1000 - 1801 Hamilton Street

REGINA, SK

S4P 4W3

Phone:

306-787-5442

Fax:

306-787-0244

Toll free: 1-877-275-7377

Email: pepp@peba.gov.sk.ca

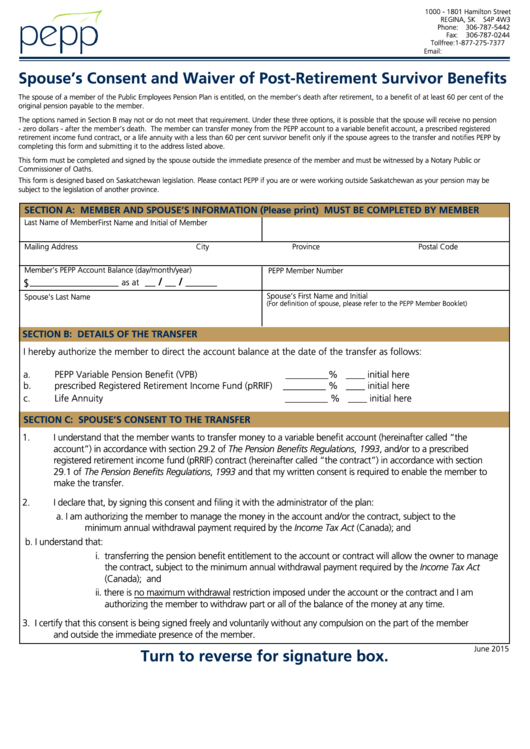

Spouse’s Consent and Waiver of Post-Retirement Survivor Benefits

The spouse of a member of the Public Employees Pension Plan is entitled, on the member’s death after retirement, to a benefit of at least 60 per cent of the

original pension payable to the member.

The options named in Section B may not or do not meet that requirement. Under these three options, it is possible that the spouse will receive no pension

- zero dollars - after the member’s death. The member can transfer money from the PEPP account to a variable benefit account, a prescribed registered

retirement income fund contract, or a life annuity with a less than 60 per cent survivor benefit only if the spouse agrees to the transfer and notifies PEPP by

completing this form and submitting it to the address listed above.

This form must be completed and signed by the spouse outside the immediate presence of the member and must be witnessed by a Notary Public or

Commissioner of Oaths.

This form is designed based on Saskatchewan legislation. Please contact PEPP if you are or were working outside Saskatchewan as your pension may be

subject to the legislation of another province.

SECTION A: MEMBER AND SPOUSE’S INFORMATION (Please print) MUST BE COMPLETED BY MEMBER

Last Name of Member

First Name and Initial of Member

Mailing Address City Province Postal Code

Member’s PEPP Account Balance (day/month/year)

PEPP Member Number

$ _________________

__ / __ / ______

as at

Spouse’s First Name and Initial

Spouse’s Last Name

(For definition of spouse, please refer to the PEPP Member Booklet)

SECTION B: DETAILS OF THE TRANSFER

I hereby authorize the member to direct the account balance at the date of the transfer as follows:

a.

PEPP Variable Pension Benefit (VPB) _________%

____ initial here

b.

prescribed Registered Retirement Income Fund (pRRIF) _________ %

____ initial here

c.

Life Annuity _________ %

____ initial here

SECTION C: SPOUSE’S CONSENT TO THE TRANSFER

1.

I understand that the member wants to transfer money to a variable benefit account (hereinafter called “the

account”) in accordance with section 29.2 of The Pension Benefits Regulations, 1993, and/or to a prescribed

registered retirement income fund (pRRIF) contract (hereinafter called “the contract”) in accordance with section

29.1 of The Pension Benefits Regulations, 1993 and that my written consent is required to enable the member to

make the transfer.

2.

I declare that, by signing this consent and filing it with the administrator of the plan:

a.

I am authorizing the member to manage the money in the account and/or the contract, subject to the

minimum annual withdrawal payment required by the Income Tax Act (Canada); and

b.

I understand that:

i. transferring the pension benefit entitlement to the account or contract will allow the owner to manage

the contract, subject to the minimum annual withdrawal payment required by the Income Tax Act

(Canada); and

ii. there is no maximum withdrawal restriction imposed under the account or the contract and I am

authorizing the member to withdraw part or all of the balance of the money at any time.

3.

I certify that this consent is being signed freely and voluntarily without any compulsion on the part of the member

and outside the immediate presence of the member.

June 2015

Turn to reverse for signature box.

1

1 2

2