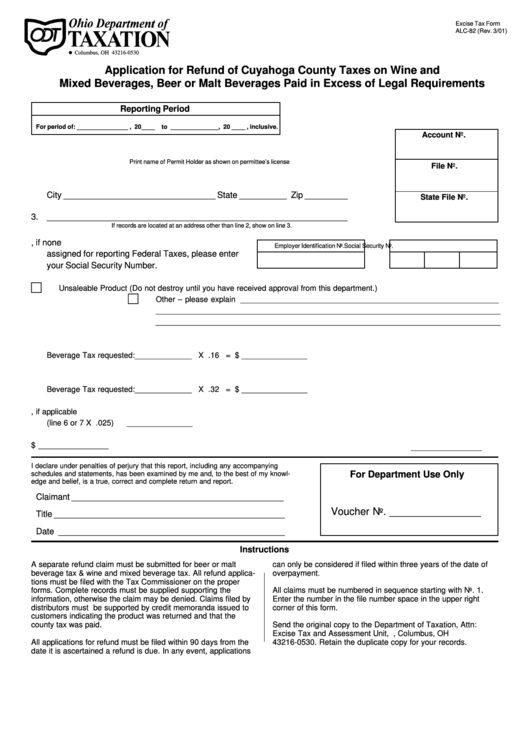

Form Alc-82 - Application For Refund Of Cuyahoga County Taxes On Wine And Mixed Beverages, Beer Or Malt Beverages Paid In Excess Of Legal Requirements - State Of Ohio

ADVERTISEMENT

Excise Tax Form

ALC-82 (Rev. 3/01)

P.O. Box 530= Columbus, OH 43216-0530

Application for Refund of Cuyahoga County Taxes on Wine and

Mixed Beverages, Beer or Malt Beverages Paid in Excess of Legal Requirements

Reporting Period

For period of: _______________ , 20____ to ______________, 20 ____ , inclusive.

Account No.

1. Name __________________________________________________________

Print name of Permit Holder as shown on permittee’s license

File No.

2. Address ________________________________________________________

City ________________________________ State __________ Zip _________

State File No.

3. ________________________________________________________________

If records are located at an address other than line 2, show on line 3.

4. Federal Employer Identification Number or, if none

Employer Identification No.

Social Security No.

assigned for reporting Federal Taxes, please enter

your Social Security Number.

c

5. Reason for Claim.

Unsaleable Product (Do not destroy until you have received approval from this department.)

c

Other – please explain ___________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

6.

Amount of Beer and/or Malt

Beverage Tax requested:

_____________ X .16 = $ _______________

7.

Amount of Wine and Mixed

Beverage Tax requested:

_____________ X .32 = $ _______________

8.

Less Discount, if applicable

(line 6 or 7 X .025)

_______________

9.

Total Amount Requested

$ ________________

I declare under penalties of perjury that this report, including any accompanying

schedules and statements, has been examined by me and, to the best of my knowl-

For Department Use Only

edge and belief, is a true, correct and complete return and report.

Claimant _____________________________________________

Voucher No. ________________

Title _________________________________________________

Date ________________________________________________

Instructions

A separate refund claim must be submitted for beer or malt

can only be considered if filed within three years of the date of

beverage tax & wine and mixed beverage tax. All refund applica-

overpayment.

tions must be filed with the Tax Commissioner on the proper

forms. Complete records must be supplied supporting the

All claims must be numbered in sequence starting with No. 1.

information, otherwise the claim may be denied. Claims filed by

Enter the number in the file number space in the upper right

distributors must be supported by credit memoranda issued to

corner of this form.

customers indicating the product was returned and that the

county tax was paid.

Send the original copy to the Department of Taxation, Attn:

Excise Tax and Assessment Unit, P.O. Box 530, Columbus, OH

All applications for refund must be filed within 90 days from the

43216-0530. Retain the duplicate copy for your records.

date it is ascertained a refund is due. In any event, applications

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1