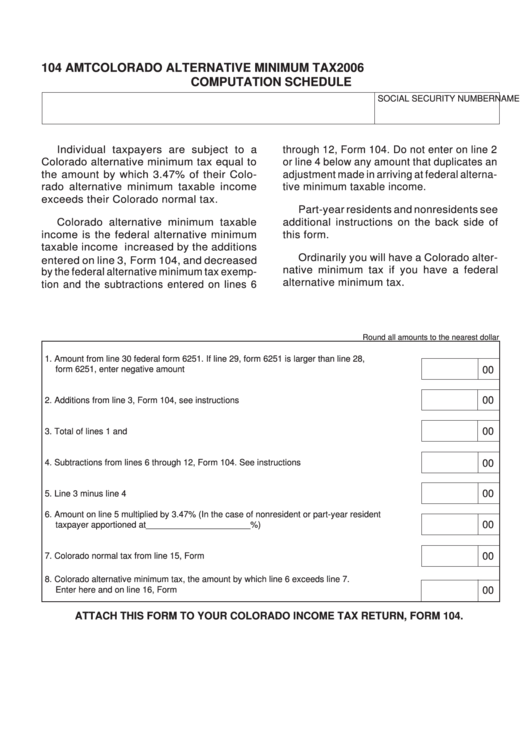

104 AMT

COLORADO ALTERNATIVE MINIMUM TAX

2006

COMPUTATION SCHEDULE

NAME

SOCIAL SECURITY NUMBER

Individual taxpayers are subject to a

through 12, Form 104. Do not enter on line 2

Colorado alternative minimum tax equal to

or line 4 below any amount that duplicates an

the amount by which 3.47% of their Colo-

adjustment made in arriving at federal alterna-

rado alternative minimum taxable income

tive minimum taxable income.

exceeds their Colorado normal tax.

Part-year residents and nonresidents see

Colorado alternative minimum taxable

additional instructions on the back side of

income is the federal alternative minimum

this form.

taxable income increased by the additions

Ordinarily you will have a Colorado alter-

entered on line 3, Form 104, and decreased

native minimum tax if you have a federal

by the federal alternative minimum tax exemp-

alternative minimum tax.

tion and the subtractions entered on lines 6

Round all amounts to the nearest dollar

1. Amount from line 30 federal form 6251. If line 29, form 6251 is larger than line 28,

00

form 6251, enter negative amount here ................................................................................... 1

00

2. Additions from line 3, Form 104, see instructions above ......................................................... 2

00

3. Total of lines 1 and 2 ................................................................................................................ 3

4. Subtractions from lines 6 through 12, Form 104. See instructions above ............................... 4

00

00

5. Line 3 minus line 4 ................................................................................................................... 5

6. Amount on line 5 multiplied by 3.47% (In the case of nonresident or part-year resident

00

taxpayer apportioned at______________________%) ........................................................... 6

00

7. Colorado normal tax from line 15, Form 104 ............................................................................ 7

8. Colorado alternative minimum tax, the amount by which line 6 exceeds line 7.

Enter here and on line 16, Form 104 ....................................................................................... 8

00

ATTACH THIS FORM TO YOUR COLORADO INCOME TAX RETURN, FORM 104.

1

1