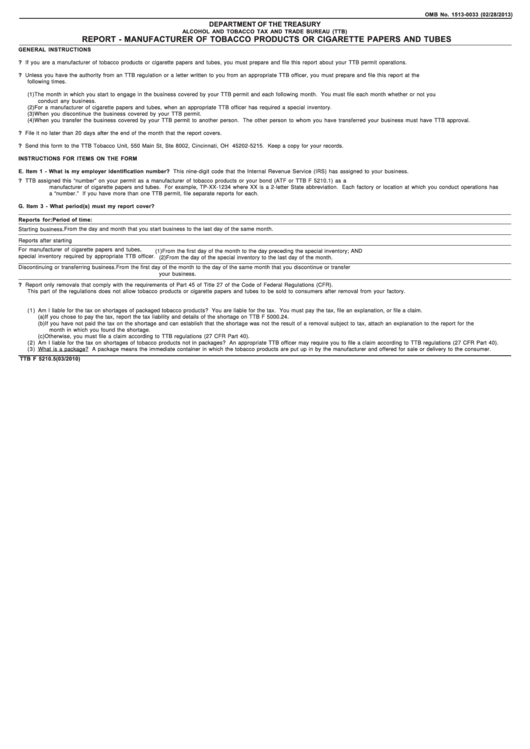

OMB No. 1513-0033 (02/28/2013)

DEPARTMENT OF THE TREASURY

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU (TTB)

REPORT - MANUFACTURER OF TOBACCO PRODUCTS OR CIGARETTE PAPERS AND TUBES

GENERAL INSTRUCTIONS

A. Who prepares this report?

If you are a manufacturer of tobacco products or cigarette papers and tubes, you must prepare and file this report about your TTB permit operations.

B. Must I prepare this report?

Unless you have the authority from an TTB regulation or a letter written to you from an appropriate TTB officer, you must prepare and file this report at the

following times.

(1) The month in which you start to engage in the business covered by your TTB permit and each following month. You must file each month whether or not you

conduct any business.

(2) For a manufacturer of cigarette papers and tubes, when an appropriate TTB officer has required a special inventory.

(3) When you discontinue the business covered by your TTB permit.

(4) When you transfer the business covered by your TTB permit to another person. The other person to whom you have transferred your business must have TTB approval.

C. When must I file this report?

File it no later than 20 days after the end of the month that the report covers.

D. How do I file this form?

Send this form to the TTB Tobacco Unit, 550 Main St, Ste 8002, Cincinnati, OH 45202-5215. Keep a copy for your records.

INSTRUCTIONS FOR ITEMS ON THE FORM

E. Item 1 - What is my employer identification number?

This nine-digit code that the Internal Revenue Service (IRS) has assigned to your business.

F. Item 2 - What is my TTB permit number?

TTB assigned this “number” on your permit as a manufacturer of tobacco products or your bond (ATF or TTB F 5210.1) as a

manufacturer of cigarette papers and tubes. For example, TP-XX-1234 where XX is a 2-letter State abbreviation. Each factory or location at which you conduct operations has

a “number.” If you have more than one TTB permit, file separate reports for each.

G. Item 3 - What period(s) must my report cover?

Reports for:

Period of time:

From the day and month that you start business to the last day of the same month.

Starting business.

Reports after starting business.

Each month.

For manufacturer of cigarette papers and tubes,

(1) From the first day of the month to the day preceding the special inventory; AND

special inventory required by appropriate TTB officer.

(2) From the day of the special inventory to the last day of the month.

Discontinuing or transferring business.

From the first day of the month to the day of the same month that you discontinue or transfer

your business.

H. Item 15e - What should be entered for use of United States?

Report only removals that comply with the requirements of Part 45 of Title 27 of the Code of Federal Regulations (CFR).

This part of the regulations does not allow tobacco products or cigarette papers and tubes to be sold to consumers after removal from your factory.

I. Item 17 - Shortages of Tobacco Products Disclosed by Inventory.

(1) Am I liable for the tax on shortages of packaged tobacco products? You are liable for the tax. You must pay the tax, file an explanation, or file a claim.

(a) If you chose to pay the tax, report the tax liability and details of the shortage on TTB F 5000.24.

(b) If you have not paid the tax on the shortage and can establish that the shortage was not the result of a removal subject to tax, attach an explanation to the report for the

month in which you found the shortage.

( c ) Otherwise, you must file a claim according to TTB regulations (27 CFR Part 40).

(2) Am I liable for the tax on shortages of tobacco products not in packages? An appropriate TTB officer may require you to file a claim according to TTB regulations (27 CFR Part 40).

(3) What is a package? A package means the immediate container in which the tobacco products are put up in by the manufacturer and offered for sale or delivery to the consumer.

TTB F 5210.5 (03/2010)

1

1 2

2 3

3 4

4