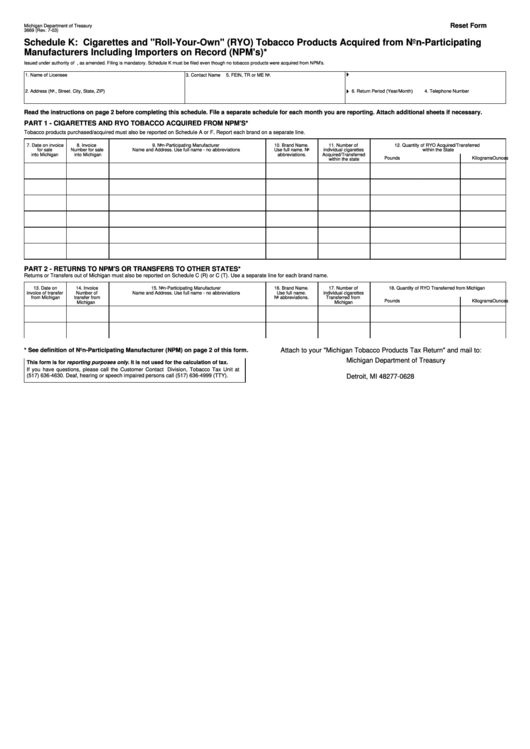

Reset Form

Michigan Department of Treasury

3669 (Rev. 7-03)

Schedule K: Cigarettes and "Roll-Your-Own" (RYO) Tobacco Products Acquired from Non-Participating

Manufacturers Including Importers on Record (NPM's)*

Issued under authority of P.A. 327 of 1993, as amended. Filing is mandatory. Schedule K must be filed even though no tobacco products were acquired from NPM's.

4

1. Name of Licensee

3. Contact Name

5. FEIN, TR or ME No.

4

2. Address (No., Street. City, State, ZIP)

4. Telephone Number

6. Return Period (Year/Month)

Read the instructions on page 2 before completing this schedule. File a separate schedule for each month you are reporting. Attach additional sheets if necessary.

PART 1 - CIGARETTES AND RYO TOBACCO ACQUIRED FROM NPM'S*

Tobacco products purchased/acquired must also be reported on Schedule A or F. Report each brand on a separate line.

7. Date on invoice

8. Invoice

9. Non-Participating Manufacturer

10. Brand Name.

11. Number of

12. Quantity of RYO Acquired/Transferred

for sale

Number for sale

Name and Address. Use full name - no abbreviations

Use full name. No

individual cigarettes

within the State

into Michigan

into Michigan

abbreviations.

Acquired/Transferred

Pounds

Ounces

Kilograms

within the state

PART 2 - RETURNS TO NPM'S OR TRANSFERS TO OTHER STATES*

Returns or Transfers out of Michigan must also be reported on Schedule C (R) or C (T). Use a separate line for each brand name.

13. Date on

14. Invoice

15. Non-Participating Manufacturer

16. Brand Name.

17. Number of

18. Quantity of RYO Transferred from Michigan

invoice of transfer

Number of

Name and Address. Use full name - no abbreviations

Use full name.

individual cigarettes

from Michigan

transfer from

No abbreviations.

Transferred from

Pounds

Ounces

Kilograms

Michigan

Michigan

* See definition of Non-Participating Manufacturer (NPM) on page 2 of this form.

Attach to your "Michigan Tobacco Products Tax Return" and mail to:

Michigan Department of Treasury

This form is for reporting purposes only. It is not used for the calculation of tax.

P.O. Box 77628

If you have questions, please call the Customer Contact Division, Tobacco Tax Unit at

(517) 636-4630. Deaf, hearing or speech impaired persons call (517) 636-4999 (TTY).

Detroit, MI 48277-0628

1

1