Form Rp-477-A - Application For Real Property Tax Exemption For Air Pollution Control Facilities

ADVERTISEMENT

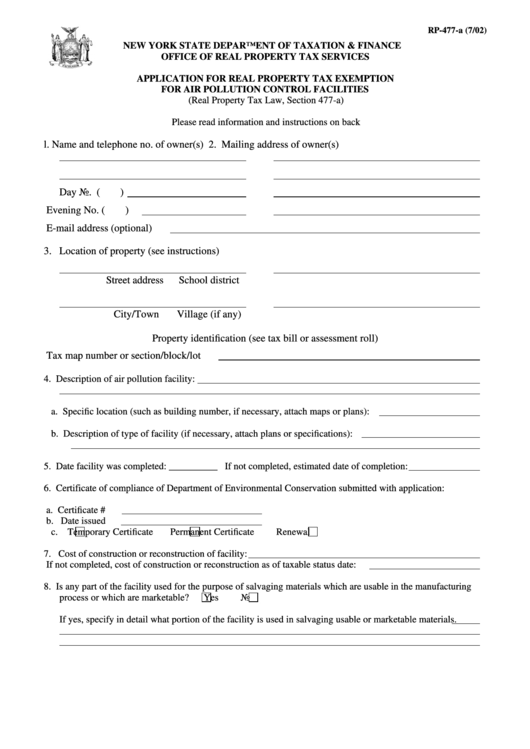

RP-477-a (7/02)

NEW YORK STATE DEPARTMENT OF TAXATION & FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

APPLICATION FOR REAL PROPERTY TAX EXEMPTION

FOR AIR POLLUTION CONTROL FACILITIES

(Real Property Tax Law, Section 477-a)

Please read information and instructions on back

l. Name and telephone no. of owner(s)

2. Mailing address of owner(s)

Day No. (

)

Evening No. (

)

E-mail address (optional)

3. Location of property (see instructions)

Street address

School district

City/Town

Village (if any)

Property identification (see tax bill or assessment roll)

Tax map number or section/block/lot

4. Description of air pollution facility:

a. Specific location (such as building number, if necessary, attach maps or plans):

b. Description of type of facility (if necessary, attach plans or specifications):

5. Date facility was completed: __________ If not completed, estimated date of completion:

6. Certificate of compliance of Department of Environmental Conservation submitted with application:

a. Certificate #

b. Date issued

c.

Temporary Certificate

Permanent Certificate

Renewal

7. Cost of construction or reconstruction of facility:

If not completed, cost of construction or reconstruction as of taxable status date:

8. Is any part of the facility used for the purpose of salvaging materials which are usable in the manufacturing

process or which are marketable?

Yes

No

If yes, specify in detail what portion of the facility is used in salvaging usable or marketable materials.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2