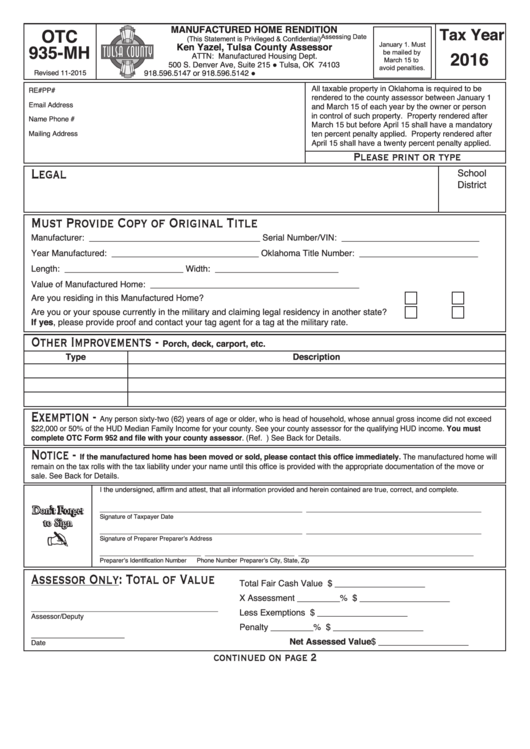

Tax Year

OTC

MANUFACTURED HOME RENDITION

Assessing Date

(This Statement is Privileged & Confidential)

935-MH

January 1.

Ken Yazel, Tulsa County Assessor

2018

Must be mailed

ATTN: Manufactured Housing Dept.

by March 15 to

500 S. Denver Ave, Suite 215 ● Tulsa, OK 74103

avoid penalties.

Revised 5-2017

918.596.5147 or 918.596.5142 ●

All taxable property in Oklahoma is required to be

RE#

PP#

rendered to the county assessor between January 1

and March 15 of each year by the owner or person

Name

Phone #

in control of such property. Property rendered after

March 15 but before April 15 shall have a mandatory

ten percent penalty applied. Property rendered after

Mailing Address

Email Address

April 15 shall have a twenty percent penalty applied.

Please print or type

Legal

School

District

Must Provide Copy of Original Title

(if this information has not changed, skip this box)

Manufacturer: ____________________________________

Serial Number/VIN: _____________________________

Year Manufactured: _______________________________

Oklahoma Title Number: _________________________

Length: _________________________

Width: __________________________

Value of Manufactured Home: ____________________________________________

Are you residing in this Manufactured Home?.................................................................................

Yes

No

Are you or your spouse currently in the military and claiming legal residency in another state? ....

Yes

No

If yes, please provide proof and contact your tag agent for a tag at the military rate.

Other Improvements -

Porch, deck, carport, etc.

Type

Description

Exemption -

Any person sixty-two (62) years of age or older, who is head of household, whose annual gross income did not exceed $22,000

or 50% of the HUD Median Family Income for your county. See your county assessor for the qualifying HUD income. You must complete OTC Form

952 and file with your county assessor.

(https:// ) See Back for Details.

Notice -

If the manufactured home has been moved or sold, please complete back of page and submit to this office immediately.

The manufactured home will remain on the tax rolls with the tax liability under your name until this office is provided with the appropriate

documentation of the move or sale. See Back for Details.

I the undersigned, affirm and attest, that all information provided and herein contained are true, correct and complete.

Don’t Forget

____________________________________________________

_____________________________________________

Signature of Taxpayer

Date

to Sign

____________________________________________________

_____________________________________________

✍

Signature of Preparer

Preparer’s Address

__________________________

_______________________

_____________________________________________

Preparer’s Identification Number

Phone Number

Preparer’s City, State, Zip

Assessor Only: Total of Value

Total Fair Cash Value ......... $ ___________________

X Assessment _________% ......... $ ___________________

________________________________________________

Less Exemptions ......... $ ___________________

Assessor/Deputy

Penalty _________% ......... $ ___________________

________________________

Net Assessed Value ......... $ ___________________

Date

continued on page 2

1

1 2

2