Form 2949 - Job Training Credit

Download a blank fillable Form 2949 - Job Training Credit in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 2949 - Job Training Credit with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

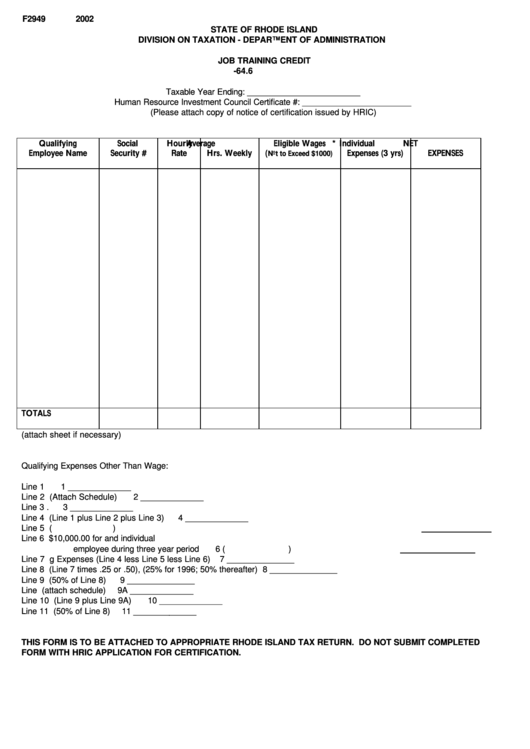

F2949

2002

STATE OF RHODE ISLAND

DIVISION ON TAXATION - DEPARTMENT OF ADMINISTRATION

JOB TRAINING CREDIT

R.I.G.L. 42-64.6

Taxable Year Ending: _________________________

Human Resource Investment Council Certificate #: ________________________

(Please attach copy of notice of certification issued by HRIC)

Qualifying

Social

Hourly

Average

Eligible Wages

* Individual

NET

Employee Name

Security #

Rate

Hrs. Weekly

(

Expenses (3 yrs)

EXPENSES

Not to Exceed $1000)

TOTALS

(attach sheet if necessary)

Qualifying Expenses Other Than Wage:

Line 1 .......... Payments for Instructors or Educational Institutions

1 ______________

Line 2 .......... Other Expenses (Attach Schedule)

2 ______________

Line 3 .......... Eligible Wages from Schedule Above

3 ______________

Line 4 .......... Total (Line 1 plus Line 2 plus Line 3)

4 ______________

Line 5 .......... Applicable Grants received

5 (

)

Line 6 .......... Amount of Training Expenses that were over $10,000.00 for and individual

employee during three year period

6 (

)

Line 7 .......... Qualifying Expenses (Line 4 less Line 5 less Line 6)

7 _______________

Line 8 .......... Credit Calculation (Line 7 times .25 or .50), (25% for 1996; 50% thereafter)

8 _______________

Line 9 .......... Credit for this taxable year (50% of Line 8)

9 _______________

Line 9A......... Carryover from prior year (attach schedule)

9A ______________

Line 10 ......... Total Credits (Line 9 plus Line 9A)

10 ______________

Line 11 ......... Carryover to following taxable year (50% of Line 8)

11 ______________

THIS FORM IS TO BE ATTACHED TO APPROPRIATE RHODE ISLAND TAX RETURN. DO NOT SUBMIT COMPLETED

FORM WITH HRIC APPLICATION FOR CERTIFICATION.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1