Earned Income Tax Return Form

ADVERTISEMENT

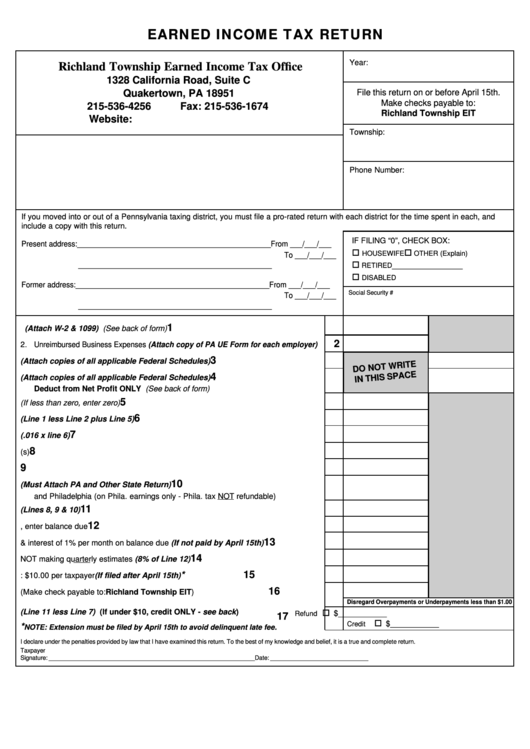

EARNED INCOME TAX RETURN

Year:

Richland Township Earned Income Tax Office

1328 California Road, Suite C

File this return on or before April 15th.

Quakertown, PA 18951

Make checks payable to:

215-536-4256

Fax: 215-536-1674

Richland Township EIT

Website:

Township:

Phone Number:

If you moved into or out of a Pennsylvania taxing district, you must file a pro-rated return with each district for the time spent in each, and

include a copy with this return.

IF FILING “0”, CHECK BOX:

Present address: _______________________________________________ From ___/___/___

HOUSEWIFE

OTHER (Explain)

To ___/___/___

_______________

_______________________________________________

RETIRED

DISABLED

Former address: _______________________________________________ From ___/___/___

Social Security #

To ___/___/___

_______________________________________________

1

1. Gross Earned Income (Attach W-2 & 1099) (See back of form)

2

2. Unreimbursed Business Expenses (Attach copy of PA UE Form for each employer)

3

3. Net Profit from Business (Attach copies of all applicable Federal Schedules)

4

4. Net Loss from Business (Attach copies of all applicable Federal Schedules)

Deduct from Net Profit ONLY (See back of form)

5

5. Subtract Line 4 from Line 3 (If less than zero, enter zero)

6

6. Income Subject to Tax (Line 1 less Line 2 plus Line 5)

7

7. Local Tax (.016 x line 6)

8

8. Local Tax Withheld by Employer(s)

9

9. Estimated Tax Payments and Carryover Credit

10

10. Credit for Tax Paid to Other States (Must Attach PA and Other State Return)

and Philadelphia (on Phila. earnings only - Phila. tax NOT refundable)

11

11. Total (Lines 8, 9 & 10)

12

12. If Line 7 is larger than Line 11, enter balance due

13

13. Penalty & interest of 1% per month on balance due (If not paid by April 15th)

14

14. Penalty for NOT making quarterly estimates (8% of Line 12)

15

*

15. Delinquent Late Fee: $10.00 per taxpayer (If filed after April 15th)

16

16. TOTAL DUE (Make check payable to: Richland Township EIT)

Disregard Overpayments or Underpayments less than $1.00

17. Overpayment (Line 11 less Line 7) (If under $10, credit ONLY - see back)

$___________

Refund

17

$___________

Credit

*

NOTE: Extension must be filed by April 15th to avoid delinquent late fee.

I declare under the penalties provided by law that I have examined this return. To the best of my knowledge and belief, it is a true and complete return.

Taxpayer

Signature: _____________________________________________________________

Date: _____________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1