Application For Student Aid

ADVERTISEMENT

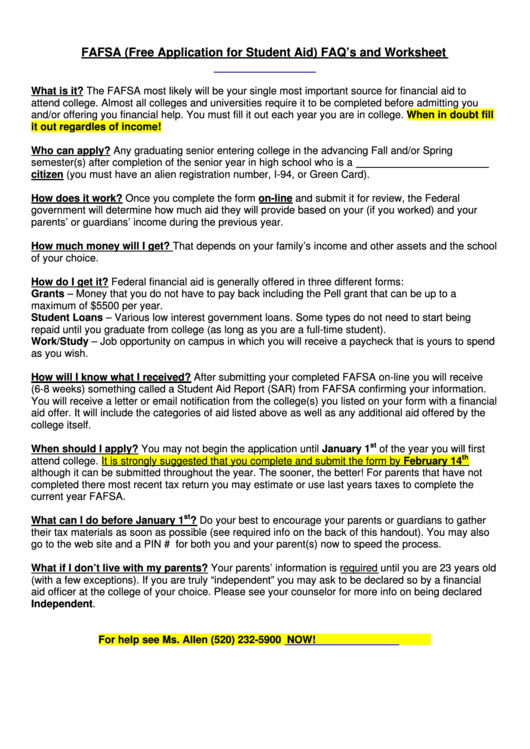

FAFSA (Free Application for Student Aid) FAQ’s and Worksheet

What is it? The FAFSA most likely will be your single most important source for financial aid to

attend college. Almost all colleges and universities require it to be completed before admitting you

and/or offering you financial help. You must fill it out each year you are in college. When in doubt fill

it out regardles of income!

Who can apply? Any graduating senior entering college in the advancing Fall and/or Spring

semester(s) after completion of the senior year in high school who is a U.S. citizen or eligible non-

citizen (you must have an alien registration number, I-94, or Green Card).

How does it work? Once you complete the form on-line and submit it for review, the Federal

government will determine how much aid they will provide based on your (if you worked) and your

parents’ or guardians’ income during the previous year.

How much money will I get? That depends on your family’s income and other assets and the school

of your choice.

How do I get it? Federal financial aid is generally offered in three different forms:

Grants – Money that you do not have to pay back including the Pell grant that can be up to a

maximum of $5500 per year.

Student Loans – Various low interest government loans. Some types do not need to start being

repaid until you graduate from college (as long as you are a full-time student).

Work/Study – Job opportunity on campus in which you will receive a paycheck that is yours to spend

as you wish.

How will I know what I received? After submitting your completed FAFSA on-line you will receive

(6-8 weeks) something called a Student Aid Report (SAR) from FAFSA confirming your information.

You will receive a letter or email notification from the college(s) you listed on your form with a financial

aid offer. It will include the categories of aid listed above as well as any additional aid offered by the

college itself.

st

When should I apply? You may not begin the application until January 1

of the year you will first

th

attend college. It is strongly suggested that you complete and submit the form by February 14

although it can be submitted throughout the year. The sooner, the better! For parents that have not

completed there most recent tax return you may estimate or use last years taxes to complete the

current year FAFSA.

st

What can I do before January 1

? Do your best to encourage your parents or guardians to gather

their tax materials as soon as possible (see required info on the back of this handout). You may also

go to the web site and a PIN # for both you and your parent(s) now to speed the process.

What if I don’t live with my parents? Your parents’ information is required until you are 23 years old

(with a few exceptions). If you are truly “independent” you may ask to be declared so by a financial

aid officer at the college of your choice. Please see your counselor for more info on being declared

Independent.

For help see Ms. Allen (520) 232-5900

NOW!

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2