Bank Franchise Tax Report Form - Arkansas Secretary Of State - 2007

ADVERTISEMENT

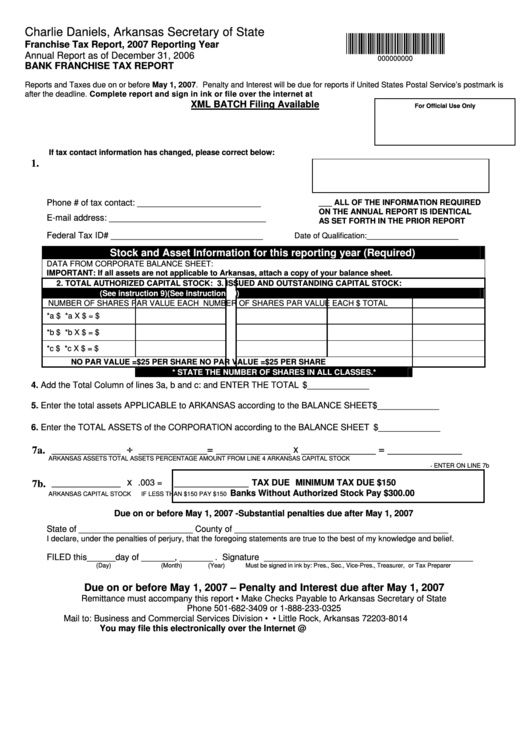

Charlie Daniels, Arkansas Secretary of State

Franchise Tax Report, 2007 Reporting Year

Annual Report as of December 31, 2006

000000000

BANK FRANCHISE TAX REPORT

Reports and Taxes due on or before May 1, 2007. Penalty and Interest will be due for reports if United States Postal Service’s postmark is

after the deadline. Complete report and sign in ink or file over the internet at

XML BATCH Filing Available

For Official Use Only

If tax contact information has changed, please correct below:

1.

Phone # of tax contact: __________________________

___ ALL OF THE INFORMATION REQUIRED

ON THE ANNUAL REPORT IS IDENTICAL

E-mail address: _________________________________

AS SET FORTH IN THE PRIOR REPORT

Federal Tax ID# ________________________________

Date of Qualification:_____________________

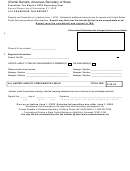

Stock and Asset Information for this reporting year (Required)

DATA FROM CORPORATE BALANCE SHEET:

IMPORTANT: If all assets are not applicable to Arkansas, attach a copy of your balance sheet.

2. TOTAL AUTHORIZED CAPITAL STOCK:

3. ISSUED AND OUTSTANDING CAPITAL STOCK:

(See instruction 9)

(See instruction 10)

NUMBER OF SHARES

PAR VALUE EACH

NUMBER OF SHARES

PAR VALUE EACH

$ TOTAL

*a

$

*a

X $

= $

*b

$

*b

X $

= $

*c

$

*c

X $

= $

NO PAR VALUE =$25 PER SHARE

NO PAR VALUE =$25 PER SHARE

* STATE THE NUMBER OF SHARES IN ALL CLASSES.*

4. Add the Total Column of lines 3a, b and c: and ENTER THE TOTAL ...........................................$ _____________

5. Enter the total assets APPLICABLE to ARKANSAS according to the BALANCE SHEET ............$ _____________

6. Enter the TOTAL ASSETS of the CORPORATION according to the BALANCE SHEET .............$ _____________

____________ ÷ ____________ =

_____________ x _____________ = _____________

7a.

ARKANSAS ASSETS

TOTAL ASSETS

PERCENTAGE

AMOUNT FROM LINE 4

ARKANSAS CAPITAL STOCK

-

ENTER ON LINE 7b

____________ x

_____________

.003 =

TAX DUE

MINIMUM TAX DUE $150

7b.

Banks Without Authorized Stock Pay $300.00

ARKANSAS CAPITAL STOCK

IF LESS THAN $150 PAY $150

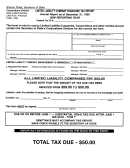

Due on or before May 1, 2007 -Substantial penalties due after May 1, 2007

State of ________________________ County of _____________________________________________

I declare, under the penalties of perjury, that the foregoing statements are true to the best of my knowledge and belief.

FILED this ______ day of _______ , _______ . Signature ____________________________________________

(Day)

(Month)

(Year)

Must be signed in ink by: Pres., Sec., Vice-Pres., Treasurer, or Tax Preparer

Due on or before May 1, 2007 – Penalty and Interest due after May 1, 2007

Remittance must accompany this report • Make Checks Payable to Arkansas Secretary of State

Phone 501-682-3409 or 1-888-233-0325

Mail to: Business and Commercial Services Division • P.O. Box 8014 • Little Rock, Arkansas 72203-8014

You may file this electronically over the Internet @

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1