Form Jw-3 - Reconciliation Of Jedd Income Tax Withheld - 2009

ADVERTISEMENT

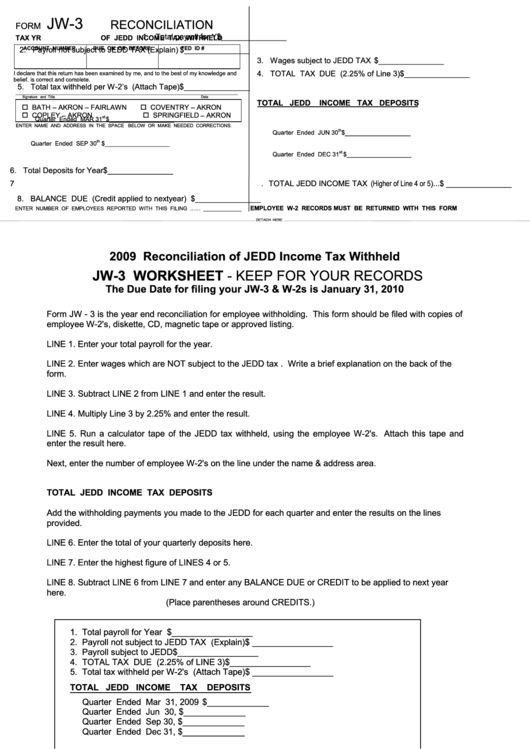

JW-3

RECONCILIATION

FORM

1. Total payroll for Year............................................. $ _______________

TAX YR

OF JEDD INCOME TAX WITHHELD

ACCOUNT NUMBER

DUE ON OR BEFORE

FED ID #

2. Payroll not subject to JEDD TAX (Explain) ........... $ _______________

3. Wages subject to JEDD TAX ................................ $ _______________

4. TOTAL TAX DUE (2.25% of Line 3)................... $ _______________

I declare that this return has been examined by me, and to the best of my knowledge and

belief, is correct and complete.

5. Total tax withheld per W-2’s (Attach Tape) .......... $ _______________

___________________________________________________________________________________________________________________

Signature and Title

Date

TOTAL JEDD

INCOME TAX DEPOSITS

BATH – AKRON – FAIRLAWN

COVENTRY – AKRON

COPLEY – AKRON

SPRINGFIELD – AKRON

st

Quarter Ended MAR 31

..................... $ ___________________

ENTER NAME AND ADDRESS IN THE SPACE BELOW OR MAKE NEEDED CORRECTIONS.

_______________

th

Quarter Ended JUN 30

...................... $

th

Quarter Ended SEP 30

..................... $ ___________________

st

Quarter Ended DEC 31

..................... $ ___________________

6. Total Deposits for Year ........................................ $ _______________

7. TOTAL JEDD INCOME TAX (Higher of Line 4 or 5) ... $ _______________

8. BALANCE DUE (Credit applied to next year) ..... $ _______________

EMPLOYEE W-2 RECORDS MUST BE RETURNED WITH THIS FORM

ENTER NUMBER OF EMPLOYEES REPORTED WITH THIS FILING …… _____________

………………………………………………………………………………………………………………………………………………………………………………………………. DETACH HERE …………………………………………………….………………………………………………………………………………………………………………………………………..

2009 Reconciliation of JEDD Income Tax Withheld

JW-3 WORKSHEET - KEEP FOR YOUR RECORDS

The Due Date for filing your JW-3 & W-2s is January 31, 2010

Form JW - 3 is the year end reconciliation for employee withholding. This form should be filed with copies of

employee W-2's, diskette, CD, magnetic tape or approved listing.

LINE 1. Enter your total payroll for the year.

LINE 2. Enter wages which are NOT subject to the JEDD tax . Write a brief explanation on the back of the

form.

LINE 3. Subtract LINE 2 from LINE 1 and enter the result.

LINE 4. Multiply Line 3 by 2.25% and enter the result.

LINE 5. Run a calculator tape of the JEDD tax withheld, using the employee W-2's. Attach this tape and

enter the result here.

Next, enter the number of employee W-2's on the line under the name & address area.

TOTAL JEDD INCOME TAX DEPOSITS

Add the withholding payments you made to the JEDD for each quarter and enter the results on the lines

provided.

LINE 6. Enter the total of your quarterly deposits here.

LINE 7. Enter the highest figure of LINES 4 or 5.

LINE 8. Subtract LINE 6 from LINE 7 and enter any BALANCE DUE or CREDIT to be applied to next year

here.

(Place parentheses around CREDITS.)

1. Total payroll for Year ............................................................ $ _________________

2. Payroll not subject to JEDD TAX (Explain)........................... $ _________________

3. Payroll subject to JEDD ........................................................ $ _________________

4. TOTAL TAX DUE (2.25% of LINE 3) .................................. $ _________________

5. Total tax withheld per W-2's (Attach Tape)........................... $ _________________

TOTAL JEDD INCOME

TAX

DEPOSITS

Quarter Ended Mar 31, 2009 .................................... $ _____________

Quarter Ended Jun 30, 2009 .................................... $ _____________

Quarter Ended Sep 30, 2009..................................... $ _____________

Quarter Ended Dec 31, 2009..................................... $ _____________

6. Total Deposits for Year ....................................................... $ _____________

7. Total JEDD INCOME TAX (Higher of LINES 4 or 5) ......... $ _____________

8. BALANCE DUE (Subtract LINE 6 from LINE 7) ................. $ _____________

(Credits are applied to the following year)

NUMBER OF EMPLOYEES REPORTED WITH THIS FILING ................__________

JEDDs - PO BOX 80538 - Akron, OH 44308

(330) 375 - 2539

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1