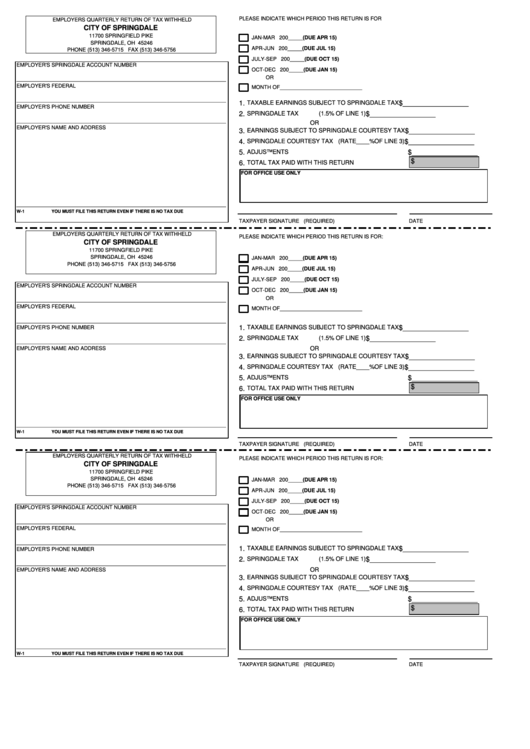

Form W-1 - Employers Quarterly Return Of Tax Withheld

ADVERTISEMENT

PLEASE INDICATE WHICH PERIOD THIS RETURN IS FOR:

EMPLOYERS QUARTERLY RETURN OF TAX WITHHELD

CITY OF SPRINGDALE

11700 SPRINGFIELD PIKE

JAN-MAR

200_____

(DUE APR 15)

SPRINGDALE, OH 45246

APR-JUN

200_____

(DUE JUL 15)

PHONE (513) 346-5715 FAX (513) 346-5756

JULY-SEP

200_____

(DUE OCT 15)

EMPLOYER'S SPRINGDALE ACCOUNT NUMBER

OCT-DEC

200_____

(DUE JAN 15)

OR

________________________________________________________________________

EMPLOYER'S FEDERAL I.D. NUMBER

MONTH OF____________________________

________________________________________________________________________

1.

TAXABLE EARNINGS SUBJECT TO SPRINGDALE TAX

$_________________

EMPLOYER'S PHONE NUMBER

2.

SPRINGDALE TAX

(1.5% OF LINE 1)

$_________________

________________________________________________________________________

OR

EMPLOYER'S NAME AND ADDRESS

3.

EARNINGS SUBJECT TO SPRINGDALE COURTESY TAX

$_________________

4.

SPRINGDALE COURTESY TAX (RATE____%OF LINE 3)

$_________________

5.

ADJUSTMENTS

$_________________

$

6.

TOTAL TAX PAID WITH THIS RETURN

FOR OFFICE USE ONLY

________________________________________________________________________

W-1

YOU MUST FILE THIS RETURN EVEN IF THERE IS NO TAX DUE

TAXPAYER SIGNATURE (REQUIRED)

DATE

EMPLOYERS QUARTERLY RETURN OF TAX WITHHELD

PLEASE INDICATE WHICH PERIOD THIS RETURN IS FOR:

CITY OF SPRINGDALE

11700 SPRINGFIELD PIKE

SPRINGDALE, OH 45246

JAN-MAR

200_____

(DUE APR 15)

PHONE (513) 346-5715 FAX (513) 346-5756

APR-JUN

200_____

(DUE JUL 15)

JULY-SEP

200_____

(DUE OCT 15)

EMPLOYER'S SPRINGDALE ACCOUNT NUMBER

OCT-DEC

200_____

(DUE JAN 15)

OR

________________________________________________________________________

EMPLOYER'S FEDERAL I.D. NUMBER

MONTH OF____________________________

________________________________________________________________________

TAXABLE EARNINGS SUBJECT TO SPRINGDALE TAX

EMPLOYER'S PHONE NUMBER

1.

$_________________

2.

SPRINGDALE TAX

(1.5% OF LINE 1)

$_________________

________________________________________________________________________

EMPLOYER'S NAME AND ADDRESS

OR

3.

EARNINGS SUBJECT TO SPRINGDALE COURTESY TAX

$_________________

4.

SPRINGDALE COURTESY TAX (RATE____%OF LINE 3)

$_________________

5.

ADJUSTMENTS

$_________________

$

6.

TOTAL TAX PAID WITH THIS RETURN

FOR OFFICE USE ONLY

________________________________________________________________________

W-1

YOU MUST FILE THIS RETURN EVEN IF THERE IS NO TAX DUE

TAXPAYER SIGNATURE (REQUIRED)

DATE

EMPLOYERS QUARTERLY RETURN OF TAX WITHHELD

PLEASE INDICATE WHICH PERIOD THIS RETURN IS FOR:

CITY OF SPRINGDALE

11700 SPRINGFIELD PIKE

SPRINGDALE, OH 45246

JAN-MAR

200_____

(DUE APR 15)

PHONE (513) 346-5715 FAX (513) 346-5756

APR-JUN

200_____

(DUE JUL 15)

JULY-SEP

200_____

(DUE OCT 15)

EMPLOYER'S SPRINGDALE ACCOUNT NUMBER

OCT-DEC

200_____

(DUE JAN 15)

OR

________________________________________________________________________

EMPLOYER'S FEDERAL I.D. NUMBER

MONTH OF____________________________

________________________________________________________________________

1.

TAXABLE EARNINGS SUBJECT TO SPRINGDALE TAX

$_________________

EMPLOYER'S PHONE NUMBER

2.

SPRINGDALE TAX

(1.5% OF LINE 1)

$_________________

________________________________________________________________________

EMPLOYER'S NAME AND ADDRESS

OR

3.

EARNINGS SUBJECT TO SPRINGDALE COURTESY TAX

$_________________

4.

SPRINGDALE COURTESY TAX (RATE____%OF LINE 3)

$_________________

5.

ADJUSTMENTS

$_________________

$

6.

TOTAL TAX PAID WITH THIS RETURN

FOR OFFICE USE ONLY

________________________________________________________________________

W-1

YOU MUST FILE THIS RETURN EVEN IF THERE IS NO TAX DUE

TAXPAYER SIGNATURE (REQUIRED)

DATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1