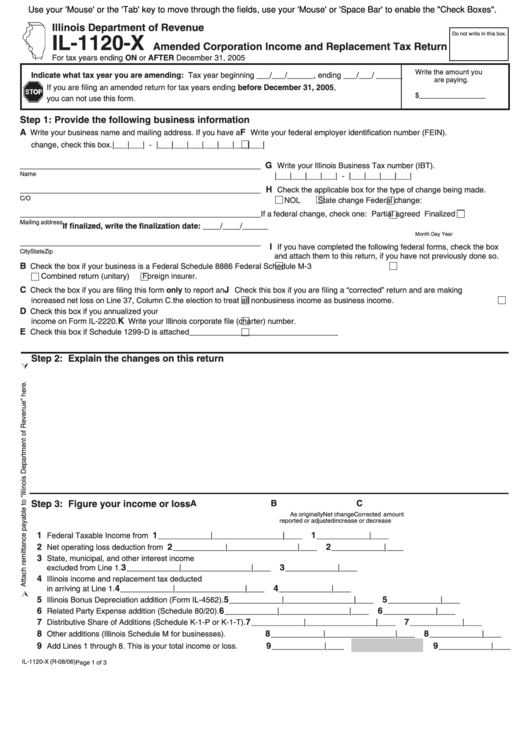

Use your 'Mouse' or the 'Tab' key to move through the fields, use your 'Mouse' or 'Space Bar' to enable the "Check Boxes".

Illinois Department of Revenue

Do not write in this box.

IL-1120-X

Amended Corporation Income and Replacement Tax Return

For tax years ending ON or AFTER December 31, 2005

Write the amount you

Indicate what tax year you are amending: Tax year beginning ___/___/______, ending ___/___/ ______

are paying.

If you are filing an amended return for tax years ending before December 31, 2005,

$_________________

you can not use this form.

Step 1: Provide the following business information

A

F

Write your business name and mailing address. If you have a

Write your federal employer identification number (FEIN).

change, check this box.

|___|___| - |___|___|___|___|___|___|___|

G

_______________________________________________________

Write your Illinois Business Tax number (IBT).

Name

|___|___|___|___| - |___|___|___|___|

H

_______________________________________________________

Check the applicable box for the type of change being made.

C/O

NOL

State change

Federal change:

_______________________________________________________

If a federal change, check one:

Partial agreed

Finalized

Mailing address

If finalized, write the finalization date: ____/____/______

Month

Day

Year

_______________________________________________________

I

If you have completed the following federal forms, check the box

CityStateZip

and attach them to this return, if you have not previously done so.

B

Check the box if your business is a

Federal Schedule 8886

Federal Schedule M-3

Combined return (unitary)

Foreign insurer.

C

J

Check the box if you are filing this form only to report an

Check this box if you are filing a “corrected” return and are making

increased net loss on Line 37, Column C.

the election to treat all nonbusiness income as business income.

D

Check this box if you annualized your

K

income on Form IL-2220.

Write your Illinois corporate file (charter) number.

E

Check this box if Schedule 1299-D is attached

__________________________________

Step 2: Explain the changes on this return

A

B

C

Step 3: Figure your income or loss

As originally

Net change

Corrected amount

reported or adjusted

increase or decrease

1

1

1

Federal Taxable Income from U.S. Form 1120.

____________|____

____________|____

____________|____

2

2

2

Net operating loss deduction from U.S. Form 1120.

____________|____

____________|____

____________|____

3

State, municipal, and other interest income

3

3

excluded from Line 1.

____________|____

____________|____

____________|____

4

Illinois income and replacement tax deducted

4

4

in arriving at Line 1.

____________|____

____________|____

____________|____

5

5

5

Illinois Bonus Depreciation addition (Form IL-4562).

____________|____

____________|____

____________|____

6

6

6

Related Party Expense addition (Schedule 80/20).

____________|____

____________|____

____________|____

7

7

7

Distributive Share of Additions (Schedule K-1-P or K-1-T).

____________|____

____________|____

____________|____

8

8

8

Other additions (Illinois Schedule M for businesses)

____________|____

____________|____

____________|____

.

9

9

9

Add Lines 1 through 8. This is your total income or loss

____________|____

____________|____

.

IL-1120-X (R-08/06)

Page 1 of 3

1

1 2

2 3

3