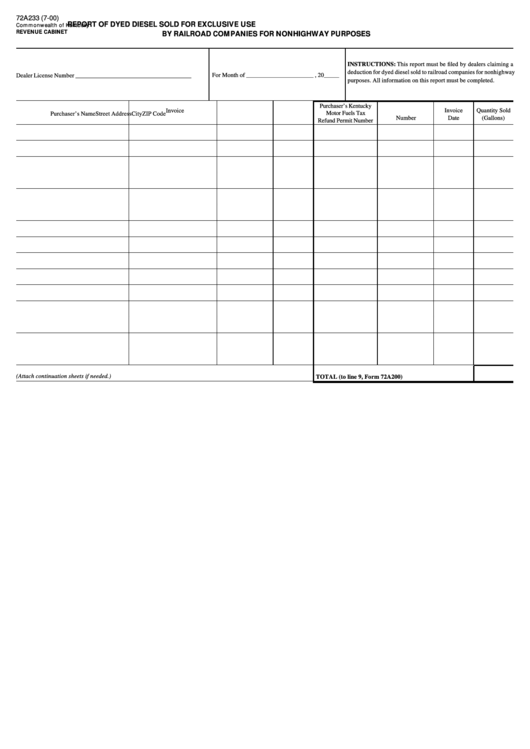

Form 72a233 - Report Of Dyed Diesel Sold For Exclusive Use By Railroad Companies For Nonhighway Purposes - Commonwealth Of Kentucky Revenue Cabinet

ADVERTISEMENT

72A233 (7-00)

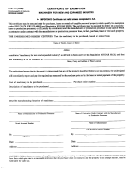

REPORT OF DYED DIESEL SOLD FOR EXCLUSIVE USE

Commonwealth of Kentucky

REVENUE CABINET

BY RAILROAD COMPANIES FOR NONHIGHWAY PURPOSES

INSTRUCTIONS: This report must be filed by dealers claiming a

deduction for dyed diesel sold to railroad companies for nonhighway

For Month of ______________________ , 20_____

Dealer License Number ______________________________________

purposes. All information on this report must be completed.

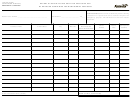

Purchaser’s Kentucky

Invoice

Invoice

Quantity Sold

Motor Fuels Tax

Purchaser’s Name

Street Address

City

ZIP Code

Number

Date

(Gallons)

Refund Permit Number

(Attach continuation sheets if needed.)

TOTAL (to line 9, Form 72A200)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1