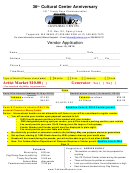

Vendor Application Page 2

ADVERTISEMENT

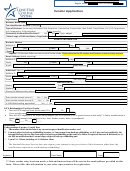

Purpose of form

A person who is required to file an information return with the IRS must obtain your correct TIN/EIN to report income

paid to you, real estate transactions, mortgage interest you paid, the acquisition or abandonment of secured property, or

contributions you made to an IRA. Use Form W-9 to furnish your correct TIN/EIN to the requester (the person asking

you to furnish your TIN/EIN) and, when applicable, (1) to certify that the TIN/EIN you are furnishing is correct (or that

you are waiting for a number to be issued), (2) to certify that you are not subject to backup withholding, and (3) to claim

exemption from backup withholding if you are an exempt payee. Furnishing your correct TIN/EIN and making the

appropriate certifications will prevent certain payments from being subject to backup withholding.

NOTE: If a requester gives you a form other than a W-9 form to request your TIN/EIN, you must use the requester's

form.

How to obtain a TIN/EIN

If you do not have a TIN/EIN, apply for one immediately. To apply, you may get Form SS-5, Application for a Social

Security Number Card (for individuals), from your lo al office of the Social Security Administration, or Form SS-4,

Application for Employer Identification Number (for business and all other entities), from your local IRS Office.

To complete Form W-9 if you do not have a TIN/EIN, write, "Applied For" in the space for the TIN/EIN in part 1, sign

and date the form. You generally have 60 days to obtain and furnish the TIN/EIN to the requester. If the requester does

not receive your form within 60 days, backup withholding will begin and continue until you furnish the TIN/EIN to the

requester.

What is backup withholding?

Persons making certain payments are required to withhold and pay to the IRS 30% of such payments, under certain

conditions. This is called "Backup Withholding." Payments that could be subject to backup withholding include interest,

dividends, broker and barter transactions, rents, royalties, nonemployee compensation, and certain payments from fishing

boat operators, but do not include real estate transactions.

If you give the requester your correct TIN/EIN, make the appropriate certifications, and report all of your taxable interest

and dividends on your tax return, your payments will not be subject to backup withholding. Payments you receive will be

subject to backup withholding if:

1. You do not furnish your TIN/EIN to the requester, or

2. The IRS notifies the requester that you furnished an incorrect TIN/EIN.

3. You are notified by the IRS that you are subject to withholding because you failed to report all of your

interest and dividends on your tax return, or

4. You fail to certify to the requester that you are not subject to backup withholding under (3) above.

5. You fail to certify your TIN/EIN.

Penalties

Civil penalty for false information with respect to withholding. If you make a false statement with no reasonable basis

that results in no backup withholding, you are subject to a $500 penalty.

Criminal penalty for falsifying information. Willfully falsifying certifications or affirmations may subject you to criminal

penalties including fines and/or imprisonment.

Misuse of TINS/EINS. If the requester discloses or uses TINS/EINS in violation of Federal law, the requester may be subject

to civil and criminal penalties.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2