Request For Native American Indians Motor Vehicle Fuel Excise Tax Refund Form 1999

ADVERTISEMENT

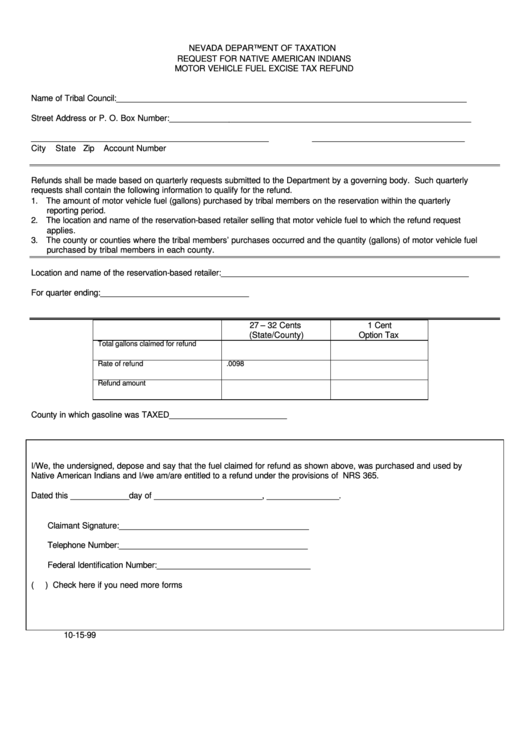

NEVADA DEPARTMENT OF TAXATION

REQUEST FOR NATIVE AMERICAN INDIANS

MOTOR VEHICLE FUEL EXCISE TAX REFUND

Name of Tribal Council:______________________________________________________________________________

Street Address or P. O. Box Number:___________________________________________________________________

_____________________________________________________

__________________________________

City

State

Zip

Account Number

Refunds shall be made based on quarterly requests submitted to the Department by a governing body. Such quarterly

requests shall contain the following information to qualify for the refund.

1. The amount of motor vehicle fuel (gallons) purchased by tribal members on the reservation within the quarterly

reporting period.

2. The location and name of the reservation-based retailer selling that motor vehicle fuel to which the refund request

applies.

3. The county or counties where the tribal members’ purchases occurred and the quantity (gallons) of motor vehicle fuel

purchased by tribal members in each county.

Location and name of the reservation-based retailer:_______________________________________________________

For quarter ending:_________________________________

27 – 32 Cents

1 Cent

(State/County)

Option Tax

Total gallons claimed for refund

Rate of refund

.0098

Refund amount

County in which gasoline was TAXED__________________________

I/We, the undersigned, depose and say that the fuel claimed for refund as shown above, was purchased and used by

Native American Indians and I/we am/are entitled to a refund under the provisions of NRS 365.

Dated this _____________day of ________________________, ________________.

Claimant Signature:__________________________________________

Telephone Number:__________________________________________

Federal Identification Number:__________________________________

(

) Check here if you need more forms

10-15-99

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1