qualifying age deduction. complete Age

You

deduction Worksheet in instructions. Enter

/

/

4a

Birth date

Spouse's Age deduction on Line 4b, column

00

(mm/dd/yyyy)

B when using Filing Status 4 ONLY. Otherwise,

Spouse

claim Your Age deduction on Line 4a, column

/

/

4b

Birth date

A and Spouse's on Line 4b, column A.

00

00

(mm/dd/yyyy)

5 Social Security Act and equivalent Tier 1 Railroad Retirement Act benefits

reported as taxable income on federal return and attributable to your period of

5

residence in Virginia. .............................................................................................

00

00

6 State income tax refund or overpayment credit reported as income on your

federal return and received while a Virginia resident. claim in the same column

6

you reported the income on Line 1. ......................................................................

00

00

7 Income attributable to your period of residence outside Virginia from Schedule

7

of Income, Part 1, Line 9, column 3. ....................................................................

00

00

8

8 Subtractions from Schedule 760PY Adj, Line 7. .................................................

00

00

9

9 Add Lines 4a, 4b, 5, 6, 7 and 8...........................................................................

00

00

10

10 Virginia Adjusted Gross Income (VAGI). Subtract Line 9 from Line 3. ..........

00

00

For Local use

coding

2601039 Rev. 02/11

LTD

v

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2