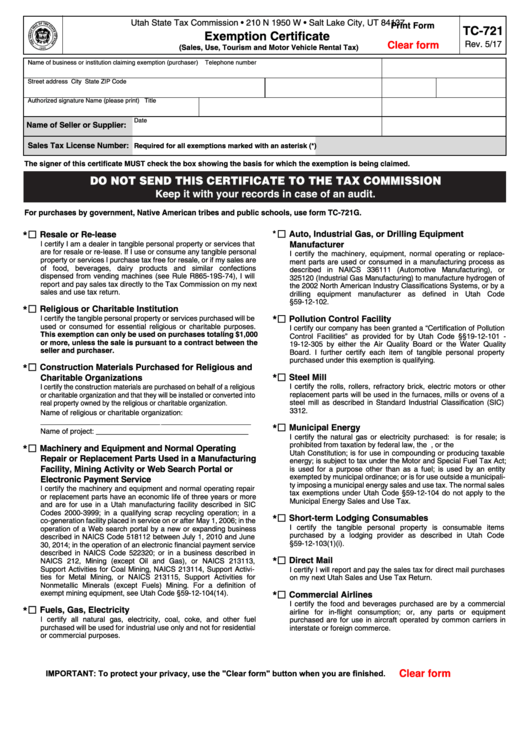

Utah State Tax Commission • 210 N 1950 W • Salt Lake City, UT 84137

Print Form

TC-721

Exemption Certificate

Rev. 5/17

Clear form

(Sales, Use, Tourism and Motor Vehicle Rental Tax)

Name of business or institution claiming exemption (purchaser)

Telephone number

Street address

City

State

ZIP Code

Authorized signature

Name (please print)

Title

Date

Name of Seller or Supplier:

Sales Tax License Number:

Required for all exemptions marked with an asterisk (*)

The signer of this certificate MUST check the box showing the basis for which the exemption is being claimed.

DO NOT SEND THIS CERTIFICATE TO THE TAX COMMISSION

Keep it with your records in case of an audit.

For purchases by government, Native American tribes and public schools, use form TC-721G.

*

Auto, Industrial Gas, or Drilling Equipment

Resale or Re-lease

*

I certify I am a dealer in tangible personal property or services that

Manufacturer

are for resale or re-lease. If I use or consume any tangible personal

I certify the machinery, equipment, normal operating or replace-

property or services I purchase tax free for resale, or if my sales are

ment parts are used or consumed in a manufacturing process as

of food, beverages, dairy products and similar confections

described in NAICS 336111 (Automotive Manufacturing), or

dispensed from vending machines (see Rule R865-19S-74), I will

325120 (Industrial Gas Manufacturing) to manufacture hydrogen of

report and pay sales tax directly to the Tax Commission on my next

the 2002 North American Industry Classifications Systems, or by a

sales and use tax return.

drilling equipment manufacturer as defined in Utah Code

§59-12-102.

Religious or Charitable Institution

*

I certify the tangible personal property or services purchased will be

Pollution Control Facility

*

used or consumed for essential religious or charitable purposes.

I certify our company has been granted a “Certification of Pollution

This exemption can only be used on purchases totaling $1,000

Control Facilities” as provided for by Utah Code §§19-12-101 -

or more, unless the sale is pursuant to a contract between the

19-12-305 by either the Air Quality Board or the Water Quality

seller and purchaser.

Board. I further certify each item of tangible personal property

purchased under this exemption is qualifying.

Construction Materials Purchased for Religious and

*

Steel Mill

Charitable Organizations

*

I certify the rolls, rollers, refractory brick, electric motors or other

I certify the construction materials are purchased on behalf of a religious

replacement parts will be used in the furnaces, mills or ovens of a

or charitable organization and that they will be installed or converted into

steel mill as described in Standard Industrial Classification (SIC)

real property owned by the religious or charitable organization.

3312.

Name of religious or charitable organization:

______ __________ ____________ ____

Municipal Energy

*

Name of project: _________ _____ _____ _ ___

I certify the natural gas or electricity purchased: is for resale; is

prohibited from taxation by federal law, the U.S. Constitution, or the

Machinery and Equipment and Normal Operating

*

Utah Constitution; is for use in compounding or producing taxable

Repair or Replacement Parts Used in a Manufacturing

energy; is subject to tax under the Motor and Special Fuel Tax Act;

Facility, Mining Activity or Web Search Portal or

is used for a purpose other than as a fuel; is used by an entity

exempted by municipal ordinance; or is for use outside a municipali-

Electronic Payment Service

ty imposing a municipal energy sales and use tax. The normal sales

I certify the machinery and equipment and normal operating repair

tax exemptions under Utah Code §59-12-104 do not apply to the

or replacement parts have an economic life of three years or more

Municipal Energy Sales and Use Tax.

and are for use in a Utah manufacturing facility described in SIC

Codes 2000-3999; in a qualifying scrap recycling operation; in a

Short-term Lodging Consumables

*

co-generation facility placed in service on or after May 1, 2006; in the

I certify the tangible personal property is consumable items

operation of a Web search portal by a new or expanding business

purchased by a lodging provider as described in Utah Code

described in NAICS Code 518112 between July 1, 2010 and June

§59-12-103(1)(i).

30, 2014; in the operation of an electronic financial payment service

described in NAICS Code 522320; or in a business described in

Direct Mail

*

NAICS 212, Mining (except Oil and Gas), or NAICS 213113,

Support Activities for Coal Mining, NAICS 213114, Support Activi-

I certify I will report and pay the sales tax for direct mail purchases

ties for Metal Mining, or NAICS 213115, Support Activities for

on my next Utah Sales and Use Tax Return.

Nonmetallic Minerals (except Fuels) Mining. For a definition of

exempt mining equipment, see Utah Code §59-12-104(14).

Commercial Airlines

*

I certify the food and beverages purchased are by a commercial

Fuels, Gas, Electricity

*

airline for in-flight consumption; or, any parts or equipment

I certify all natural gas, electricity, coal, coke, and other fuel

purchased are for use in aircraft operated by common carriers in

purchased will be used for industrial use only and not for residential

interstate or foreign commerce.

or commercial purposes.

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

Clear form

1

1 2

2