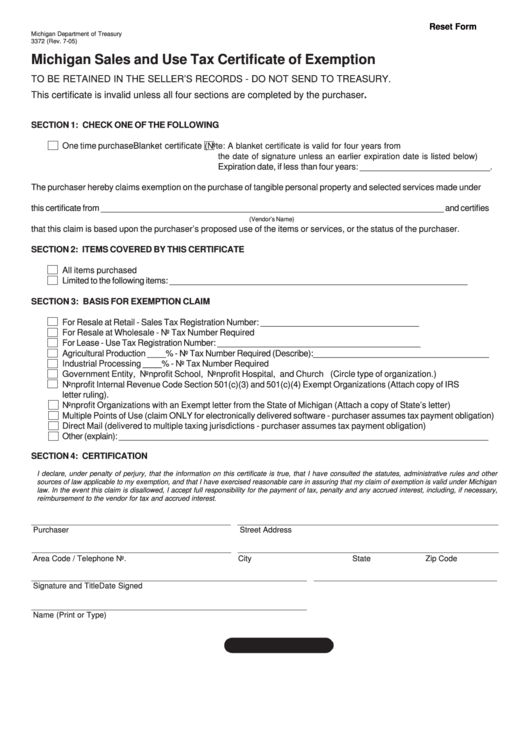

Reset Form

Michigan Department of Treasury

3372 (Rev. 7-05)

Michigan Sales and Use Tax Certificate of Exemption

TO BE RETAINED IN THE SELLER’S RECORDS - DO NOT SEND TO TREASURY.

This certificate is invalid unless all four sections are completed by the purchaser.

SECTION 1: CHECK ONE OF THE FOLLOWING

One time purchase

Blanket certificate

(Note: A blanket certificate is valid for four years from

the date of signature unless an earlier expiration date is listed below)

Expiration date, if less than four years: ____________________________.

The purchaser hereby claims exemption on the purchase of tangible personal property and selected services made under

this certificate from ___________________________________________________________________________ and certifies

(Vendor’s Name)

that this claim is based upon the purchaser’s proposed use of the items or services, or the status of the purchaser.

SECTION 2: ITEMS COVERED BY THIS CERTIFICATE

All items purchased

Limited to the following items: _________________________________________________________________

SECTION 3: BASIS FOR EXEMPTION CLAIM

For Resale at Retail - Sales Tax Registration Number: __________________________________

For Resale at Wholesale - No Tax Number Required

For Lease - Use Tax Registration Number: ____________________________________________

Agricultural Production ____% - No Tax Number Required (Describe):______________________________________

Industrial Processing ____% - No Tax Number Required

Government Entity, Nonprofit School, Nonprofit Hospital, and Church (Circle type of organization.)

Nonprofit Internal Revenue Code Section 501(c)(3) and 501(c)(4) Exempt Organizations (Attach copy of IRS

letter ruling).

Nonprofit Organizations with an Exempt letter from the State of Michigan (Attach a copy of State’s letter)

Multiple Points of Use (claim ONLY for electronically delivered software - purchaser assumes tax payment obligation)

Direct Mail (delivered to multiple taxing jurisdictions - purchaser assumes tax payment obligation)

Other (explain): __________________________________________________________________________________

SECTION 4: CERTIFICATION

I declare, under penalty of perjury, that the information on this certificate is true, that I have consulted the statutes, administrative rules and other

sources of law applicable to my exemption, and that I have exercised reasonable care in assuring that my claim of exemption is valid under Michigan

law. In the event this claim is disallowed, I accept full responsibility for the payment of tax, penalty and any accrued interest, including, if necessary,

reimbursement to the vendor for tax and accrued interest.

Purchaser

Street Address

Area Code / Telephone No.

City

State

Zip Code

Signature and Title

Date Signed

Name (Print or Type)

1

1